A Decade Past, the Decade to Come

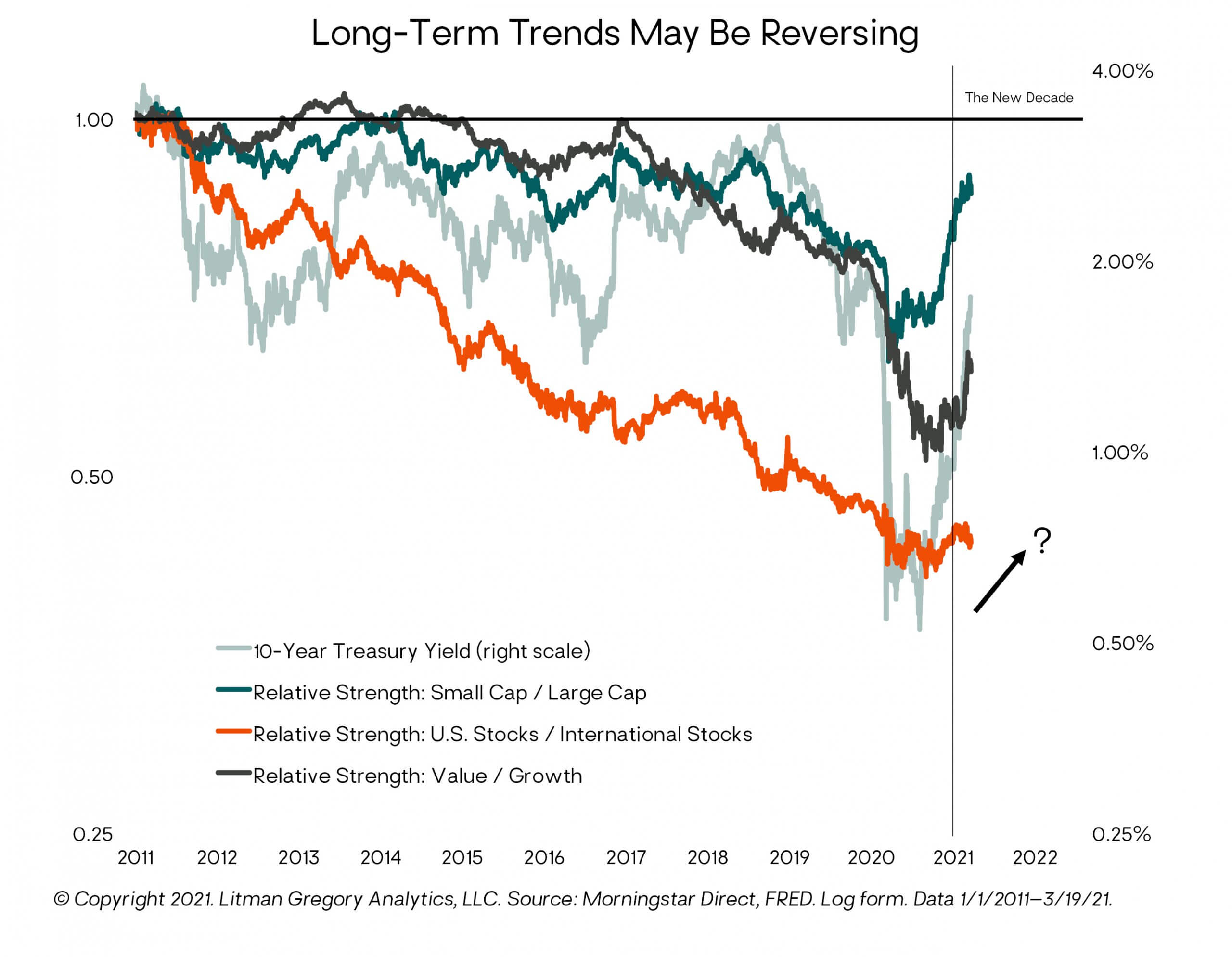

By quirk of year reckoning, 2021 actually marked the beginning of the 2020s decade, not 2020. So now that we have “truly” entered the new decade, what better time to reflect on the last 10 years and consider what we should expect over the next 10. We may see major reversals of longer-term market trends. Investors and institutions managing money face big challenges because of this: muted prospective returns but the same fixed spending needs. There are always tradeoffs, and there’s no free lunch. But based on our research, we think the answer is to tilt in contrarian ways (or not so contrarian ways as we’ll discuss) toward what has not worked as well since the market’s recovery from the 2008 financial crisis, knowing that markets move in long cycles and we are at or near an unsustainable point.

The Decade Past

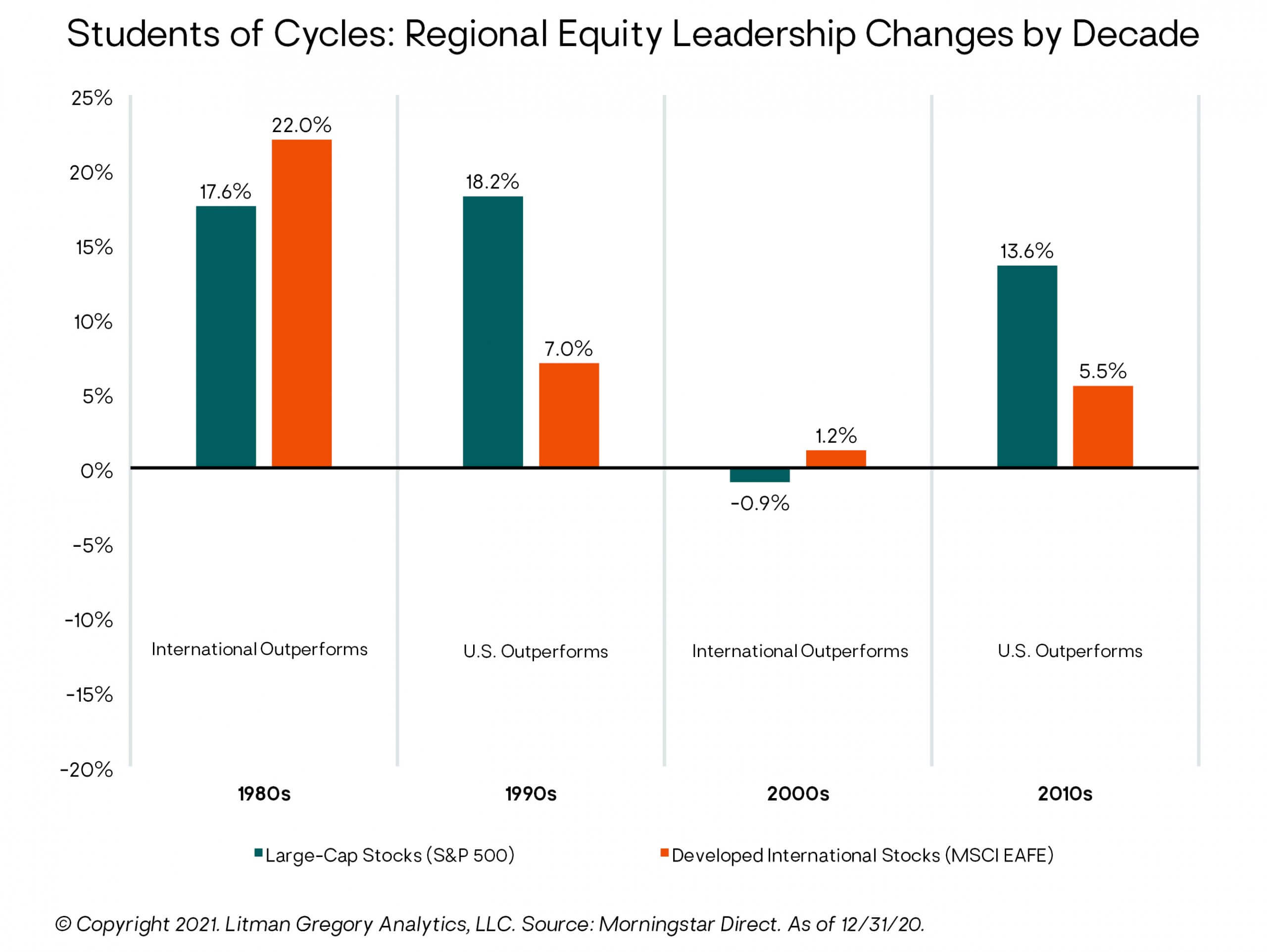

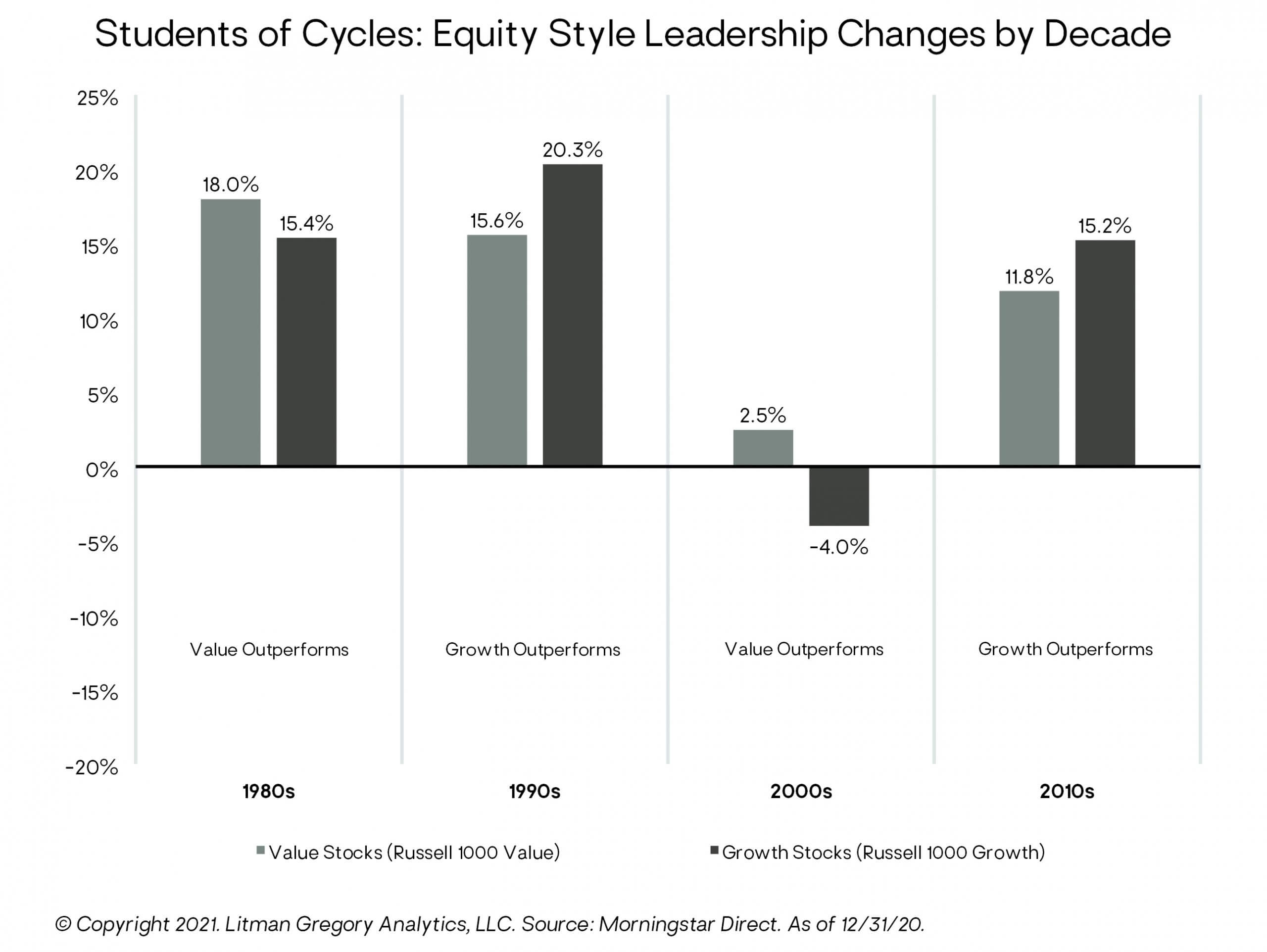

The last 10 years have seen U.S. stocks significantly outperform non-U.S. stocks, large caps outperform small caps, and growth strongly outperform value. The dominance of these trends has been unrelenting. Whenever a cyclical turn looked near, it would be arrested by some exogenous event (like Brexit) or die prematurely. In hindsight, the justification for what has happened seems clear.

There were several forces at work that supported U.S. stocks, particularly the large-cap growth variety, and U.S. bond returns:

Structural Issues in Overseas Economies

Despite the subprime crisis emerging from the United States, we handled it better and recovered from it quicker than Europe, for example. Our government and regulators responded relatively quickly and effectively. Europe on the other hand faced bureaucratic inertia, wasted valuable time compromising with proponents of austerity, and became mired in infighting. In 2011, even though the recovery was nascent at that point, the European Central Bank started raising rates. A few years later, Brexit arrived.

And while all developed areas face some demographic challenges, the problems are more acute in Europe and Japan where the populations are much older. Their societies are more constrained in terms of immigration, openness, and entrepreneurial spirit. Consequently, the U.S. economy emerged from 2008 the strongest of the developed regions. This contributed to investors favoring U.S. assets.

Low Growth, Inflation & Interest Rates

Globalization, aging populations, the side effects of monetary interventionism, and technological innovation have all been powerful disinflationary influences. They capped inflation and GDP growth, enabled the multidecade decline in interest rates to continue, and permitted central banks to hold policy rates near zero or lower without negative consequences.

A low-inflation, low-growth environment disproportionately favors high-growth businesses on two fronts: (1) The associated low interest rates increase the present value of growth stocks’ more distant and uncertain cash flows. And (2) in a situation where growth is scarce, companies that can generate growth independent of aggregate economic activity become that much more attractive and valuable. Since the large-cap U.S. equity indexes are weighted much more heavily toward high-growth sectors like Internet/technology, investors gravitated toward U.S. stocks.

The Globalization Process

U.S.-based global multinationals have profited greatly from the globalization process by itself. For decades globalization shifted centers of manufacturing to emerging economies where labor was cheaper and expanded supply through greater global trade. Along with natural monopolies, powerful network effects, and other unique advantages, globalization boosted the profit margins and valuations of the largest U.S. companies.

A Rising U.S. Dollar

Currency trends have also had an important influence on returns. Interest rate differentials, improving U.S. budget and trade deficits, and weak global economic growth have supported U.S. dollar appreciation since the 2008 financial crisis. The combination of a higher yield and an appreciating currency attracted foreign capital. At the same time, a rising dollar acted as an added drag on the returns of non-U.S. assets for U.S. investors.

Passive Over Active

Outperforming an equity benchmark after fees has always been difficult. Only a select few stock pickers have consistently done so. Still, we think identifying great managers is possible. That belief is deep in our firm’s DNA, as we’ve been conducting due diligence on managers for over 30 years with great long-term success. The last 10 years have been especially difficult for active equity, though. Even some managers we’ve invested with for decades and who maintain great long-term records have found it extremely difficult to keep up with their index foils in the most recent 10-year period.

Passive indexes benefit to some extent from a momentum effect by their capitalization-weighted construction. Over time, the best performers increase in market cap and receive increased weights. Within a performance cycle, this trend feeds upon itself and gains momentum. It naturally leads to periods of high concentration. During these short-term periods (in the context of an organization’s investment horizon), passive investing comes into vogue because deviating from a market-cap weighting goes unrewarded.

Since active equity managers must look different from their benchmarks for any chance to win, by definition they will avoid or underweight the largest index constituents. If they are not investing in small caps and midcaps, they are likely investing in smaller large-cap stocks. So when mega caps dominate, as they have over the last 10-plus years, active managers tend to underperform, and vice versa. Our selected active managers often also have a value bias overall, especially those for whom valuation is a key part of their investment framework. This has been even more true in the last few years as several blend managers we invest with have leaned into cyclical stocks given the stretched valuations of many growth stocks. Since sentiment has been against small-cap stocks and value stocks, for some good macro/fundamental reasons, active managers have struggled.

To sum up, the United States has offered stronger relative economic growth, less-bad structural issues, greater exposure to growth or higher-profit-margin businesses, a stronger currency, and a yield advantage. It’s no wonder then that investors have favored mega-cap U.S. growth stocks and U.S. bonds. On top of this, performance chasers have piled into the trend toward equity indexing, as these various market trends have been a headwind for active equity managers. Capital will naturally flow toward the highest return. The question is, what does the future hold?

Trends Are Changing

Some of the forces behind the last decade’s major market trends are already starting to reverse:

Higher Growth, Inflation & Interest Rates

If we can bring the pandemic under control, a cyclical rebound in economic growth could emerge. The difference today versus after the 2008 financial crisis is that enormous fiscal stimulus (with no end in sight) is coinciding with extremely accommodative monetary policy. Adding fiscal stimulus into the mix may drive economic activity. And if it materially increases personal income on net, rather than merely replacing it, we could get the inflation the Fed wants. Longer-term rates should rise in response.

This is not to say inflation will rise to a concerning level, just toward a level closer to the historical average and the Fed’s target. The Fed seems bent on achieving that goal. Given the old adage “Don’t fight the Fed,” investors should take them at their word. Decent real economic growth, higher inflation but at a level that remains under control, and higher interest rates but not to a level that would seriously impact the economy have several investment implications. That environment can still be a rewarding one for investors.

A higher economic growth regime would be positive for the cyclical/value areas that make up the backbone of the global economic engine (industrials, commodity-based businesses, financials). More economically sensitive non-U.S. stocks should also benefit disproportionately, particularly in the wider emerging markets where there is still plenty of exposure to traditional commodity-based and low-value manufacturing businesses. We are much more bullish on China as it progresses on its transition to a consumer-based economy. They handled the pandemic better than most countries, and its economy is still growing much faster than most of the world. Based on recent capital flows data, we are starting to see investors realize the need for greater global diversification. Emerging-market (EM) stocks have now outperformed U.S. stocks strongly over the last six months and since we swapped more into EM stocks from European stocks.

The Reversal of Globalization

Even prior to COVID-19, trade conflicts began a trend toward “regionalization” versus globalization. Global businesses are moving operations to the same locales as their customer bases and/or founding regional headquarters to immunize themselves against potential supply chain/trade disruption. More recently, the lack of supplies early on to fight the pandemic exposed developed nations’ overreliance on the global supply chain and just-in-time inventory to maximize profits. Globalization reversing is inherently inflationary as it increases input costs and decreases supply. It also could be a headwind for U.S. multinationals’ profit margins.

A Falling U.S. Dollar

Currency trends are turning too. Eventually capital inflows erode an interest rate differential (which they did by the fall of 2020). Other supports have fallen away too. The “twin deficits” (budget and trade) are expected to expand greatly now with the massive fiscal stimulus launched in the United States. And the consensus expectation is for the pandemic to subside this year, releasing pent-up demand and ushering in a period of higher economic growth and inflation. The U.S. dollar was down 10% right on cue as of year-end. It may still have a yield advantage, but the U.S. dollar is now depreciating, and currency markets are very momentum driven. All these points indicate the dollar decline can continue. Just as a rising dollar supported U.S. stocks versus non-U.S. stocks, a sustained dollar decline could be a tailwind for non-U.S. markets. Periods of meaningful non-U.S. outperformance since 1970 have generally coincided with a falling U.S. dollar.

Active Over Passive

While we believe strongly in the value of global diversification, we are currently not making a direct bet on small caps or value stocks. The small-cap index may not be attractive in the aggregate on a valuation basis. And we don’t have the conviction to make the value factor a “fat pitch”. Nonetheless, we have been tilted toward these areas on a look-through basis due to the bottom-up views of our managers. However, they are not constrained by market-cap weightings or purely statistical measures of value. They can troll through the broader stock market to find the very best opportunities, regardless of size.

As noted prior, mega-cap growth stock index leadership and high concentration has hurt active equity management to date. Thankfully, index leadership is usually ephemeral. Over the long term, the largest stocks have underperformed the index and eventually fallen out of the top spots simply because the forces of change make it impossible to sustain a dominant position forever.

Smaller companies are also arguably closer to the real economy and should benefit more from reflation. They have significantly outperformed large caps since March 2020. Value stocks are also more economically sensitive and are starting to outperform. There are now two trends reversing simultaneously in our active managers’ favor. Last year, despite the dominance of growth, the outperformance of our portfolios was largely due to contributions from active equity managers in the latter half after many years of disappointment.

The new economic regime we are likely entering means higher economic growth and higher inflation—in direct contrast with the conditions of the last 10 years or more. The current environment is supportive of reflationary assets: mainly non-U.S. stocks but also small-cap stocks and value/cyclical stocks. Global diversification has never been more critical in our eyes. And since our active equity managers are overweight to non-U.S., small cap, and value, we also want to be invested with them over highly concentrated passive indexes looking ahead, despite the experience of the last decade.

The Decade to Come

If you undertake a thorough survey of market history, the presence of repeating cycles is clear and undeniable. And the mistake of extrapolating long-term trends indefinitely into the future is made again and again by the market at large. We intend to not make that mistake for our clients. As students of cycles, we are wary of any argument that says things have permanently changed and that the processes that have repeated again and again through history have suddenly stopped. Hundreds of years of evidence stacked up against newly birthed theories seems like a lopsided affair. There are immutable aspects of human nature and the systems we create (markets, economies, politics, cultures, societies). We see no evidence that they have materially changed and that the pendulum of history has been arrested.

This is why we’ve designed our disciplined framework the way we have and why we keep our focus on the fundamentals, even when the market doesn’t seem to care about them for extended periods of time. We may be contrarian, we may be early or late in our assessments and we will not always time our investment decisions perfectly. Yet we’ve learned much in the last 10 years that we can now apply going forward. The same as investors shouldn’t ignore the past, they also shouldn’t forego an honest look at what may have indeed changed about the future. Sometimes the present state of affairs can continue longer than you might think possible—and with good reason. That is one of the lessons we’ve taken away from the 2010s. But there are limits to everything. Some market cycles are so overextended at this point, we are convinced the odds are very low that they can be sustained for many more years, let alone another decade.

In the 2020s, we are much more likely to see an environment radically different than what we’ve experienced in the last decade (or really the last three). We believe sentiment and performance leadership in equity markets will swing back toward non-U.S. markets. We think an economic rebound from the pandemic will spur an extended period of outperformance for value and possibly smaller companies, which bodes well for active management at the expense of passive indexing. With interest rates having nowhere to go but up, we could see a secular period of rising rates for the first time since the 1970s. The time to prepare for a new regime is before it manifests itself and becomes the consensus. That’s why we are already positioned to benefit from these dynamics and are encouraged by the fact that more and more our previously contrarian views seem to be gaining traction, with markets confirming those views. Importantly, we believe we’ve constructed our portfolios for the new decade in such a way that they should still meet our clients’ spending needs even if the current cycle continues a bit longer.

—Litman Gregory Investment Team

Please contact us to learn more about our services for endowments and foundations.