Turning Points in 2025: Global Markets and the U.S. Dollar

April delivered a clear reminder of how quickly markets can turn. The April 2nd “Liberation Day” announcement of sweeping and unexpectedly high tariffs sparked significant market volatility, and the S&P 500 endured two of its steepest daily losses in history—down 4.8% and 6.0% on back-to-back days. However, soon after that the market staged an impressive recovery as strong earnings and a 90-day pause in some tariffs helped ease some concerns. By the time April ended, the S&P 500 was down less than 1% for the month, and is up just over 1% year-to-date (as of mid-late May).

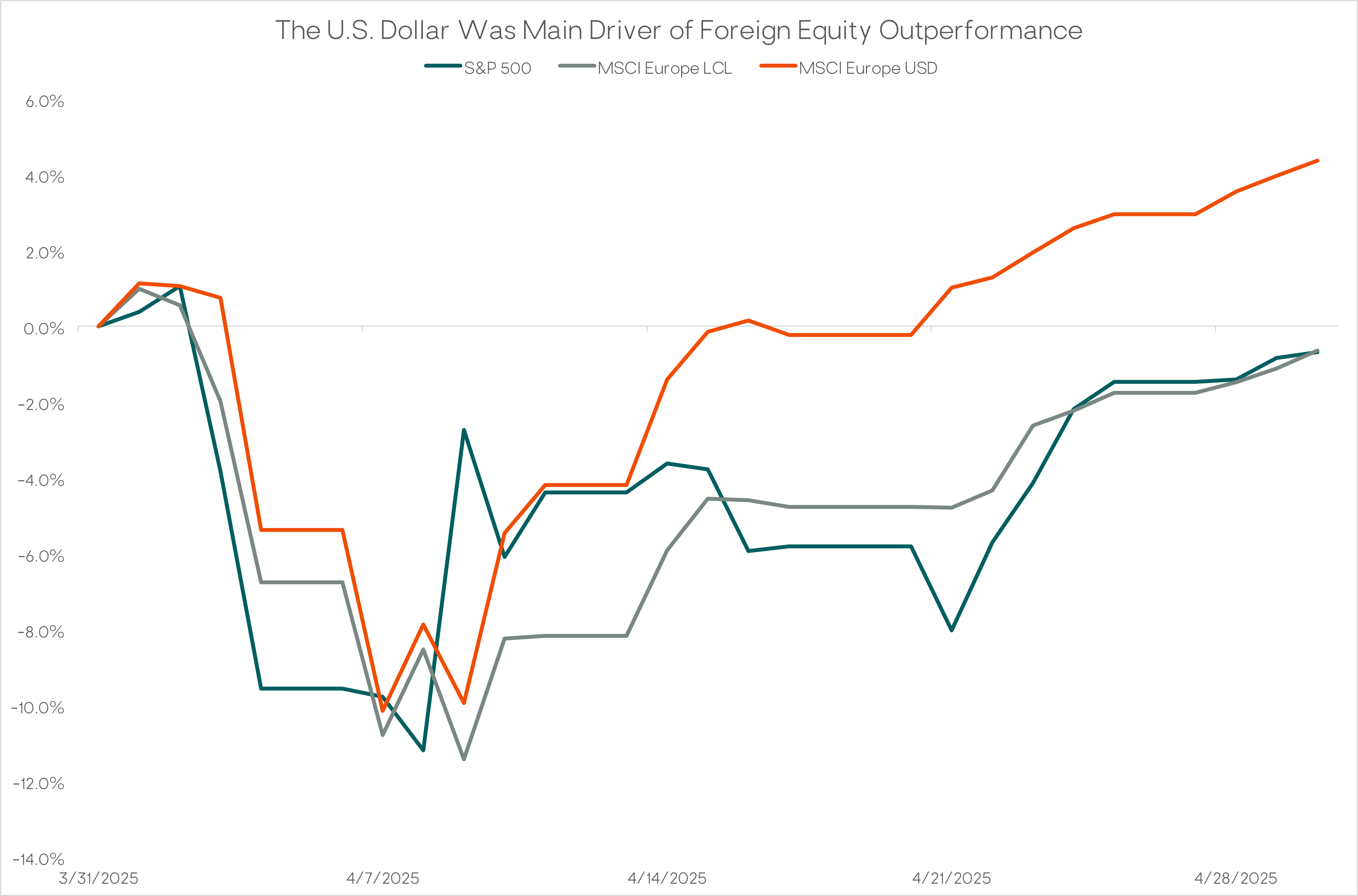

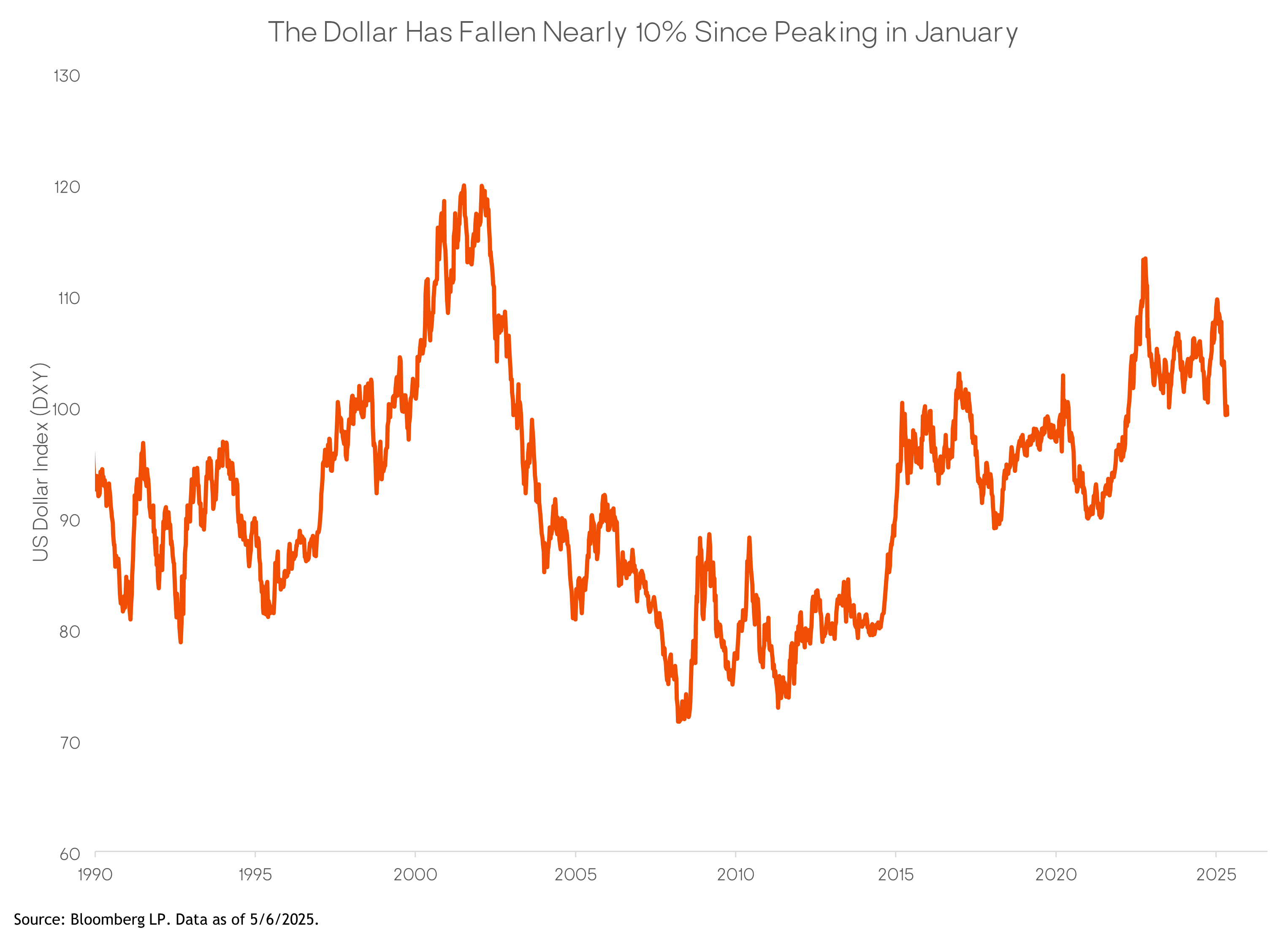

International equities outperformed U.S. stocks in April, but not necessarily because of superior underlying fundamentals. Instead, currency moves played a central role in their favor, as the U.S. dollar fell 4.6% in April—and is now down over 8% year-to-date (as of mid-late May)—which boosted returns for un-currency-hedged international assets. For example, European equities posted similar local-currency returns to U.S. stocks during April, but the weaker dollar turned those results into a 4.6% gain in U.S.-dollar terms. This currency tailwind has become a key driver in diversified portfolio performance.

Source Morningstar data as of 4/30/2025.

Following the stock market’s roller coaster during April, the first two weeks of May saw stocks continue their rebound, with the S&P 500 tacking on close to 7% to reach positive territory for the year to-date. International stocks saw smaller gains, in part due to the U.S. dollar strengthening slightly since the start of May.

Fixed-income markets mirrored equity volatility in April, which has continued into mid-May. Yields on 10-year U.S. Treasuries dipped from 4.23% to 4.17% in April, leading to modest gains for core investment-grade bonds. Into mid-May, yields have reached 4.5%, leading to a slight loss for core bonds. High-yield bonds were flat in April but have posted a gain midway through May.

U.S. Jobs and the Economy

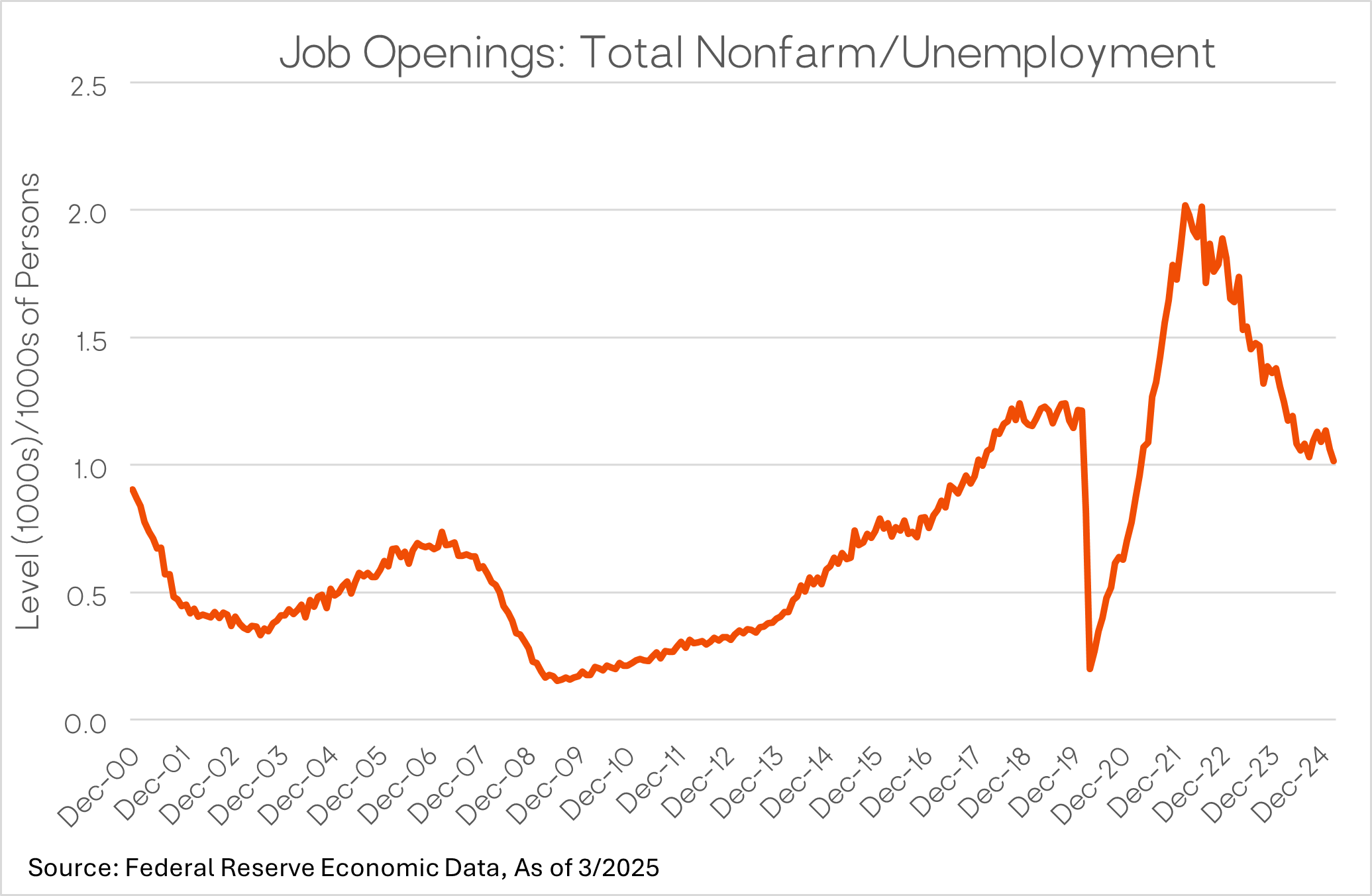

The labor market, meanwhile, is sending mixed but important signals. Jobless claims remain relatively low, but we’re watching hiring activity more closely than layoffs. The hiring slowdown may prove a more reliable early-warning sign of a weakening economy. Unemployment data shows a shift toward longer job searches and fewer new opportunities, particularly in the private sector.

Additionally, the size of the labor force—boosted post-COVID by higher immigration—may now begin to shrink due to more restrictive immigration policies. This could create a misleadingly low unemployment rate, even as economic momentum fades.

What Policy Developments Mean for Investors

Policy developments—both fiscal and monetary—are now at the front of investors’ minds. The inflationary effect of tariffs will likely become more evident in the coming months. However, we expect the Federal Reserve to look through this spike, focusing instead on labor market health. While interest rate cuts are unlikely before summer, the Fed may pivot quickly if economic conditions weaken materially.

At the same time, the White House is proposing additional tax reforms: extending 2017 tax cuts, eliminating taxes on tips and overtime, reducing corporate tax rates, and introducing new deductions. While not yet law, these proposals are something we will be monitoring closely from both a growth and planning perspective.

The U.S. Dollar: Structural Shifts and Strategic Implications

Perhaps the most notable story in recent months for global investors is the U.S. dollar. Traditionally, new tariffs might be expected to boost the dollar by improving trade balances. But this time, the opposite occurred. Markets saw the tariffs as a drag on global growth and a source of economic uncertainty, causing the dollar to fall sharply.

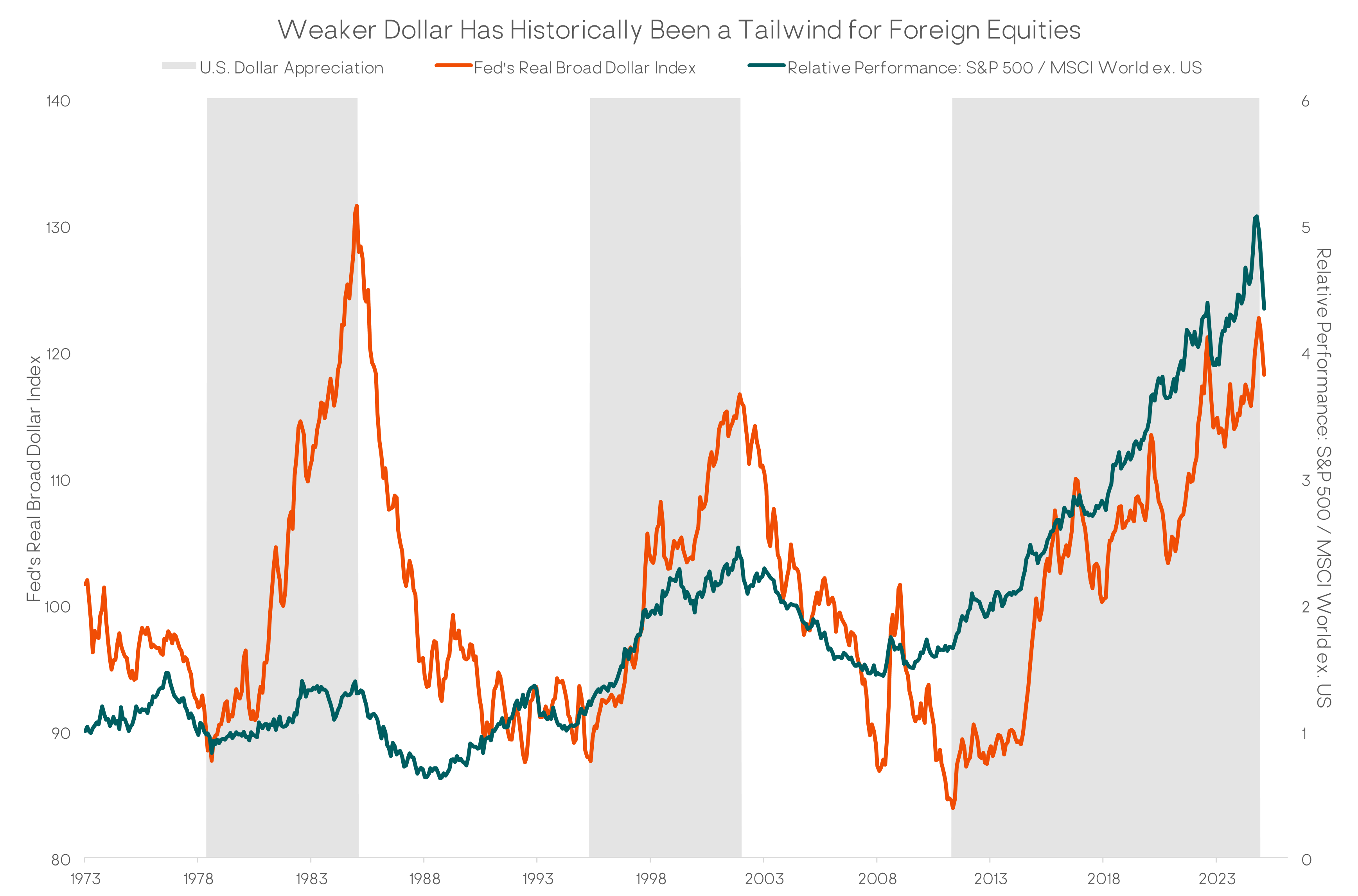

For years, the strong dollar supported U.S. asset outperformance. In early 2025, that narrative has reversed. A weaker dollar has significantly enhanced international equity returns and may continue to do so if this trend persists.

The current Administration has signaled a willingness to see a weaker dollar in order to boost exports and domestic manufacturing while attempting to preserve the dollar’s role as the global reserve currency. But that’s a difficult balance. The dollar’s reserve status brings key advantages—like lower borrowing costs and steady global demand for U.S. assets—that could be threatened if foreign investors grow wary of U.S. policy direction.

Portfolio Positioning: Cautious & Opportunistic

The current environment underscores the importance of diversification, not just across asset classes but also currencies and geographies. A weakening dollar creates a tailwind for un-currency-hedged international equities and real assets, while volatility in U.S. markets highlights the value of being flexible and owning bonds, specifically high-quality short-term bonds.

We believe the months ahead will continue to challenge conventional wisdom. As the Fed, the Administration, and global markets navigate inflation, growth, and geopolitical tensions, we remain focused on managing risk while identifying opportunities, especially in segments benefiting from structural shifts like dollar depreciation and fiscal expansion.

As always, we’ll continue monitoring these developments closely and adjust positioning to seek out return opportunities that align with our clients’ long-term financial goals and risk tolerance.