Commentary from iMGP CIO—First Quarter 2022

A lot has happened since our year-end communication. In this commentary letter, we will highlight the key developments as they relate to the global economy and financial markets. The biggest macro event is Russia’s brutal invasion of Ukraine. As is our job, our focus here is on the economic and financial market impact of this event. Clearly, the human impact has been devastating and tragic. With no resolution yet in sight, our hearts and support are with the Ukrainian people.

First Quarter Market Recap

Financial markets had a rough first quarter across the board—stocks, bonds, U.S., international and emerging markets—hurt by rising interest rates, inflation and the war in Ukraine.

Global stocks (MSCI ACWI Index) fell 5.4% for the quarter. Among major global markets, the S&P 500 was a relative outperformer, dropping 4.6%, compared to developed international markets (MSCI EAFE Index) down 5.9% and Emerging Market (EM) stocks down 7.0%.

The relatively mild declines for the full quarter masked the intra-quarter volatility. At its low point on March 8, the S&P 500 was down 13% from its high on January 3. The developed international and EM stock indexes had drawdowns in the 16-17% range during the quarter, before rebounding roughly 10% by quarter-end.

Unusually, the damage was worse in the U.S. core bond market than the U.S. stock market. The benchmark Bloomberg U.S. Aggregate Bond Index (the “Agg”) fell 5.9% for the quarter. This was the second-worst quarter for the Agg since Q1 of 1980, when Paul Volcker’s Fed was in full-bore tightening mode.

As we’ve discussed, a period of rising inflation and rising interest rates creates challenges for both bonds and stocks, and in turn for a traditional balanced portfolio comprised only (or largely) of core bonds and stocks. Diversification into other asset classes, market segments and alternative strategies can be particularly valuable in such an environment.

In the fixed-income markets outside of core bonds, high-yield (lower credit quality) bonds lost 4.5%, while floating-rate loans had just a 0.1% decline.

Finally, as we discuss next, managed futures strategies were the standout performers with the benchmark SG Trend Index gaining 17.9% for the quarter and posting gains in each month.

Portfolio Performance & Key Performance Drivers

In the first quarter, our portfolios performed generally in line with their strategic benchmarks, with some variation depending on the specific portfolio type. Absolute returns for the period were negative for almost all asset classes and for our portfolios.

There was one striking exception in our portfolios: trend-following managed futures. Managed futures strategies had a very strong quarter with double-digit gains, showing the diversification value they can bring to a portfolio when traditional stock and bond funds struggle. In the current inflationary environment, trend-following managed futures have been particularly beneficial, as we expected. Year to date, the benchmark SG Trend Index was up 17.9%, while the SG CTA Index, which includes other strategies in addition to trend following, was up 13.1%.

As a reminder, managed futures funds can take long and short positions across global fixed-income, equity, commodity, and currency markets. Trends in interest rates and bonds have been a powerful contributor to their performance this year, providing a sharp contrast to the losses in investment-grade bonds, which have suffered losses as rates have risen.

Managed futures funds’ short exposure across the U.S. yield curve has been positive for returns, as well as short positions in most developed markets’ sovereign bonds. Commodities have been the other dramatic winner in terms of asset classes, driven by long exposure to various energies (e.g., crude oil, natural gas, heating oil), as well as agricultural markets like wheat, corn, and soybeans. Many of these assets were benefitting from inflationary pressures coming into the year, and some experienced additional gains due to Russia’s invasion of Ukraine (both are major agricultural exporters, and Russia is a major energy exporter).

Commodities and rates/bonds accounted for the vast majority of the gains in the SG Trend Index. Equities were a slight detractor, with many CTA managers coming into the year with positive exposure to equities, which had negative returns nearly across the board. Most managed futures funds are now short equities, picking up their declining trend. Currencies have generally been a positive contributor for managed futures, benefiting from long U.S. dollar exposure against most major non-commodity-driven developed markets as the U.S. Dollar Index (DXY) is up 2.8% this year.

In terms of our fixed-income allocation, our tactical positions in flexible, actively managed bond funds and floating-rate loan funds again added value relative to the core bond index from which the positions are funded, although they still posted losses. This was not surprising given the interest rate and credit market backdrop during the period, with Treasury yields sharply rising and corporate bond spreads widening.

On the downside, our tactical overweight to EM stocks detracted from relative performance. After a strong January, EM stocks gave up ground in the latter half of the quarter, trailing U.S. stocks and bonds.

Macro Backdrop: We Remain Cautiously Optimistic, But Inflation and Recession Risks have Risen

War in Ukraine

The war in Ukraine has had wide-ranging but diverse impacts on the global economy and individual regions. Besides Ukraine itself, the most direct and damaging economic impact is on Russia. Given that Russia’s economy is less than 2% of global GDP and that our portfolios had close to zero exposure to Russian stocks or bonds, it is immaterial.

However, Russia is a major producer and exporter of oil and natural gas—to Europe in particular, accounting for roughly 50% of Europe’s natural gas imports and 25% of its oil imports—and certain agricultural commodities and base metals. As such, the war and the sanctions imposed on Russia by the West are having, and for the foreseeable future will continue to have, a material impact on global economic growth and inflation.

In a nutshell, the war is a “stagflationary” supply-shock: it fuels higher inflation via sharply rising commodity prices (especially oil) while also depressing growth via negative impacts on real disposable income and consumer spending. It is also triggering various government and central bank policy responses, which as we discuss below create additional risks and uncertainties for the economy and markets, given already-high inflation and decelerating growth coming into the year.

As we write this, the path, timing, impact and ultimate outcome of the war are highly uncertain. Russian and Ukrainian commodity exports could be further disrupted forcing prices even higher; the conflict with Russia could expand beyond Ukraine, with even more death and destruction. On the other hand, we may be positively surprised by a quicker and/or less destructive resolution than the current consensus. As we’ve often said about shocking events such as this: the truth is no one knows (and if they think they know, they’re fooling themselves).

As such, we continue to frame our macro outlook and market analysis by incorporating a range of scenarios and outcomes we believe are plausible. We construct our client portfolios to be balanced, diversified and resilient across this range. We also proceed with a large dose of humility. The future is inherently uncertain. We should be prepared to be—expect to be—surprised again and again as it unfolds. Or as Nobel Prize winner Daniel Kahneman put it: “The correct lesson to learn from surprises is that the world is surprising.” In short, we want to build portfolios that are resilient in the face of surprises rather than ones whose success depends on predicting them.

COVID-19

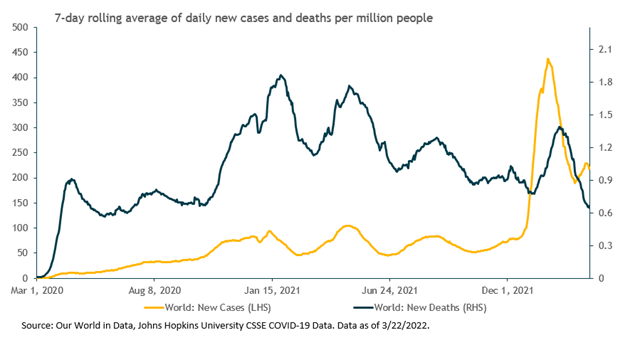

The disheartening events in Ukraine came as the COVID-19 pandemic news was getting better, with the Omicron wave sharply receding. Of course, the risk remains of new or more severe waves of the virus. As the chart below shows, there has been a recent uptick in new cases globally — in China (leading to full lockdowns in the affected areas under China’s “zero-COVID” approach), other Asian countries and Europe. The U.S. may soon face a similar uptick. But over time, with continued rising immunity rates, vaccines, medical advancements, and social and business adaptation, the economic damage and disruption should continue to recede. That is our base case.

If so, this should both support economic growth via consumer and business spending and mitigate some of the inflationary pressures the U.S. and global economy experienced last year caused by widespread supply-chain bottlenecks, supply/demand mismatches for consumer durable goods (e.g., autos) and the sub-par recovery in the U.S. labor force participation rate, which has contributed to higher U.S. wage inflation and increased the risk of a self-reinforcing wage-price spiral taking hold.

Economic Conditions: Growth and Inflation

With the war in Ukraine, most economists and investment strategists have lowered their 2022 economic growth forecasts and upped their inflation forecasts, reflecting the expected stagflationary impacts discussed above.

Growth:

On the growth side, for example, Capital Economics cut their global real GDP growth forecast from 4% to 3.2% for this year, which is only slightly above the economy’s long-term trend growth rate. The Federal Reserve, at its March FOMC meeting, cut its 2022 U.S. real GDP growth forecast from 4% to 2.8%.

Growth forecasts for Europe have taken the biggest hit since the war. For example, Ned Davis Research (NDR) cut their 2022 Europe real GDP growth forecast from 4% to 2.7%. Oil prices are up more than 30% this year to around $100 per barrel, while European natural gas prices have soared nearly 80%. NDR estimates that a $20 increase in real (inflation-adjusted) oil prices shaves 0.6 percentage points off European GDP growth.

However, absent a severe deterioration in the war, NDR (and most other research we follow) still sees a low risk of recession in Europe this year due to large household savings, pent-up consumer demand from the pandemic, a strong job market (Eurozone unemployment recently hit a record low at 6.8%), and additional fiscal stimulus on the way.

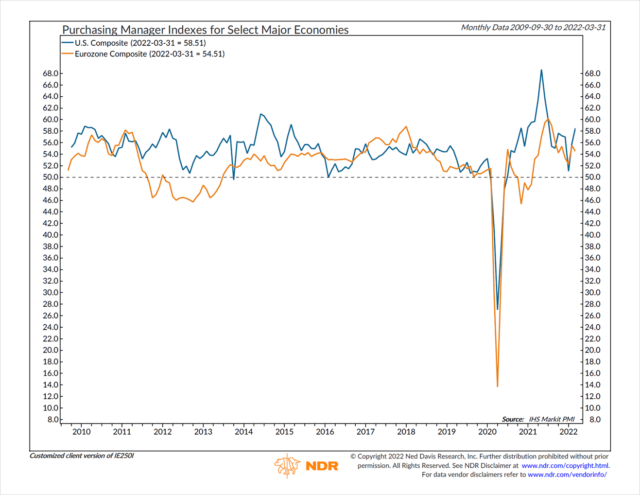

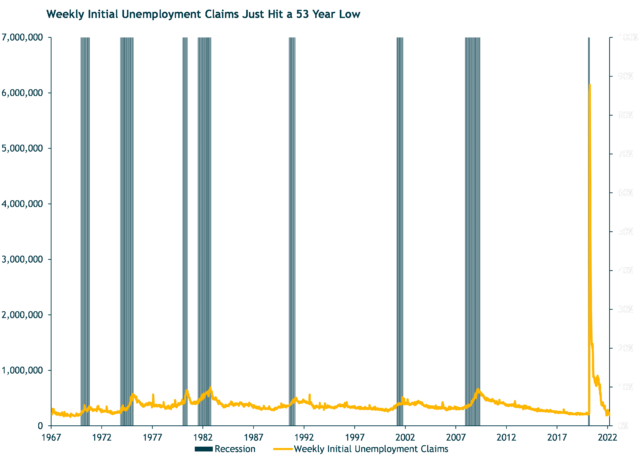

The weight of the evidence also suggests a U.S. recession in the next 12 months is unlikely – we’d call it in a rough ballpark of 25% odds or less. Several recent U.S. economic data points have been solid/strong, including expansionary Purchasing Manager Index (PMI) readings, record-high job openings, record-low weekly new unemployment claims, and a positive Leading Economic Indicator (LEI). Household wealth and savings are also high, which should support consumer borrowing and spending even with high inflation and rising interest rates. Corporate balance sheets are also generally in good shape.

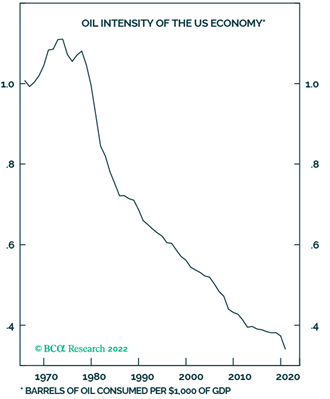

Moreover, the “oil intensity” of the U.S. economy has dropped sharply over the past four decades. The economy is less sensitive to oil price spikes, and much less exposed than during the 1970s OPEC oil crisis. The U.S. is also now a slight net exporter of petroleum, which mitigates the overall economic damage from rising oil prices, although domestic consumers—lower income households in particular—certainly suffer.

Source: BCA, U.S. Investment Strategy, 3/14/22

With the Ukraine war and COVID as wildcards, the growth backdrop could certainly deteriorate further, possibly leading to a recession next year. But as things currently stand, the U.S. and global economy still look likely to post solid, above-trend growth this year, albeit lower than was expected three months ago.

Inflation:

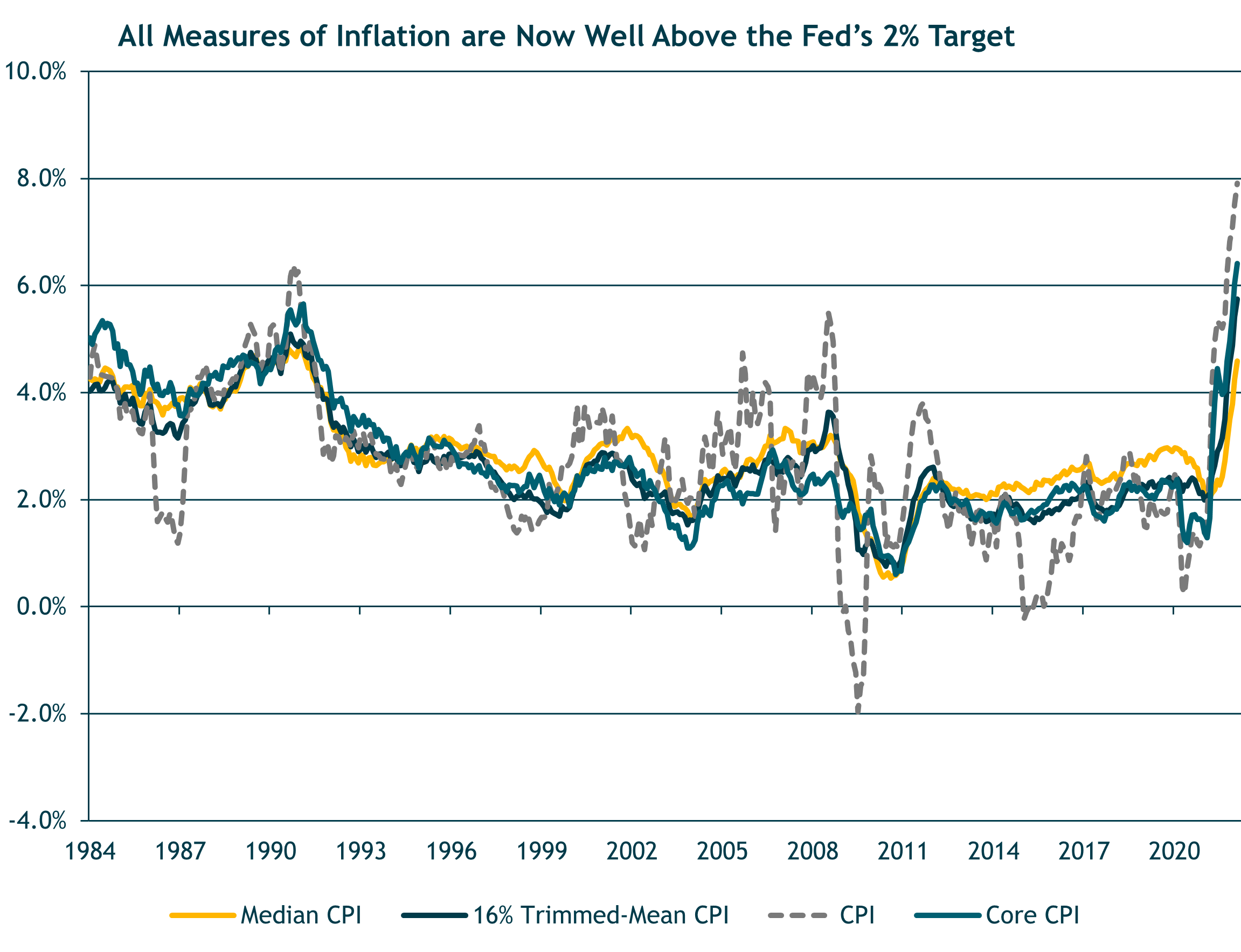

Moving on to the inflation backdrop in the U.S., the news has gotten worse over the past three months as can be seen across any number of inflation measures: core, median, trimmed mean – take your pick.

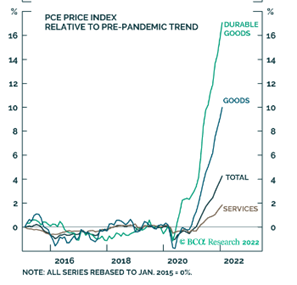

However, as the following chart shows, the highest inflation by far is still coming from the consumer goods side of the economy, where the supply/demand imbalances due to COVID are worst. These imbalances should recede as the pandemic recedes, reducing at least some of the broad inflationary pressure.

Source: BCA. U.S. Investment Strategy, 3/21/22

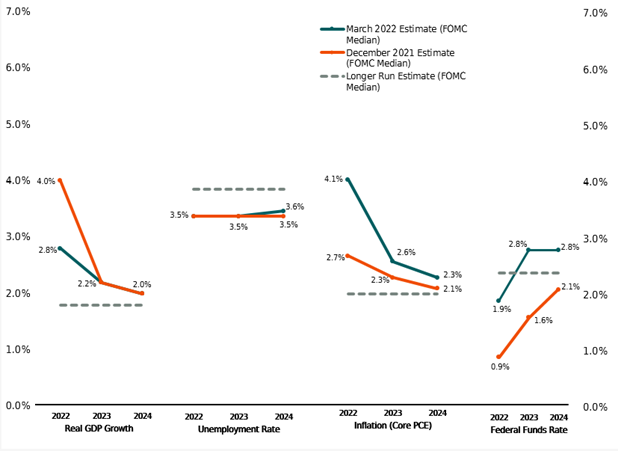

While most forecasters expect U.S. inflation to be lower by year-end than it is now, the consensus estimate has risen compared to three months ago. This includes the Fed. At its March FOMC meeting it projected core PCE inflation of 4.1% for this year, up from its 2.7% forecast last December.

The persistence of high and broadening inflation has led to a further hawkish shift in the Fed’s monetary policy stance, to which we will now turn.

Monetary and Fiscal Policy

Monetary Policy

The Fed has finally begun to raise interest rates (the fed funds policy rate), starting with a 25-basis point (0.25%) increase at the March FOMC meeting. The chart below shows the sharp increase in the fed funds rate the FMOC now expects in 2022 and 2023 compared to their previous meeting in December: 1.9% (2022) and 2.8% (2023) vs. 0.9% and 1.6%, respectively.

The Fed also indicated it will start to shrink its $9 trillion balance sheet of Treasury and government agency mortgage-backed securities this year. This is another form of monetary tightening—quantitative tightening (QT), the opposite of quantitative easing (QE).

Hawkish Fed Now Anticipating Seven Rate Hikes This Year and Stubborn Inflation

In his post-FOMC meeting comments, Fed chair Jerome Powell clearly stated that fighting inflation is the Fed’s focus, now that the labor market has reached maximum employment and then some. “We need to get rates back up to a more neutral level as quickly as we practicably can and then move beyond neutral if it turns out to be appropriate,” he said. As to the Fed’s full employment mandate, Powell was surprisingly hawkish, pointing to “a very, very tight labor market; tight to an unhealthy level, I would say.”

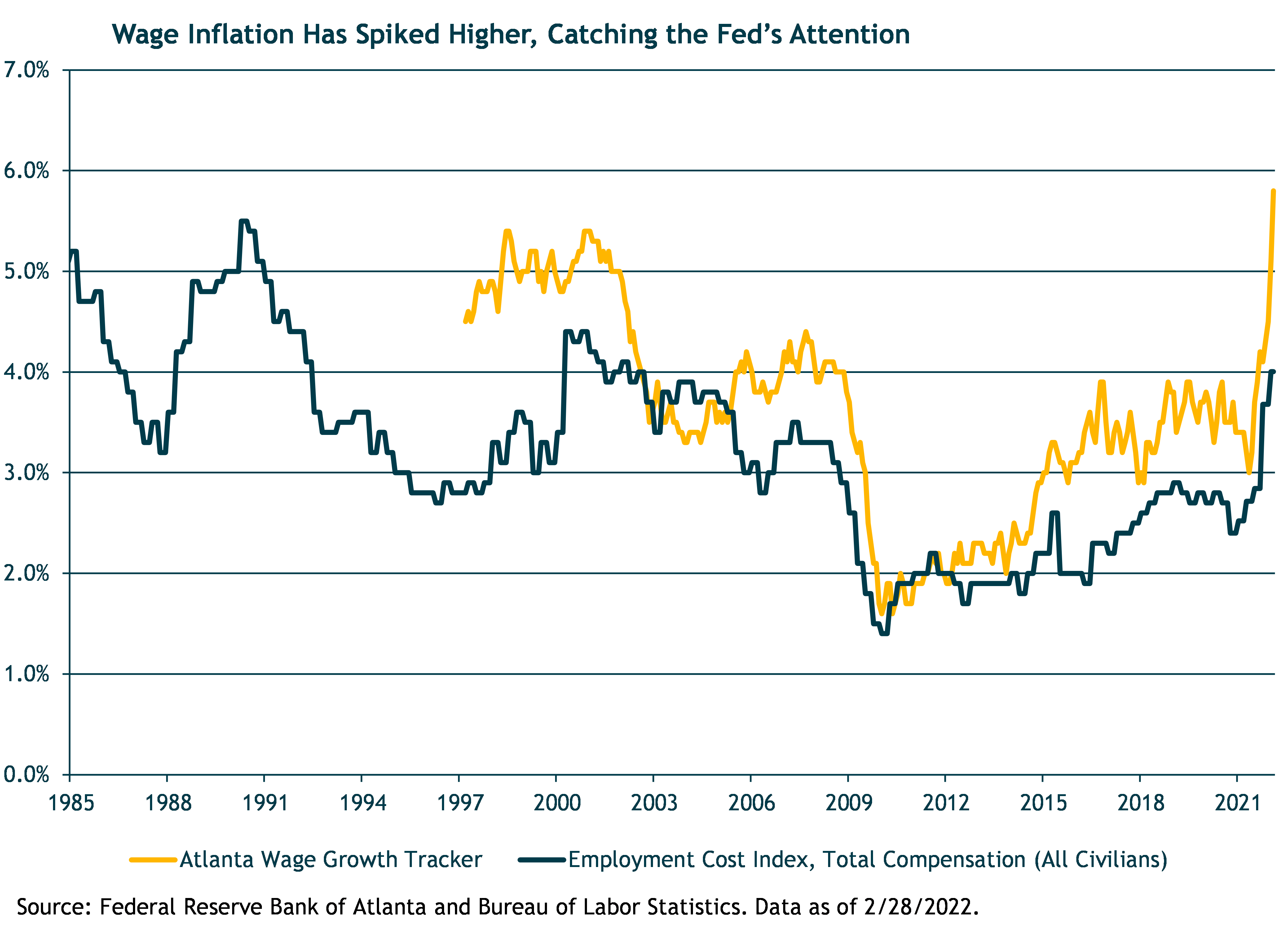

Below are two charts we’ve presented in prior commentaries showing various measures of (1) wage/labor cost inflation and (2) survey- and market-based inflation expectations. These variables can drive a self-reinforcing inflationary wage-price-expectations spiral, so the Fed pays close attention them.

Wage inflation is becoming a particular concern, as reflected in the chart and Powell’s “unhealthy” tight labor market comment.

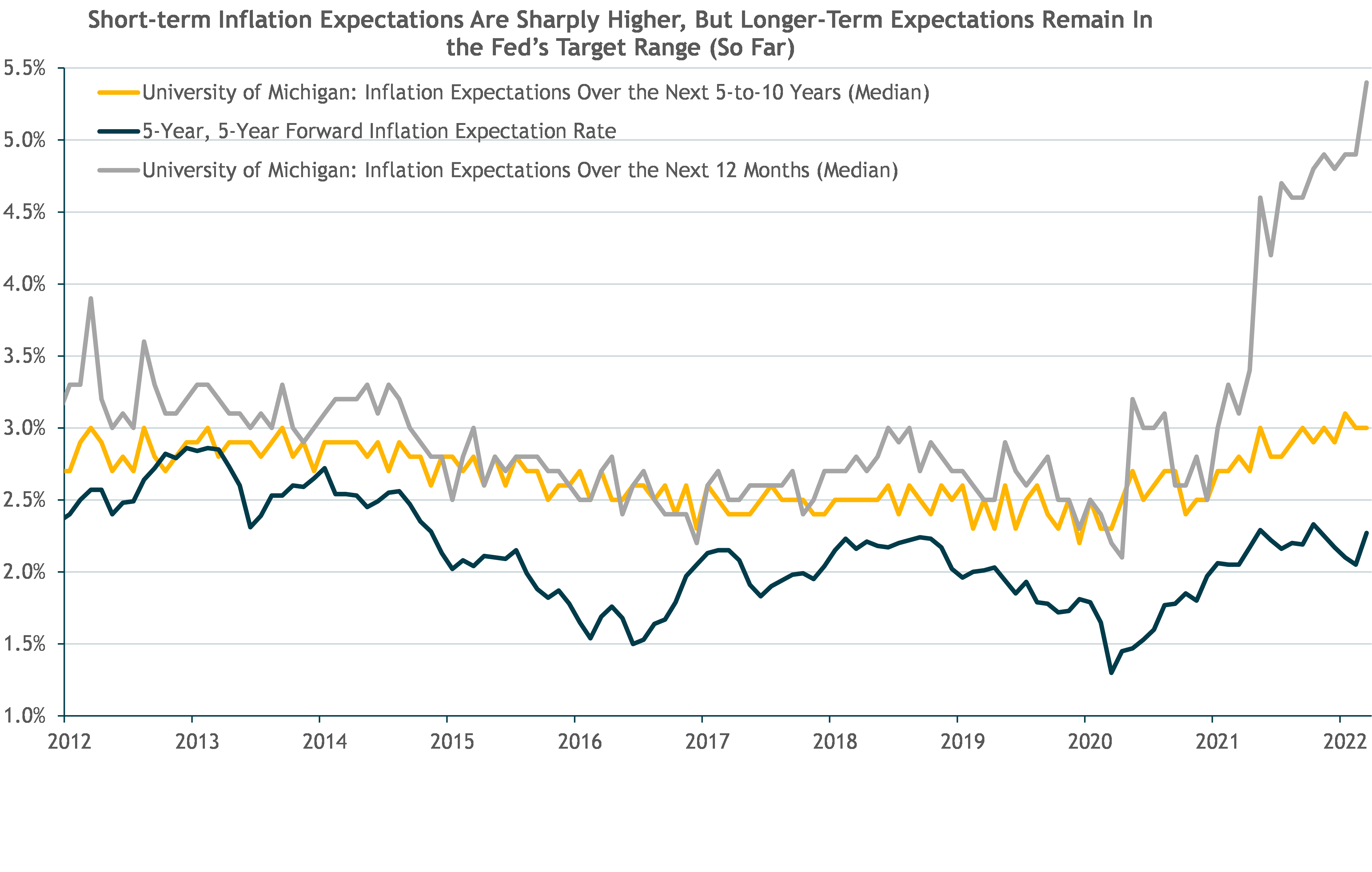

On the more positive side, longer-term inflation expectations remain mostly “anchored” in a range consistent with the Fed’s 2% long-term core inflation target. Short-term (12-month) inflation expectations have spiked higher, consistent with the recent sharp rise in gasoline prices and overall CPI. Should the longer-term measures move higher, we’d expect the Fed to accelerate its tightening pace.

Powell and the Fed are in a tough spot. They know they need to tighten to combat high inflation, keep longer-term inflation expectations anchored, and prevent a wage-price spiral from taking hold. If they fail, it will require even more drastic policy tightening down the road. Yet, much of the current inflation is driven by exogenous supply-side disruptions due to COVID and the Ukraine war that the Fed can’t control. Raising rates is intended to crimp aggregate demand, i.e., consumer and business spending. This should eventually have a downward impact on inflation (basic Econ 101 supply and demand). But it also raises the risk of driving the economy into recession or near-recession and increasing unemployment to unhealthily high levels.

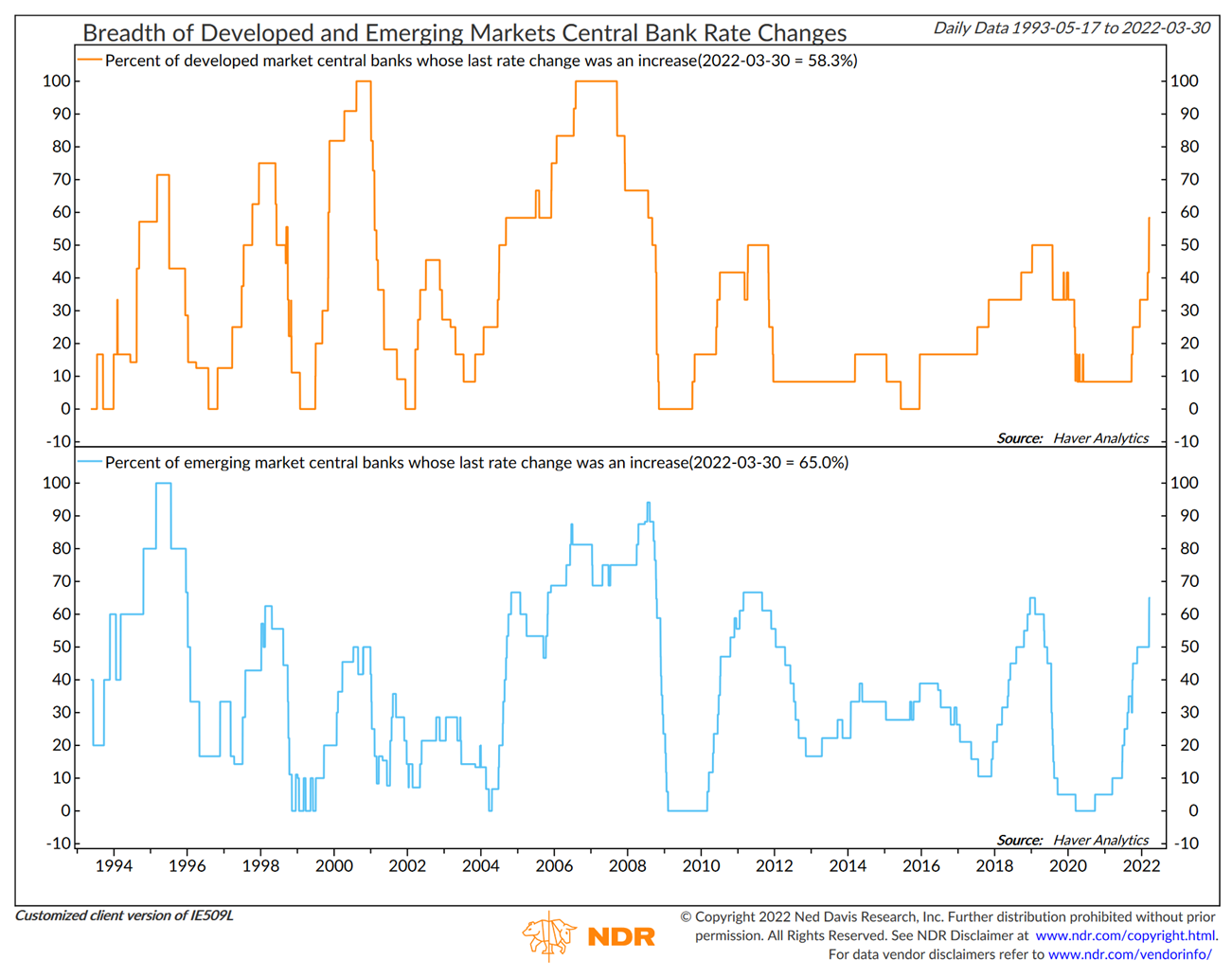

In terms of monetary policy outside the United States, the chart below shows that roughly two-thirds of global central banks (including developed and emerging markets) have also been raising interest rates. The notable exceptions continue to be the European Central Bank (ECB) and the Bank of Japan (BoJ), although the ECB has signaled potential rate hikes later this year.

Meanwhile, as we noted last quarter, China is a notable outlier in that it has started loosening monetary policy—cutting interest rates and Chinese banks’ reserve requirement ratio, allowing for additional lending. The PBoC is expected to continue to loosen in the months ahead to support the economy and markets. On March 16, senior Chinese authorities also signaled additional fiscal stimulus, regulatory relaxation and equity market support. This triggered an incredible 20% rebound in the MSCI China Index ETF that day; Alibaba and Tencent’s stock prices soared over 30%, off depressed levels. It remains to be seen if, how and when the authorities’ words translate into substantive policy actions. But BCA Research estimates China’s fiscal spending impulse will increase to over 3% of China GDP this year.

A Majority of Central Banks are Now Tightening Policy, Raising Rates

Fiscal Policy

As we wrote at year-end, after unprecedented stimulus in 2020 and 2021, both fiscal and monetary policy in the United States were set to tighten in 2022. There hasn’t been any major change on the fiscal side. Meaningful new stimulus appears unlikely. Instead, the economy faces a fiscal growth drag, estimated by the Brookings Institute to be in the range of negative 2.5-3 percentage points this year.

Economic Outlook

Taking all of these factors into account, our base case shorter-term (12-month) economic outlook is for decelerating economic growth and still-high but moderating inflation. Absent a recession, which of course we can’t rule out, this macroeconomic backdrop should be generally supportive for “risk asset” returns, such as global equity and credit markets, and a headwind for core bonds in the face of rising government bond yields.

We’ve seen the latter play out so far this year, with sharply negative bond returns. Risk asset markets have also been generally negative, but not much worse than core bonds and in some cases better. As we’ll discuss in the next section, looking forward we believe equities and credit have relatively attractive return potential from current levels.

To summarize the key risks around our cautiously optimistic macro base case:

- The war in Ukraine expands to other countries and/or intensifies causing deeper economic damage, beyond the terrible human toll.

- A new highly infectious and deadly COVID-19 variant emerges, leading to renewed lockdowns with resultant economic and social impacts.

- The Fed makes a policy mistake: Either (1) tightens too much triggering a severe slowdown/recession; or (2) allows inflation to become entrenched, inflation expectations un-anchored and a wage-price inflation spiral takes hold.

- The Chinese economy has a sharp downturn (“hard landing”), for example, due to a policy mistake related to the property-market deleveraging, or possibly Western sanctions if China supports Russia’s war in Ukraine.

- Another geopolitical or exogenous shock impacts the global economy (always a possibility).

Financial Markets Outlook and Our Portfolio Positioning

As noted in our Market Recap above, there was a lot of volatility in Q1. But as the quarter ended, most major global equity markets were only 5%-7% below where they started the year. Lower prices are a long-term investor’s friend, as they set the stage for higher future expected returns, all else equal. But of course, volatility is unsettling in the moment. And markets drop in response to worse-than-expected news and negative surprises, when “all else” doesn’t seem equal.

Our job as long-term investors is to sift through the shorter-term market noise, stand back from the emotional whipsaw of the day-to-day headlines, and remain focused on the interplay between underlying economic fundamentals and the financial markets’ current pricing. As we’ve said before, the key question for a fundamental investor is, “What’s in the price?” What consensus expectations and assumptions are implicitly being discounted in current market prices? And then, “Do we have a variant view?” And if so, “What is the basis for that view, and do we have high conviction based on our research, analysis and judgment that we have a high probability of being right and the market wrong?”

When we gain conviction that the current market pricing is significantly out of whack with our view of the fundamentals, as expressed across our range of plausible scenarios, we will tactically re-position our portfolios. Otherwise, we stay the course, confident that our portfolios have a well-diversified balance of defensive assets (depending on the portfolio risk profile) able to withstand shorter-term negative outcomes or shocks, and riskier “offensive” assets that are the primary long-term return generators and wealth builders.

This is a long way of saying that we did not make any portfolio changes in the first quarter because our fundamental views relative to the current market pricing are still in-line with where they stood at year-end. Said differently, the war in Ukraine has increased upside inflation risk and downside growth risk. But looking through the day-to-day gyrations, the financial markets have reacted reasonably rationally, with U.S. interest rates rising sharply and riskier assets/equities falling moderately during the quarter.

Equities

U.S. Stocks

The consensus is for S&P 500 EPS growth of around 6%-8% this year. This seems a reasonable ballpark base case, given the macro backdrop. (The S&P 500’s long-term average EPS growth has been 6%.) Key downside risks are the Ukraine war, spiraling inflation and/or aggressive Fed and fiscal tightening beyond expectations—although monetary policy typically acts with a long lag on the real economy.

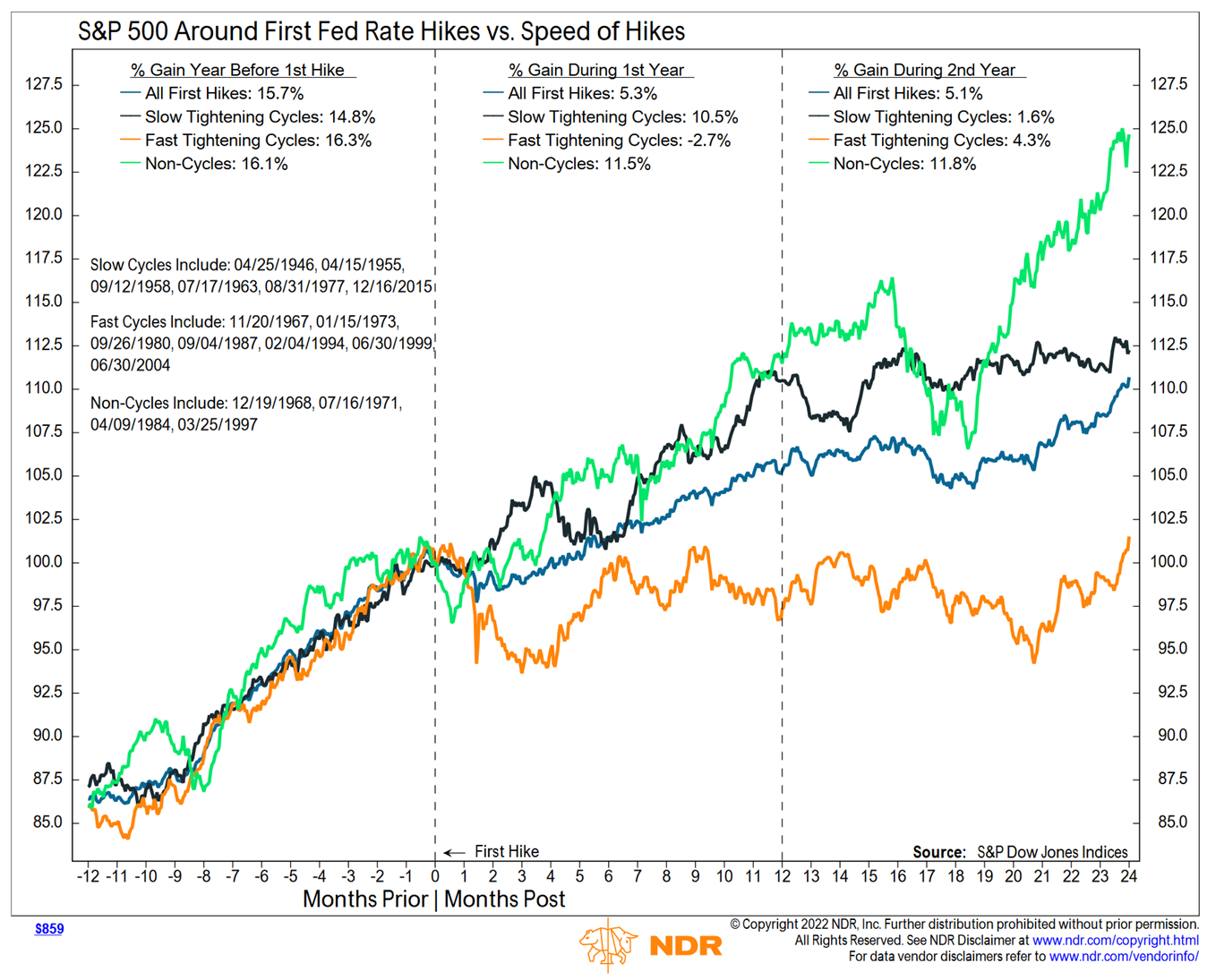

As to the latter risk, we shared the NDR chart below in our year-end commentary, when the consensus was for the Fed to begin slowly raising rates this year. Now the Fed has signaled its intention to raise rates at every Fed meeting, with possibly one or more 50 basis point rate hikes, and to also begin reducing its balance sheet. These actions would clearly qualify as a “fast” Fed tightening cycle under NDR’s definition. As the chart shows, historically that is bad news for stocks.

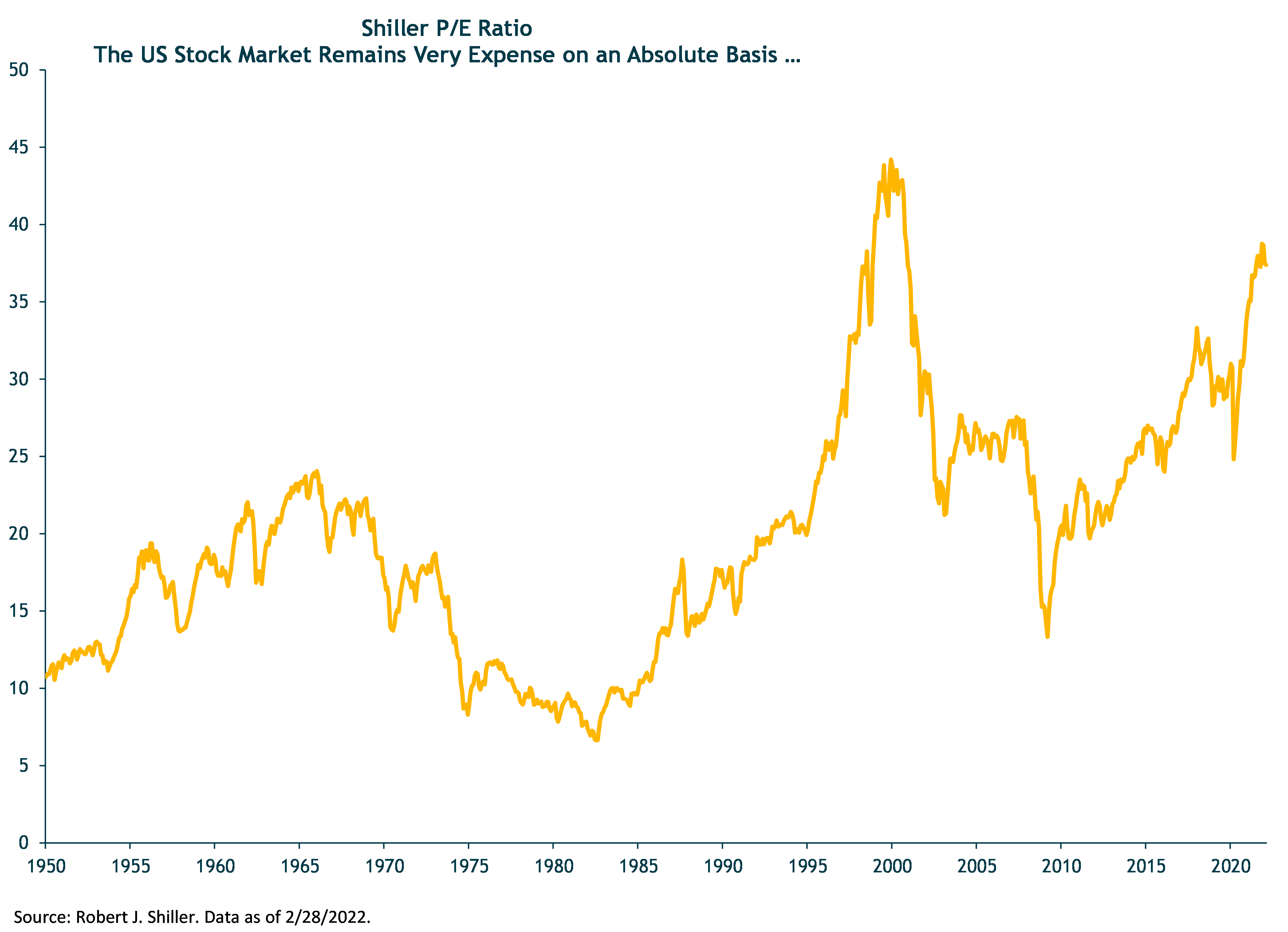

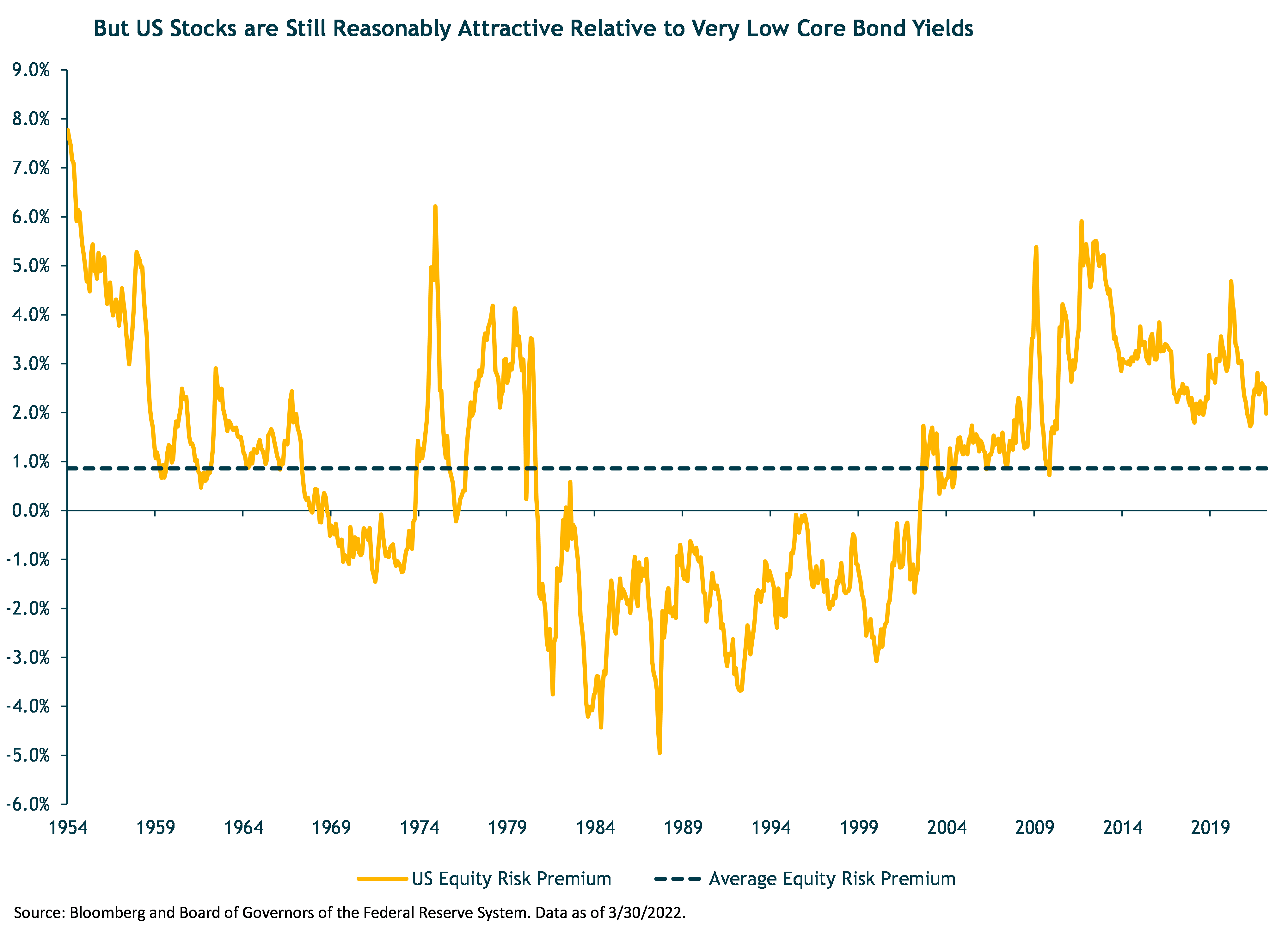

In the short-term, changes in valuations (P/E multiples) driven by investor sentiment and emotion can have a big impact on stock returns. Despite the recent drop, the S&P 500 still looks expensive on an absolute valuation basis. But, relative to still-low (but not as low) bond yields, U.S. stocks are still attractive.

However, valuation multiples are susceptible to rising interest rates. This is especially true for high-P/E, long-duration growth stocks, where most of the company’s current market value is based on profits expected to be earned far out in the future. As those future expected profits get discounted at a much higher interest rate, the present value mathematically declines and the stock price should also decline.

So, Fed tightening creates equity valuation risk as well as fundamental (earnings) risk if it triggers an economic hard-landing, sharply lower corporate earnings growth or outright earnings declines.

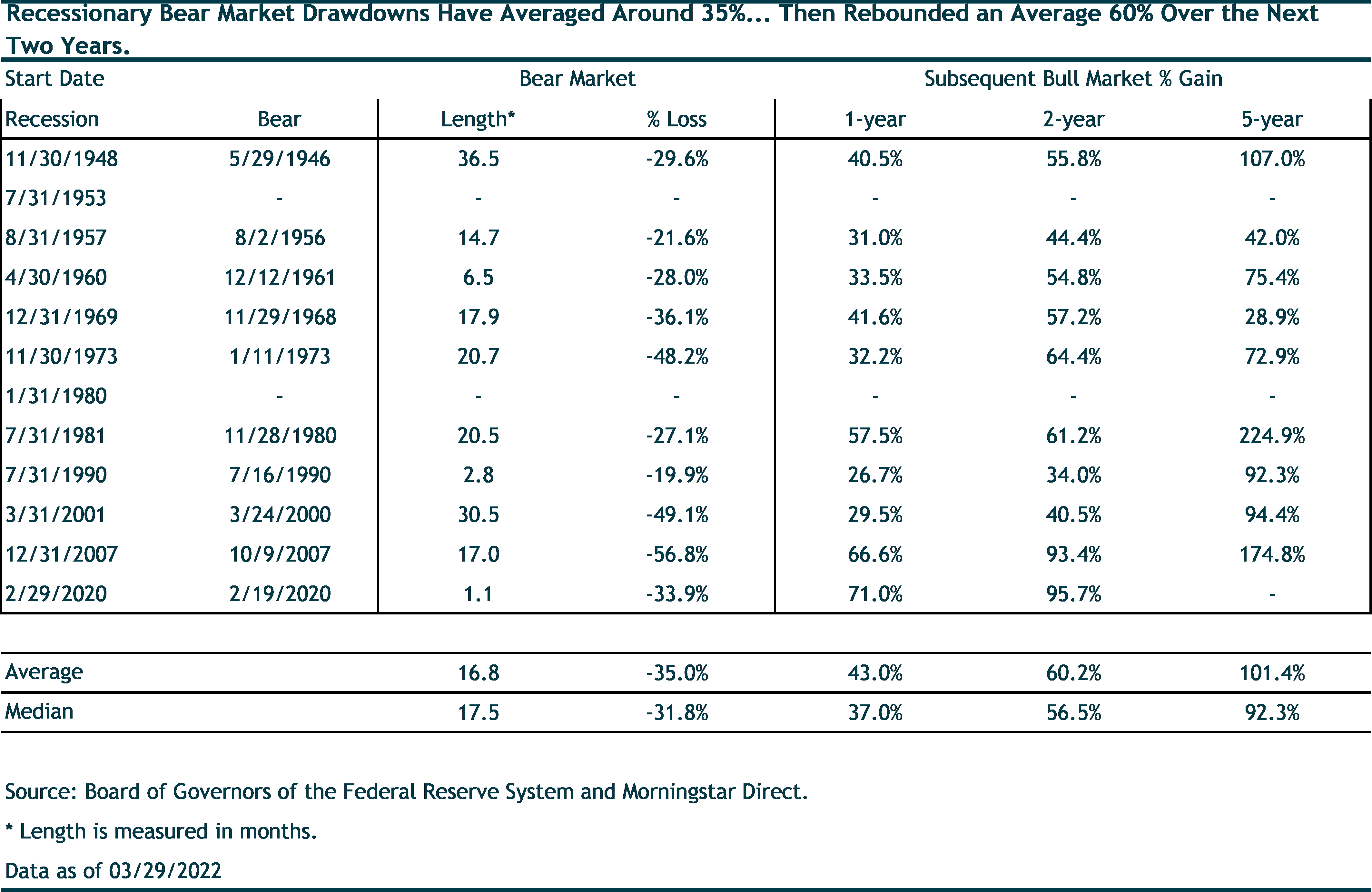

Goldman Sachs Research reports that in the 12 U.S. recessions after World War II, S&P 500 earnings per share (EPS) fell a median 13% from peak to trough; earnings then recovered 17% in the subsequent four quarters. Our analysis (table below) shows the S&P 500 Index had a median peak-to-trough decline of 32% corresponding to 10 of those recessions (the other two didn’t have bear market declines). However, for the last three U.S. recessions in 2001, 2008 and 2020, the market dropped 49%, 57% and 34%, respectively. Given current market valuations, interest rates and inflation, we’d be prepared for the next recessionary bear market to potentially be in the -30% range. That’s not a prediction but it’s a plausible bearish shorter-term scenario.

But after bear markets come bull markets—as anyone who has lived through the past few decades can attest and the table above shows. As we extend our time frame to a medium term (five- to 10-year) horizon, our current base-case outlook for the S&P 500 is for at least mid-single digit annual average returns. That’s decent in absolute terms, although well below the past decade’s 15% returns. But it’s quite a bit better than what we expect core bonds to deliver. This is as one would expect, and what one should require when investing in higher-risk assets over the long-term.

International and Emerging Markets Stocks

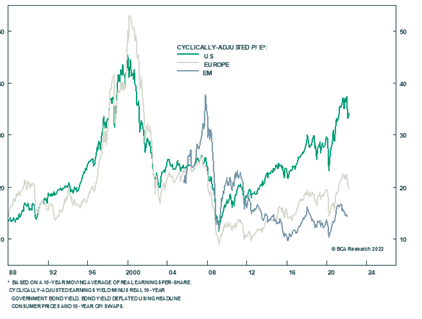

International and EM stocks are also higher-risk, even more so than U.S. stocks during the past decade-plus. Once again in the first quarter they were harder hit, due largely to the war in Ukraine. Consensus earnings estimates for both regions have come down this year as the economic risks have risen. But unlike the S&P 500, the European and EM stock indexes are selling at reasonably attractive valuations, both absolute and relative to bonds. They are also selling at deep discounts to the U.S. market – deeper than their historical discounts.

Europe and EM Absolute Valuations are Reasonably Attractive

While we acknowledge their higher shorter-term risks, especially in the current environment, our analysis continues to indicate we are being more than fairly compensated for investing in these markets over the medium-term (5-year) scenarios we believe are most likely to play out. And we believe our underlying analytical assumptions are, if anything, conservative, providing an additional margin of safety.

Most significantly, we expect to see a rebound in EM and European corporate earnings growth back towards their historical longer-term trends, after being deeply depressed for many years. For example, in our base case, the five-year implied EM EPS growth is a bit above 8%. We assume only a small increase in the EM index valuation multiple—from roughly 13x currently to 14x five years out. There is an argument to be made that we could see a larger multiple expansion on top of the stronger earnings growth as investor sentiment shifts in favor of these markets. Adding in the EM market index dividend yield, we estimate annualized five-year expected returns in the low double digits for EM stock markets. As such, we retain our slight tactical overweight to EM stocks, which is funded primarily from our underweight to core bonds and, depending on the specific portfolio, somewhat from U.S. stocks.

In our 2021 year-end commentary, we noted that we were evaluating whether to split our EM overweight allocation with European stocks. We completed our analysis but put the decision on hold in February as Russia built up troops and weapons on the Ukrainian border. With the invasion of Ukraine on February 24, the uncertainty and risks to the European economy increased materially. Meanwhile, the European stock index has only moderately declined since then, indicating that a worst-case recession scenario is not fully discounted. As such, we have no imminent plans to overweight European stocks. We continue to actively evaluate the risk/reward tradeoffs.

Finally, related to our foreign equity positioning, we continue to believe the U.S. dollar is likely to depreciate over the next several years for reasons we discussed at year-end: the U.S. faces twin deficits, the dollar is a counter-cyclical currency, it is fundamentally overvalued, and it is susceptible to a dovish Fed pivot. The dollar has gotten a boost this year (gaining around 2.8%) from the Fed’s hawkish stance and the Ukraine war. But a depreciating dollar will add to dollar-based investor returns from overseas markets, in addition to their diversification benefits.

Fixed Income

Our broad outlook for fixed-income assets has not materially changed. We have been expecting interest rates to rise putting continued pressure on core bond returns, and that played out in spades in Q1. With the core bond index now yielding 3%, expected 5-year returns have increased. But they are still very low and are susceptible to heightened inflation risk over the near-term and medium-term.

As such, we have a significant underweight to core bonds relative to a traditional bond benchmark. But we still hold meaningful core bond allocations in our more conservative portfolios as ballast in the event of a deflationary recession or traditional “flight-to-safety” market shock. However, core bonds will provide little benefit in a stagflationary recession scenario, which is an increasing risk as we’ve discussed.

In this respect, our flexible, lower-duration and credit-oriented fixed-income allocations have continued to add value relative to the core bond index, although they couldn’t entirely avoid the rising rate and widening credit spread backdrop in the first quarter.

Our research team continues to evaluate whether additional tactical changes to our fixed-income mix are appropriate, such as increasing the portfolio’s inflationary ballast. As always, we are weighing a range of shorter-term risk scenarios against each asset’s medium- and longer-term return potential and portfolio diversification benefits assuming different macro environments (inflation/disinflation, growth/stagnation).

Alternative Assets and Strategies – Marketable and Private

Well-managed alternative strategies with reasonable fees can add beneficial diversification and improve risk-adjusted returns as part of traditional stock/bond balanced portfolios. Given the current macro risks, elevated U.S. equity valuations, and depressed bond yields, we think this is especially true right now.

Most of our portfolios (depending on individual client circumstances and risk profile) hold a mix of marketable (liquid) alts, such as trend-following managed futures funds and multi-alternative strategy funds, and private funds focused on real estate and private equity/venture capital.

We fund the marketable alt positions largely from core bonds. We expect higher alt returns with low beta to equities and bonds. As expected, the managed futures positions have been powerful portfolio diversifiers. Even better, we are finally reaping strong returns from these allocations after several lean years that were lacking in major sustained trends.

Our private real estate investments are funded from a mix of stocks and bonds, depending on our assessment of the real estate fund’s risk profile. Private equity/VC is funded one-for-one from our strategic public equities’ allocation.

Closing Thoughts

The war in Ukraine has caused massive human suffering. From an economic and investment perspective, it has added to already-high uncertainty, degraded the near-term growth outlook, and added additional fuel to the inflationary fire. Crises, as painful as they are, often create opportunities. However, the equity and fixed-income markets have reacted quickly to the headlines, and as currently priced aren’t offering any compelling new top-down tactical asset allocation opportunities, in our view.

Our balanced portfolios remain positioned with (1) a small overweight to global equities, coming from our tactical overweight to EM stocks; (2) a large overweight to flexible, actively managed, credit-oriented fixed-income and floating-rate funds; (3) core positions in lower-risk and diversifying marketable alternative strategies; and (4) a large underweight to core bonds, but still meaningful allocations in our most conservative portfolios.

For many of our clients, we also have core holdings in private equity and private real estate funds run by skilled managers with strong track records and reasonable fees. These investments offer attractive long-term return potential plus additional portfolio diversification benefits relative to publicly traded securities.

While tilting towards our highest-conviction tactical views, our portfolios remain strategically balanced and well-diversified across multiple global asset classes, investment strategies, equity styles and risk-factor exposures. This should enable them to be resilient should a risk scenario or shock outside our cautiously optimistic base case occur.

We are confident that our long-term, team-driven investment process, research depth and discipline, and access to exceptional managers will enable us to continue to navigate whatever macro and market environments come our way. We all hope whatever comes next is not as grim as a pandemic or war. But as investors we need to be prepared for the unexpected in the shorter term when building portfolios to succeed over the long term.

We sincerely appreciate your continued confidence and trust.

—Jeremy DeGroot, CFA, Chief Investment Officer