The Anticipatory Nature of Markets

Global stock markets keep going up and up. Some things have indeed improved since the dark days of March 2020. But other conditions have worsened. Yet, it almost seems no matter what the news is, investors remain bullish. Clearly the collective market wisdom is that the pandemic and our economic troubles will resolve without lasting damage.

But as investment managers, we can’t take that on faith. There are real risks to the consensus view. So we prepare for different eventualities by constructing portfolios resilient to a range of plausible scenarios. At the same time, we work with our clients to continue to secure their full financial picture.

Looking Through Near-Term Concerns

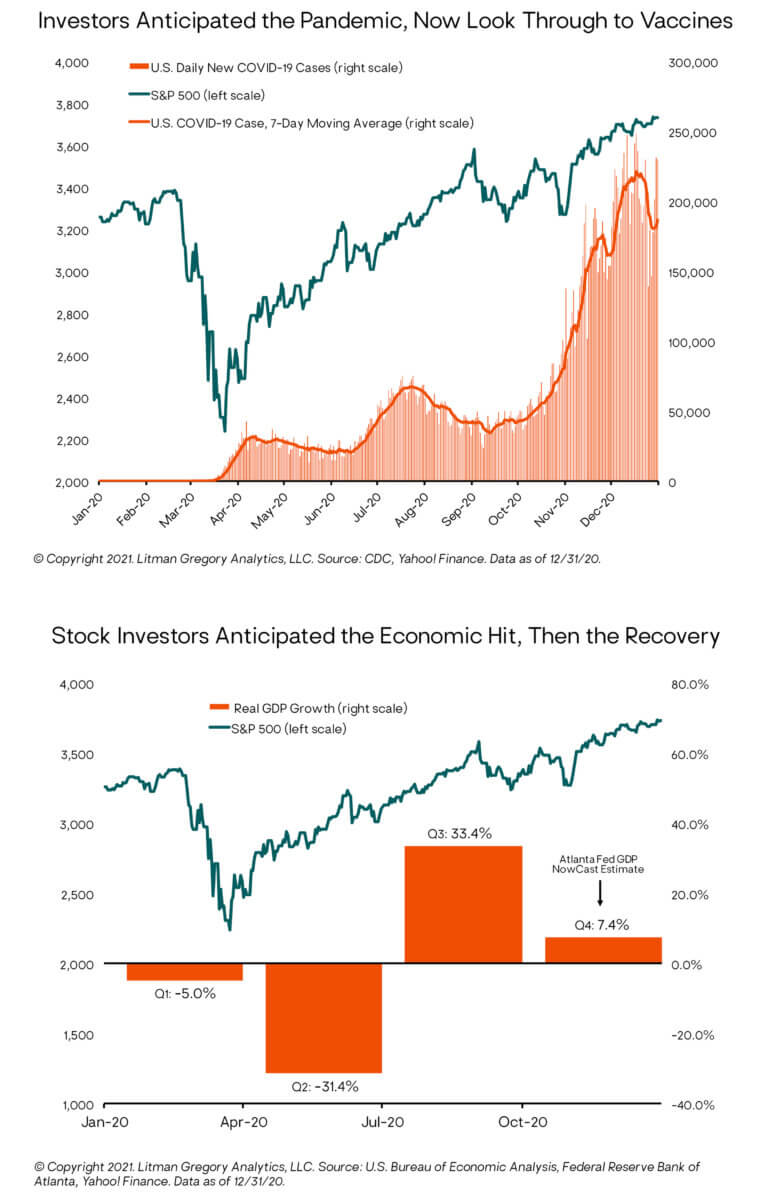

COVID-19 cases, hospitalizations, and deaths are alarmingly high and still rising in the United States. Economic activity has recovered some but is still well below pre-COVID-19 levels. And the potential for political turmoil has not gone away with the elections resolved, as witnessed by the recent Capitol riot. Why have markets been so strong in the face of crises, medical, economic, and political?

One answer is markets are often anticipatory: Investors are trying to understand the future with the information available to them today. In the case of stocks, they realize (to some extent) that a big part of their value is predicated on cash flows many, many years into the future. Today’s prices will reflect that. Investors don’t wait until events unfold or conditions develop. By then, competing investors would have already positioned themselves and it’s too late to react. Investors will tend to look-through near-term concerns when they see them as temporary. In fact, the best times to buy stocks have been when GDP growth was lowest or negative, unemployment was highest—effectively when everything was bad and everyone knew it.

The Markets ≠ the Economy or the Political Situation

There are some plausible reasons why the connection between the economy and the stock market is not as strong as one might think. Consider this: S&P 500 Index companies only employ about 17% of the non-farm workforce in this country. Many public firms are in sectors that have been more insulated from the pandemic’s effects. Meanwhile, tens of millions of private small businesses employ almost 50% of U.S. workers. These have been disproportionately impacted by the COVID-19 shutdowns given the industries they are in (think restaurants, mom-and-pop stores, hair salons). This is how the average business (and the overall economy) can be hurting while the largest public companies continue to do well.

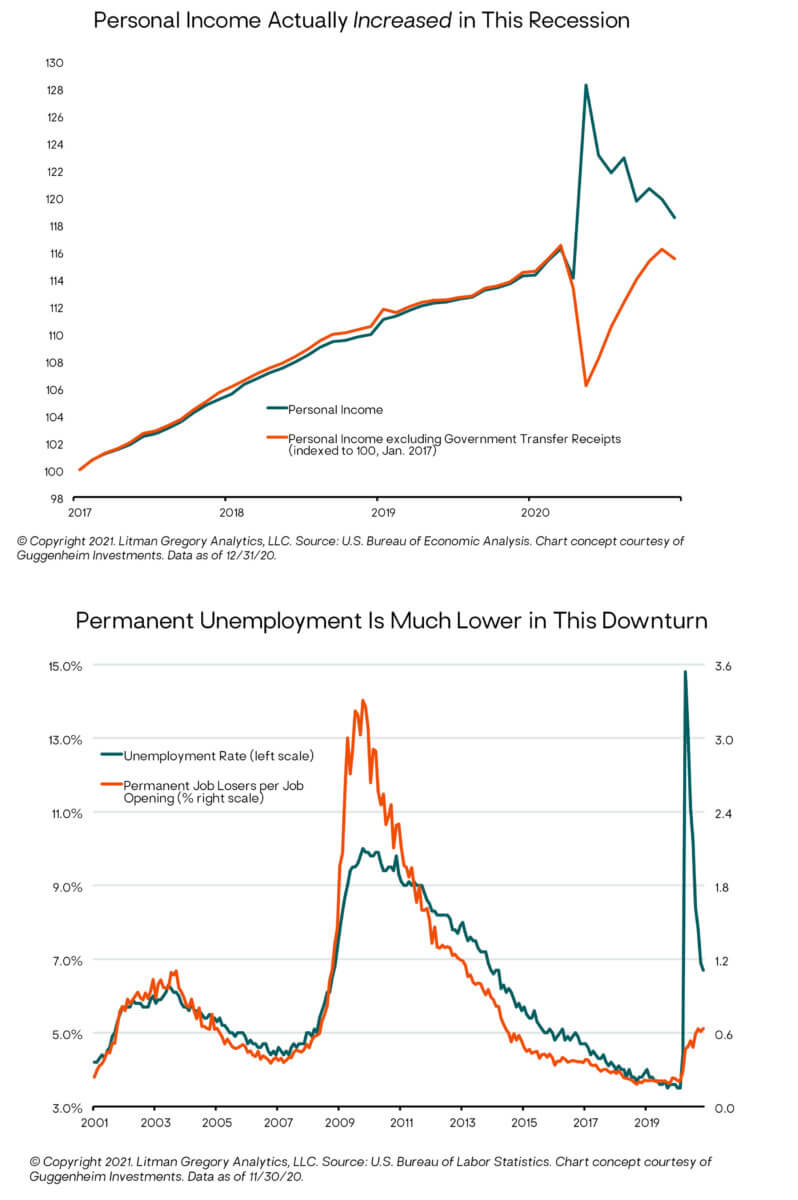

In addition, the current recession experience has been quite unique, which may explain the market’s reaction. This is the first U.S. recession during which personal income actually increased. How? The stimulus payments and higher unemployment compensation provided directly to citizens throughout 2020. And while headline unemployment spiked and remains very high, the number of workers saying they are permanently laid off per job opening is much, much lower than is typically the case in a recession. Usually it is 1% or more (3% during the 2008 financial crisis). That damage can take a long time to heal. But during the COVID-19 recession, it has only been around 0.6%. This emphasizes the likely short-term nature of the pandemic’s disruption to our economy, a belief reflected in the stock market.

Finally, while shocking, the recent political chaos is likely to have an even weaker influence on markets than the economy, except perhaps to increase daily volatility in the short term. Riots, another impeachment trial, power transition concerns—these are disconcerting to anyone who cares about democracy. But they do not have a direct impact on business conditions. Actual implemented policies can matter, though. Those policies when announced, the course of the pandemic, and business fundamentals will be greater drivers of market returns than elections or so far isolated political unrest.

The Risks Are Real

The risks in our world today should not be minimized because they are very real. There will be further loss of life due to COVID-19. The return of lockdowns, however targeted, or a lack of government support could lead to another economic downturn before the pandemic is under control. Investor optimism is extreme right now, historically not a good sign for near-term stock returns. And poorly designed or implemented government policies could impact the economic climate (and in turn markets), whereas general political uncertainty hasn’t really yet.

But with effective vaccines being administered, we are looking at potentially reaching “herd immunity” by the summer. One strategy manager we invest our clients with concurred on a recent webcast and thinks we will get there as soon as June. Enough of the citizenry could be inoculated by then to allow us to open the economy up more fully (at least in the United States). Hopefully, this releases pent-up demand. Unless other data points change meaningfully, we’d likely view any market declines in the interim as temporary and as possible opportunities to invest at higher rates of return for our clients.

Partnering with Our Clients

Because no one knows for certain what the future holds, we are prepared to deal with this uncertainty in the same way we deal with general market uncertainty—by remaining disciplined and focused on the long term. As always, if you have questions or would like to discuss your individual situation, please contact our team to arrange time for discussion.