Update on the Markets: A Shift in Bond Yields

U.S. equity markets rebounded in May, with the S&P 500 gaining 6.3%, with the tech-heavy Nasdaq advancing sharply (9.6%) on the back of strong earnings from AI leaders like Nvidia. This strong market performance in early May seemed to be driven more by improving investor sentiment and corporate earnings results than by fundamental shifts in the macroeconomic backdrop. However, over the final two weeks of the month, markets lost momentum, with the S&P 500 trading in a choppy, sideways range just shy of 6,000, reflecting investor uncertainty.

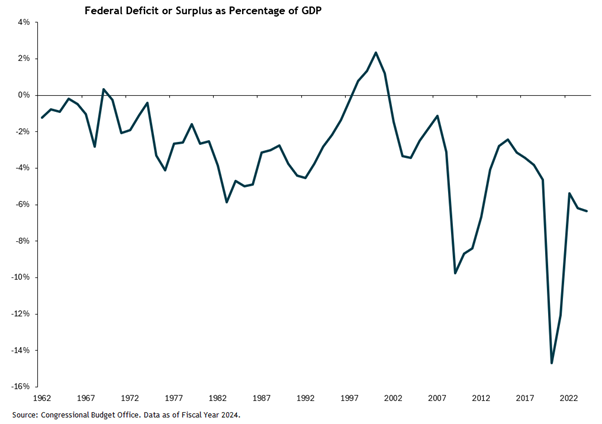

Meanwhile, bond markets have been under pressure amid growing fiscal concerns as Trump’s proposed tax and spending package fanned worries about larger deficits. (See chart below for growing deficit, which stands at approximately 6.4% of GDP.) This led investors to sell long-term maturity Treasury bonds, which in turn lifted yields across the curve. The 10-year Treasury yield started the month at 4.17% and reached 4.6% before retreating to 4.41% by month end. The 30-year Treasury yield also climbed during the month, reaching 5.1%, its highest level since 2023.

Another key driver behind higher yields came on May 16, when Moody’s downgraded the U.S. credit rating from Aaa to Aa1. The agency cited the roughly $36 trillion debt load and an unsustainable fiscal path, warning that deficits will widen (to near 9% of GDP by 2035, from 6.4% in 2024) driven by rising interest costs, tax breaks, growing entitlement spending, and weak revenue. Moody’s noted that successive administrations had failed to rein in deficits, and this move put Moody’s in line with S&P and Fitch (which cut the U.S. below AAA in 2011 and 2023, respectively. In our opinion, this latest downgrade from Moody’s will not have any material investment implications.

Shift in Bond Yields: Portfolio Implications

With the shift in U.S. bond market yields, we now see an opportunity to begin a planned transition in our portfolios’ fixed-income allocations. We had anticipated making these adjustments earlier this year, but held off when interest rates had remained unchanged. The move we are implementing now is a modest shift in which we reduce the tactical overweight to short-duration, higher-yielding bonds (which perform better when long-term rates go up) and increase the duration (or average maturity) of our portfolios by increasing exposure to broader investment-grade bonds.

This duration shift will leave our fixed income portfolio allocations more neutrally positioned. Although we aren’t convinced long-term yields have peaked, given that 10-year Treasury yields have climbed from 4% when we made the shift in the Spring of 2024 to 4.5% today, we now think it makes sense partially unwind the overweight to short duration. If the 10-year Treasury yield moves closer to 5%, we’ll look to unwind the rest of that overweight. Over the longer-term, we remain mindful of the potential for structurally higher long-term interest rates, driven in part by ongoing fiscal concerns and rising government debt levels.

An Update on the Economy

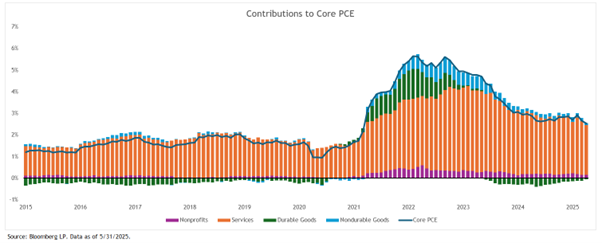

On the economic front, the data continues to reflect stability without strength. The labor market remains resilient for now, but broader indicators don’t suggest momentum for a new economic expansion. Core PCE inflation, which is the Fed’s preferred inflation measure that excludes volatile food and energy costs, eased to 2.5% year-over-year in April, in line with expectations and below March’s 2.7%. Still, inflation remains above the Fed’s 2% target, and tariff-related pressures could soon reaccelerate inflation. The persistently elevated inflation can still largely be attributed to services inflation that remains higher than it was pre-pandemic. And within services, health care and housing remain the key contributors to the elevated number. Inflation for goods has been essentially flat since 2022.

Trade policy developments continued to inject volatility into markets. While tensions had calmed earlier in the month, late-May saw renewed uncertainty as conflicting court rulings on President Trump’s tariffs emerged. In addition, Trump accused China of violating a tariff truce, further straining relations. Investor sentiment has become highly reactive to such developments, underscoring the market’s sensitivity to political news over economic fundamentals.

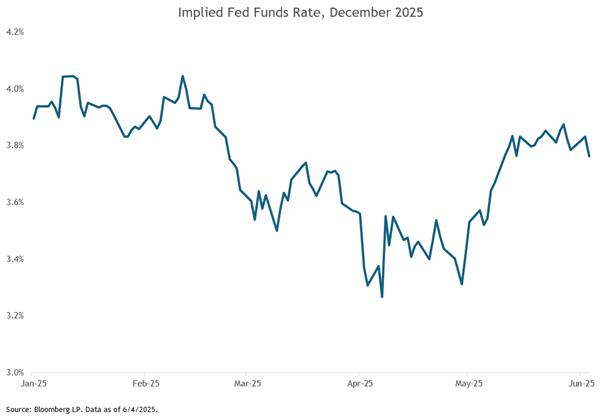

The Federal Reserve, for now, remains on pause with respect to its interest-rate policy. Their focus remains on achieving their dual mandate of price stability and maximum employment. A more “dovish” pivot (or move to lower rates) could materialize later this year if economic conditions weaken. For now, market pricing (as shown in the chart below) implies just over two cuts, or 50 basis points, by the end of this year, bringing the Fed Funds target rate to a range of 3.75-4.00%.

Looking ahead, we remain cautious. While May’s stock market rally was a welcome reversal from April, it appears more sentiment-driven than fundamentally supported. With fiscal concerns mounting, trade tensions resurfacing, and inflation potentially bottoming, we believe markets could see further volatility as investors seek clarity on economic direction, policy response, and geopolitical risks.

Investment Positioning

In today’s rapidly shifting environment, where government policies, particularly around trade and tariffs, can change with little warning, the market landscape has become increasingly unpredictable. These policy swings can create sudden volatility across sectors, geographies, and asset classes. In such an uncertain climate, diversification remains one of the most effective tools investors have to manage risk.

Our equity positioning remains broadly diversified across regions, with strategic weightings to U.S., developed international markets, and emerging-markets equities. From a tactical perspective, our equity allocation maintains a neutral stance across the main regions. However, looking through the exposures of our active managers, equity portfolios have a modest overweight to developed international equities (mainly Europe) due to many U.S. large-cap managers having some foreign exposure.

On the fixed-income side (as mentioned above), we are implementing a modest shift in our bond allocation by reducing a tactical overweight to short-duration, higher-yielding bonds (which perform better when long-term rates go up) and increasing the duration of our portfolios with more exposure to broader duration investment-grade bonds. In this environment, disciplined diversification and prudent portfolio construction are more important than ever. As we move into June and the rest of 2025, we believe that staying flexible will be key to managing investment strategies effectively in this evolving environment.