Commentary from Our CIO—Second Quarter 2021

Second Quarter Market Recap

Global stock markets continued to surge in the second quarter. Developed markets led the way, with the S&P 500 Index gaining 8.5% and developed international stocks gaining 5.7%. Emerging-market (EM) stocks rose 4.9%, held back by mixed news on the COVID-19 front and a tightening in China’s financial conditions.

Within the U.S. stock market, the rotation from growth to value stocks took a pause, with the Russell 1000 Growth Index gaining 11.9% versus a 5.1% rise for the Value index. Smaller-cap value stocks slightly outperformed their growth counterparts and remain the top-performing segment of the U.S. market this year. However, large-cap stocks handily beat small-cap stocks in the second quarter.

In fixed-income markets, the 10-year Treasury yield dipped below 1.50% in June, ending the quarter at 1.45%, down from 1.75% at the end of March, despite higher inflation readings during the quarter. This contributed to a solid 2.0% return for the core bond index during the second quarter. However, core bonds are still down 1.6% for the year. Our selected flexible actively managed bond funds also posted solid gains for the quarter in the 1.5% to 4.1% range. Floating-rate loans were up 1.5%.

Portfolio Performance & Key Performance Drivers

During the second quarter, our actively managed client portfolios performed broadly in line with or slightly better than their passive strategic allocations. In general, our moderately “risk-on” (reflationary) positioning—represented by a slight overweight to global equities in most portfolios and our favoring of non-core bonds over core bonds—was beneficial despite the rebound in core bond prices due to falling interest rates.

The Macro Backdrop

“This is an extraordinarily unusual time, and we really don’t have a template or, you know, any experience of a situation like this.” —Federal Reserve chair Jerome Powell, June 16, 2021

The Big Picture Bottom Line

Our assessment of the macroeconomic backdrop and outlook has not meaningfully changed since last quarter-end. We continue to expect a strong global economic recovery over the next 12 months at least, driven by expanding COVID-19 vaccinations and immunity, and still-accommodative global monetary and fiscal policy (although increasingly less so). While most asset class valuations are expensive, these macro conditions remain broadly supportive of corporate earnings and risk assets, such as global equities, corporate bonds, asset-backed securities, and floating-rate loans.

Inflation risks have increased since three months ago. But in our view, the weight of the evidence (our base case) still suggests much of the recent price surge is transitory and that sustained high inflation is not an imminent risk. This is primarily because there remains meaningful slack in the economy and labor market. We expect the competitive forces of supply and demand to restrain price increases over the coming months as economic activity continues to normalize. We are already seeing this trend in many commodity markets.

However, as Jay Powell says, there is significant uncertainty as the economy recovers from the unprecedented pandemic-induced dislocations. There are inflationary and deflationary risks on either side of our base case. We are not adamant in our macro or market views. Our analysis and views will continue to evolve as new economic data arise and the markets respond.

Our Base Case Is for a Continued Strong Global Economic Recovery

With COVID-19 vaccinations and immunity continuing to spread across the globe (albeit unevenly distributed), we continue to expect a strong global economic recovery. Recent economic data support this. For example, as Ned Davis Research highlights, the Global Composite Purchasing Managers Index (PMI), a monthly proxy for GDP, jumped to its highest level in over 15 years in May, and the recovery has finally broadened from manufactured goods to services as economies reopen and social distancing restrictions are relaxed. Another global economic metric, the OECD composite leading indicator, rose in May to its highest level since February 2018.

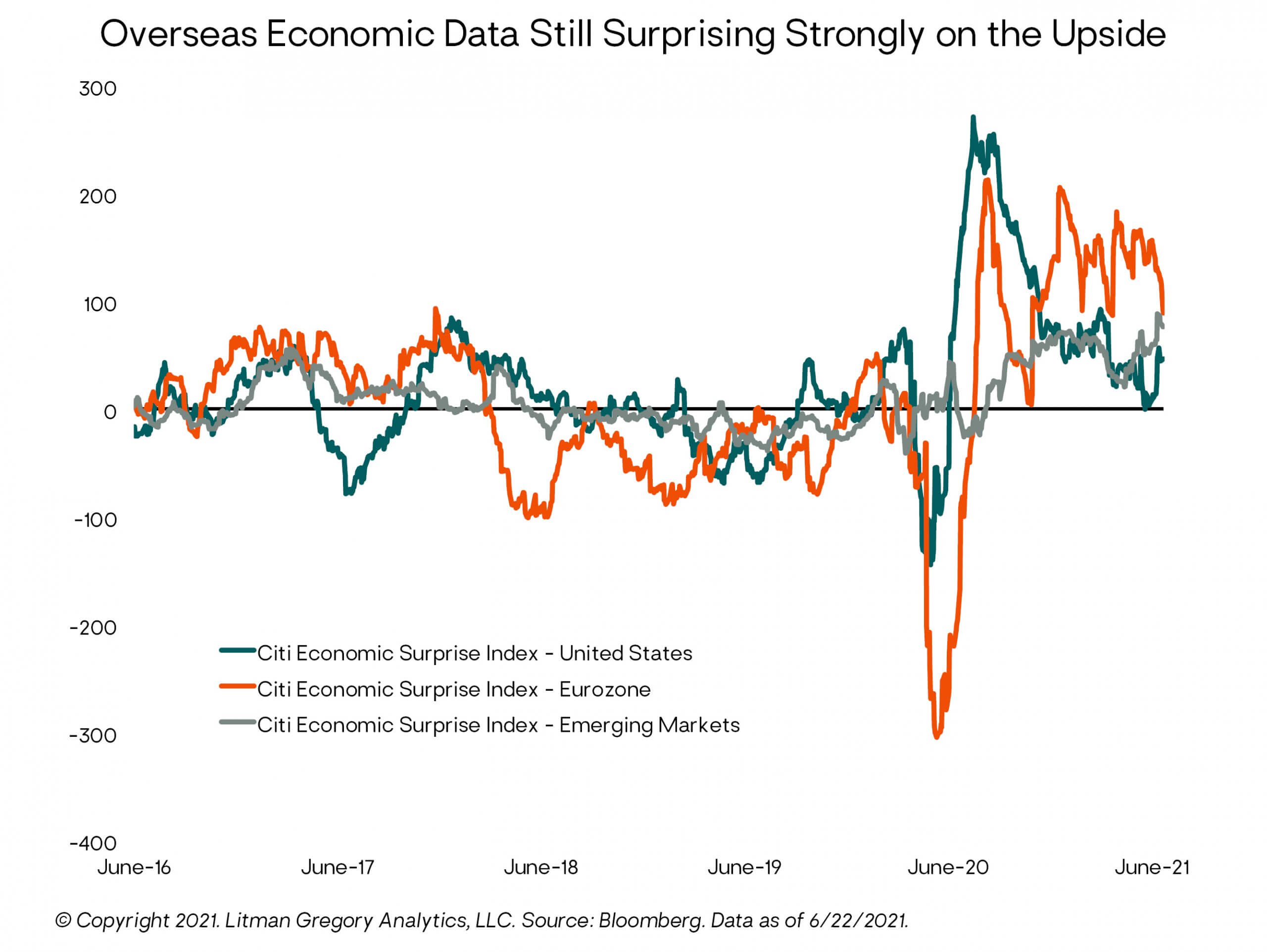

The U.S. economy has been very strong this year, but it looks like U.S. GDP growth peaked in the second quarter and will decelerate going into 2022. However, global GDP growth is likely to strengthen in the second half of the year, driven by accelerating growth outside the United States. Overseas economic data is still surprising strongly on the upside, as shown in the Citi Economic Surprise Indexes for Europe and Emerging Markets (the orange and grey color lines on the chart below). Meanwhile, U.S. economic surprises have fallen sharply toward zero. The U.S. economy has led the global growth parade so far this year and will continue to grow at a well-above-trend rate. But this strength is now largely discounted in consensus expectations and so probably more susceptible to a negative surprise.

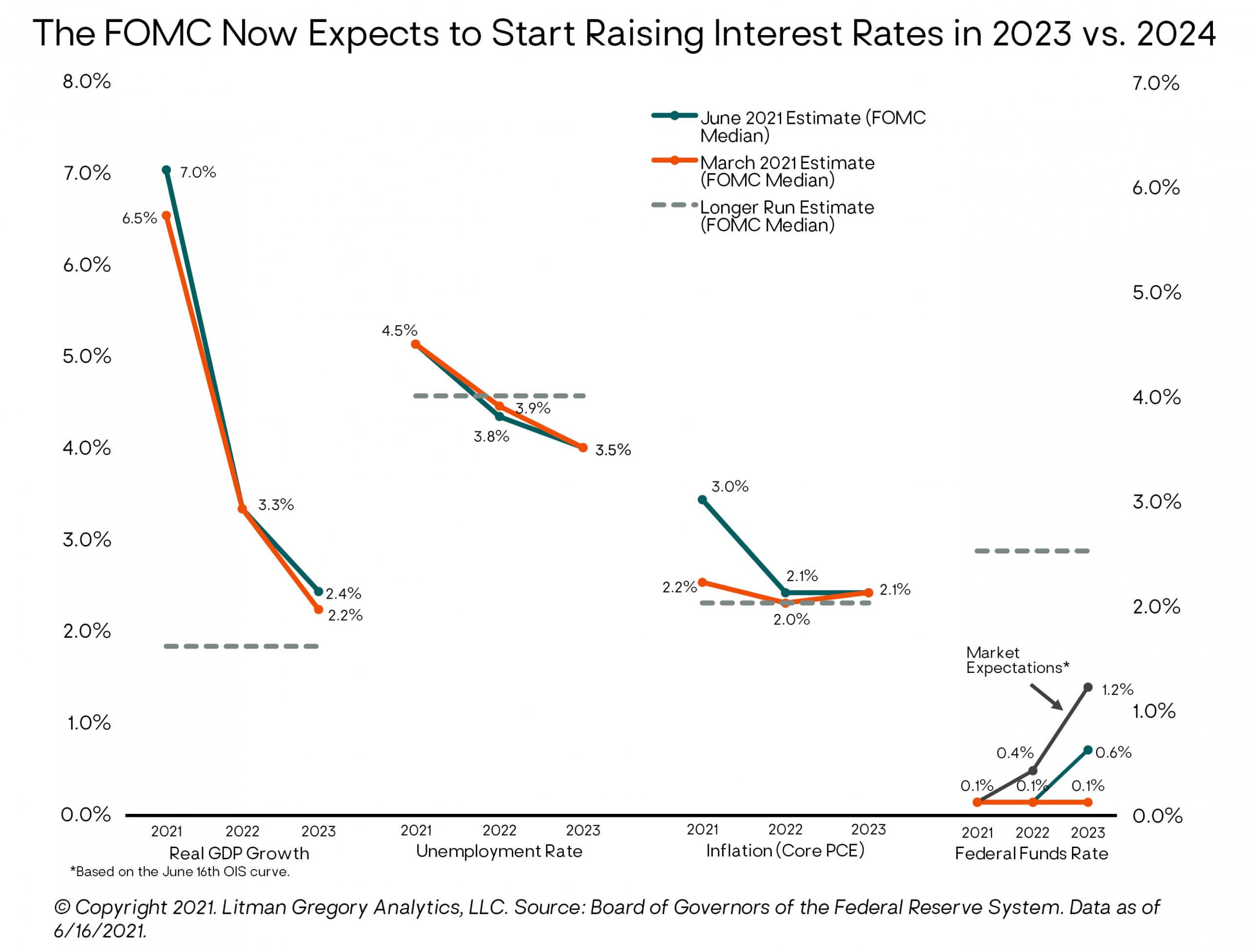

The Fed reflected the consensus growth view when it updated its economic forecasts at its June 16 Federal Open Market Committee (FOMC) meeting. As shown in the chart below, the Fed now expects U.S. real GDP to grow 7.0% this year, up from its 6.5% growth forecast in March. The Fed left its 2022 GDP growth forecast at 3.3%. Most economists and the Fed estimate the U.S. economy’s longer-term potential GDP growth rate, which is a function of labor force growth and productivity growth, is around 2.0%.

The Monetary & Fiscal Policy Impulse Is Becoming a Bit More Uncertain

The increase in the Fed’s 2021 growth expectations wasn’t a surprise. What was a surprise, and what got most of the market and media attention, was the Fed’s updated “dot plot” showing the 18 individual FOMC participants’ current expectations for future federal funds rate hikes. Whereas at the March meeting the median dot implied the Fed was not expecting to start raising rates until at least 2024, the latest dots revealed a surprisingly hawkish shift, with the median dot now indicating two rate hikes in 2023.

The financial markets went into a bit of a tizzy for a few days over this change, but we would not read too much into it. The Fed dot plots have had no accuracy in predicting what the fed funds rate actually is several years hence. Basically, the Fed itself doesn’t know what it will end up doing two or three years from now. Nor should we expect them to know as it depends on what’s going on in the economy at that time, and no one has a crystal ball.

As Fed chair Powell himself said about the dots:

These are, of course, individual projections. They’re not a committee forecast. They’re not a plan. And we did not actually have a discussion of whether [interest rate] liftoff is appropriate at any particular year because discussing liftoff now would be highly premature. The dots are not a great forecaster of future rate moves. There is no great forecaster of the future—so dots need to be taken with a big, big grain of salt.

We believe the Fed and monetary policy are still likely to remain accommodative for a long time, although increasingly less so at the margin. Before starting to raise the fed funds rate, the Fed will need to wind down its $120 billion per month quantitative easing (QE) asset purchasing program that it started last March. The consensus seems to be for the Fed to start QE “tapering” in early 2022 and end QE by the end of 2022. The Fed is afraid of upsetting the financial markets—it does not want another 2013 “taper tantrum”—and says it will give plenty of notice before beginning tapering. Then, after tapering is complete, it will allow some time before it starts signaling it is preparing to begin to increase the fed funds rate.

Therefore, we think a reasonable base case is that we are still at least a couple of years from Fed rate hikes—an eternity for the financial markets. But we acknowledge a wide band of uncertainty around our base case. And we expect market volatility as markets react to each and every Fed governor utterance.

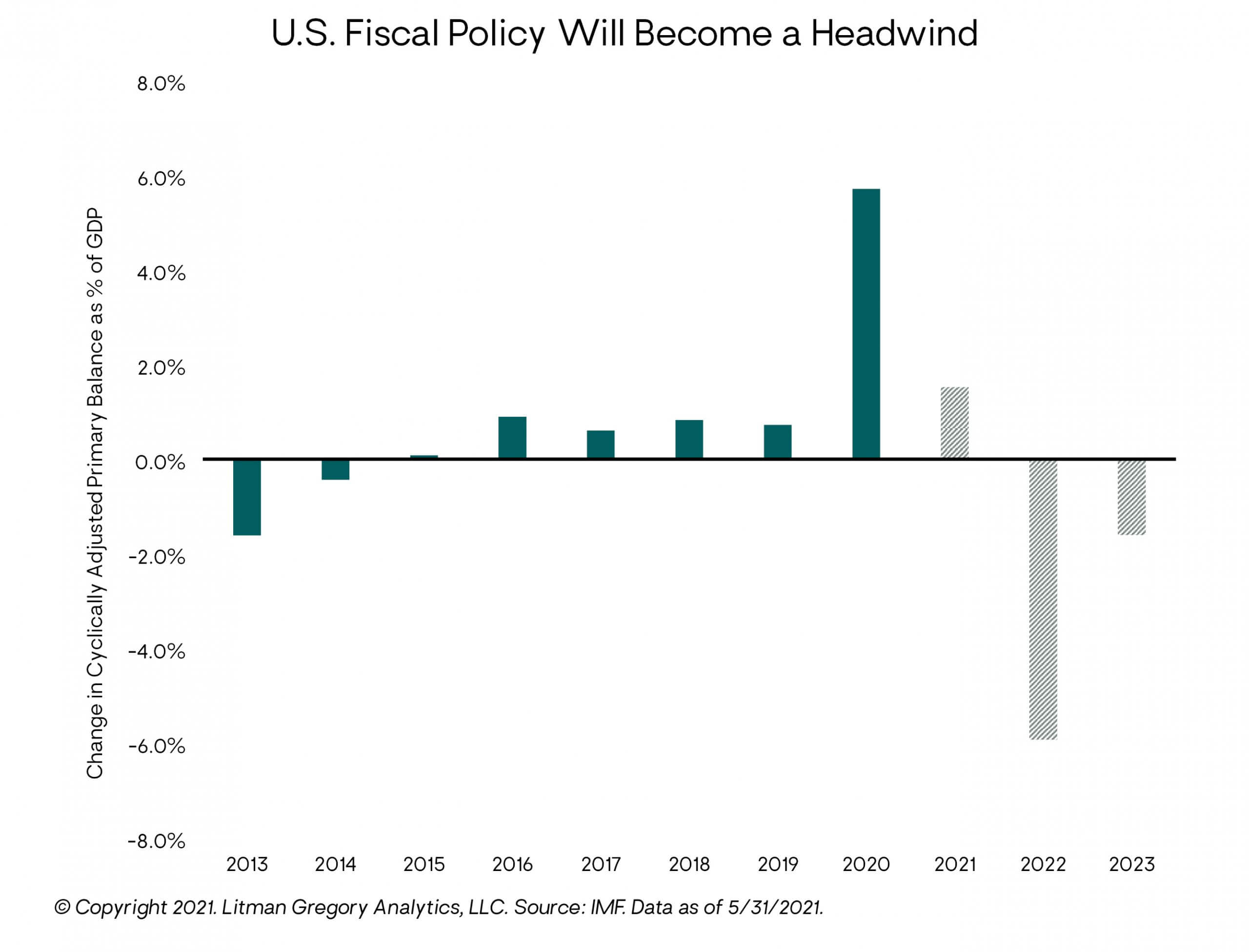

The other policy pillar—fiscal policy—is also more uncertain as the American Rescue Plan and other emergency pandemic programs lapse later this year, including the $300/week enhanced unemployment benefits that expire nationally in September (and sooner in Republican-controlled states).

While the Biden administration clearly wants trillions more in government spending, for example for infrastructure, the politics of passing additional fiscal stimulus are proving challenging given the Democrats’ slimmest of Senate majorities.

Regardless of what happens with the infrastructure negotiations, the U.S. economy is about to shift from getting a large fiscal boost to facing a meaningful fiscal drag—a negative impact on GDP growth—in the latter half of 2021 into 2022 from the expiration of the pandemic programs.

Our Take on the Inflation Question Is Nuanced

This brings us once again to the macroeconomic topic du jour: inflation. More specifically, whether the recent surge in U.S. consumer prices is transitory or a macroeconomic “regime change” to a high-inflation environment.

Absent a severe resurgence in the pandemic, inflation is probably the key current market and macro risk. Our base-case view on this has not materially changed since last quarter. As we weigh the evidence, we think the recent surge in inflation is likely to be largely transitory. But as always, there are no certainties. Maintaining a high degree of humility and flexibility on this question is important. And it is much more nuanced than simply, “Is it transitory or permanent?”

At its core, our current baseline view on inflation is driven by evidence that the U.S. economy still appears to have significant slack before aggregate demand would start overwhelming the economy’s productive capacity (the supply side), leading to the economic “overheating” that could cause significant, sustained, and broad-based inflation.

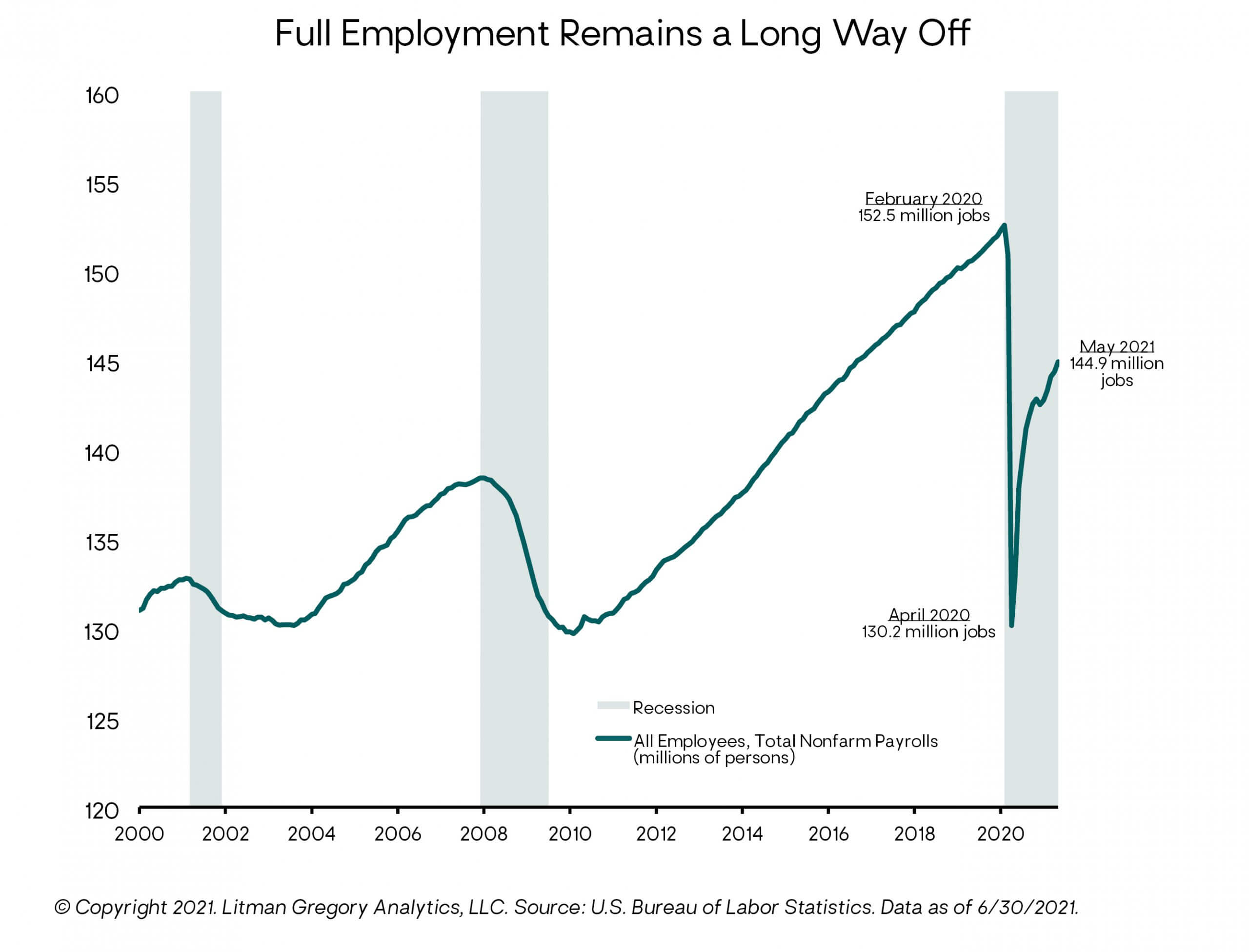

The labor market is a key supply-side indicator, and the one the Fed is most focused on as part of its dual mandate. We’ve updated the nonfarm payrolls chart (to the right) through the end of May. It still shows nearly 8 million fewer jobs compared to February 2020. And if we extend the pre-pandemic employment trend to account for labor force growth over time, it would take until early 2024 to reach the extended trendline assuming the economy adds 500,000 new jobs per month. Meanwhile, more than 9 million people are currently unemployed and potentially available to work immediately.

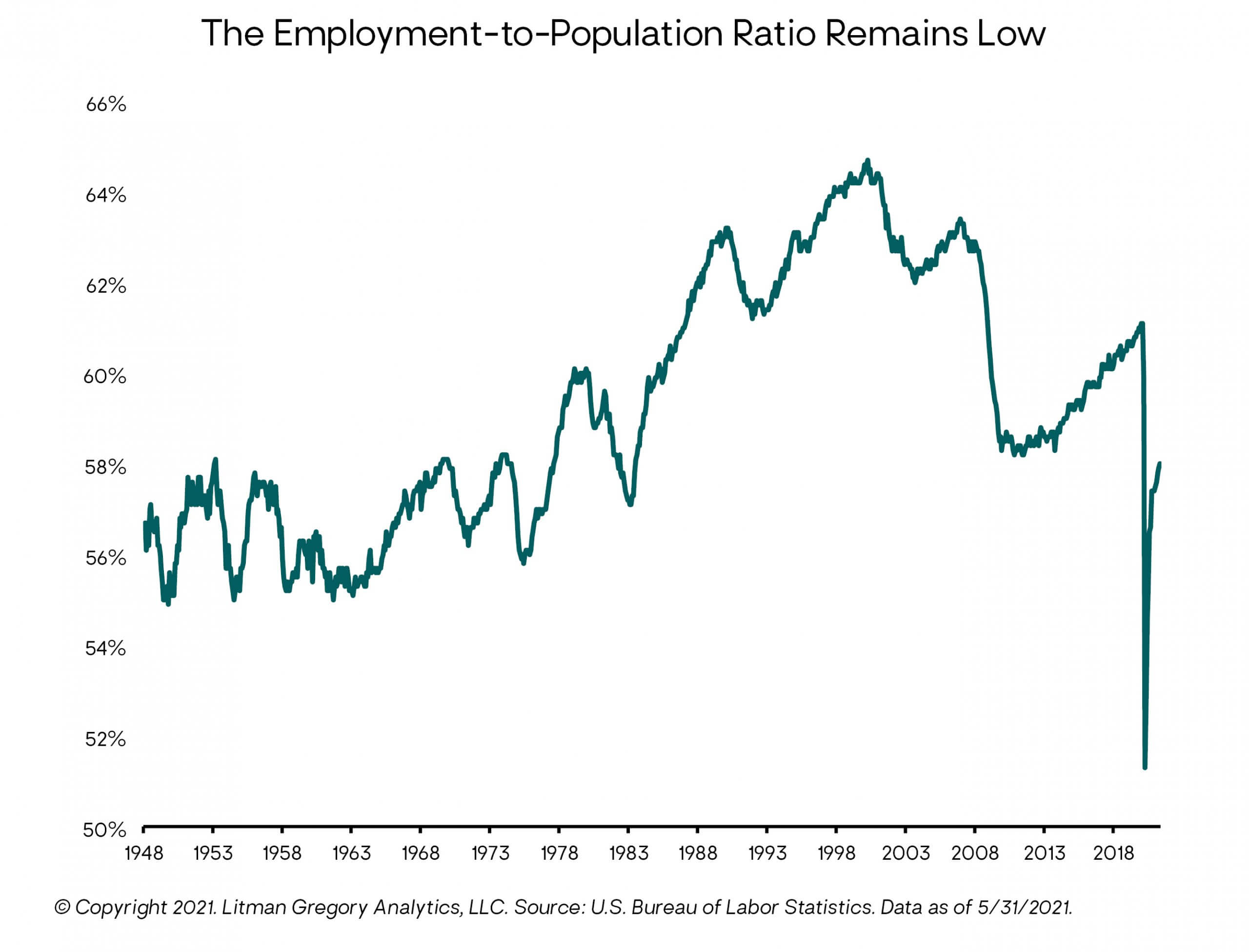

Another labor market indicator emphasized by the Fed—the employment-to-population ratio—is also well below its pre-pandemic level and still below its low point following the 2008 financial crisis.

While there have been recent reports of businesses unable to hire enough workers, this looks to be temporary. The labor supply for (lower-wage) leisure and hospitality businesses in particular should expand in the coming months as virus contagion fears continue to recede, schools reopen for in-class learning (enabling more parents to work again), and enhanced unemployment benefits expire by early September.

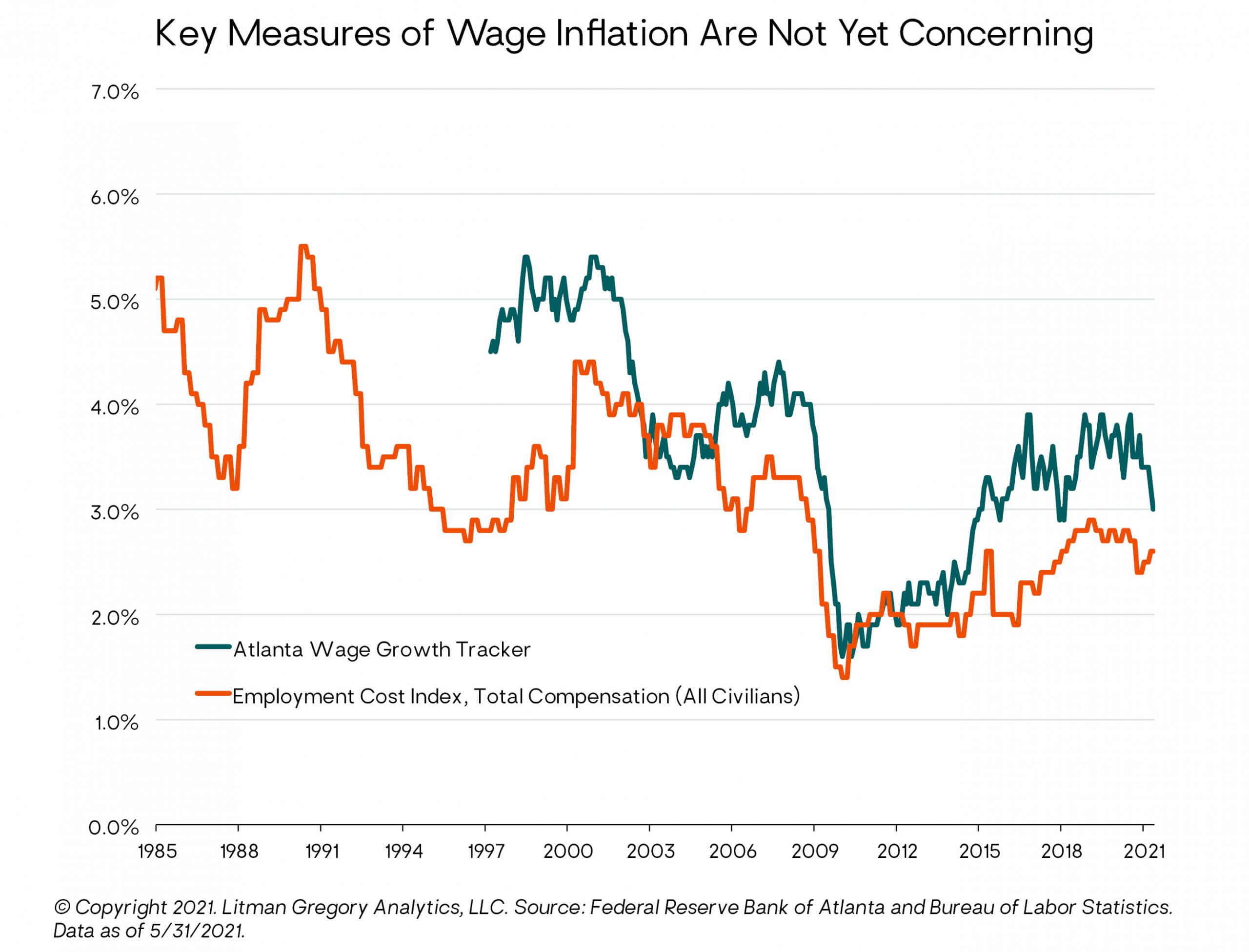

As long as there is slack in the labor market, wage inflation is unlikely to surge. This means there is low risk of a wage-price spiral that becomes self-reinforcing via “unanchored” inflation expectations, such as the United States experienced in the 1970s.

So far at least, key measures of wage inflation that calculate wages on a consistent basis (adjusted for the changing job mix in the economy) are moderate and well within their range over the past 20 years.

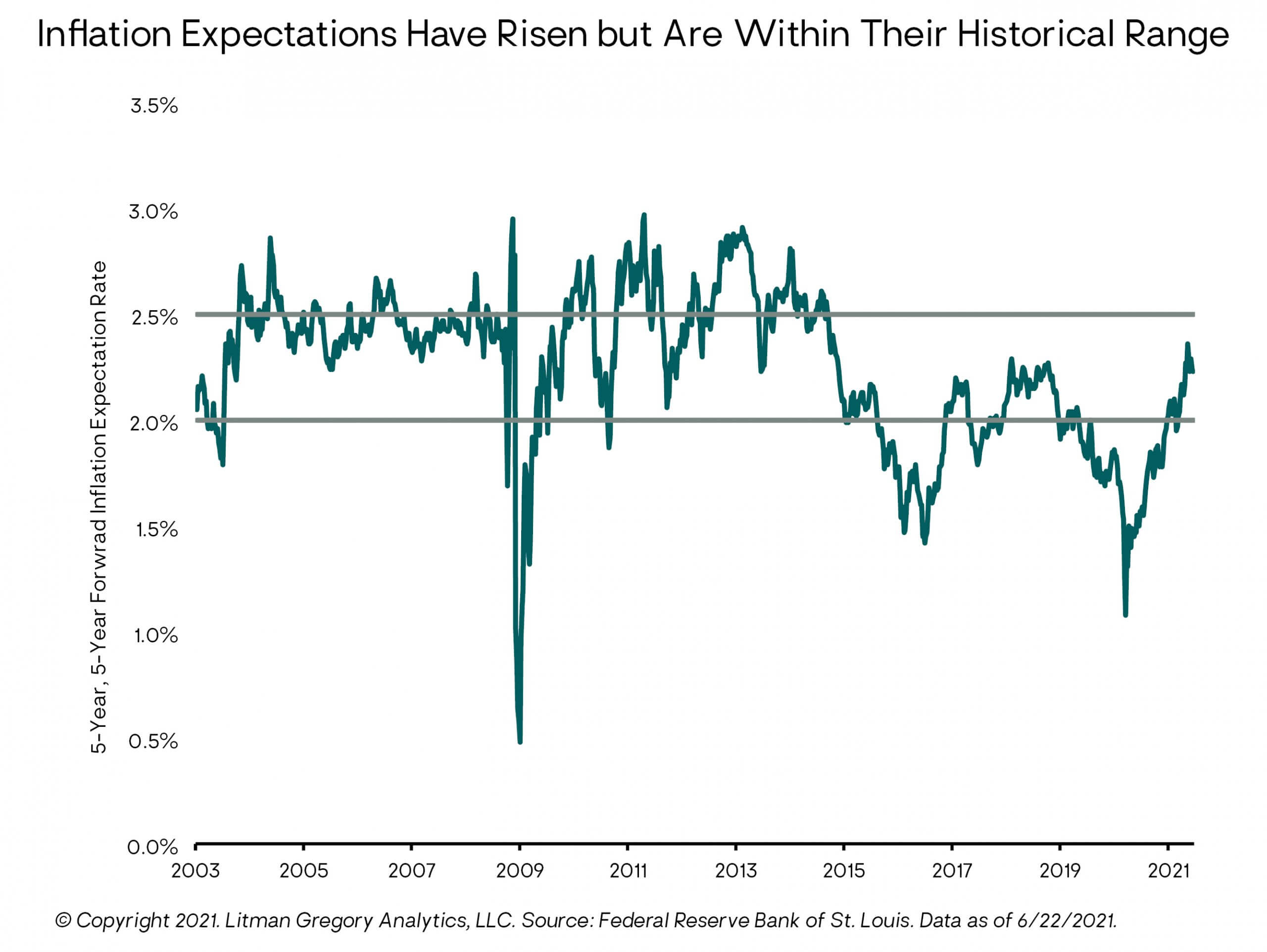

Meanwhile, longer-term consumer price index (CPI) inflation expectations have increased from their pandemic lows, but also remain well within their 20-year historical range and consistent with the Fed’s long-term 2% core inflation objective.

The chart below is the Fed’s index of “Common Inflation Expectations,” a composite of 21 market and survey-based measures of expected inflation. The Fed believes the CIE index effectively captures the general trajectory of many indicators of long-term inflation expectations. It is only published quarterly and will almost certainly show a higher reading at the end of June. But it is likely to still indicate longer-term inflation expectations in the very low 2% range. Again, this would be in line with its history over the past two decades.

Similarly, Capital Economics’ proprietary measure of U.S. medium-term inflation expectations—a composite of 22 indicators—has barely moved during the past three months and remains below the Fed’s 2% long-term target.

Other nearer-term disinflationary forces include the upcoming fiscal drag (discussed above) and China’s tightening credit conditions.

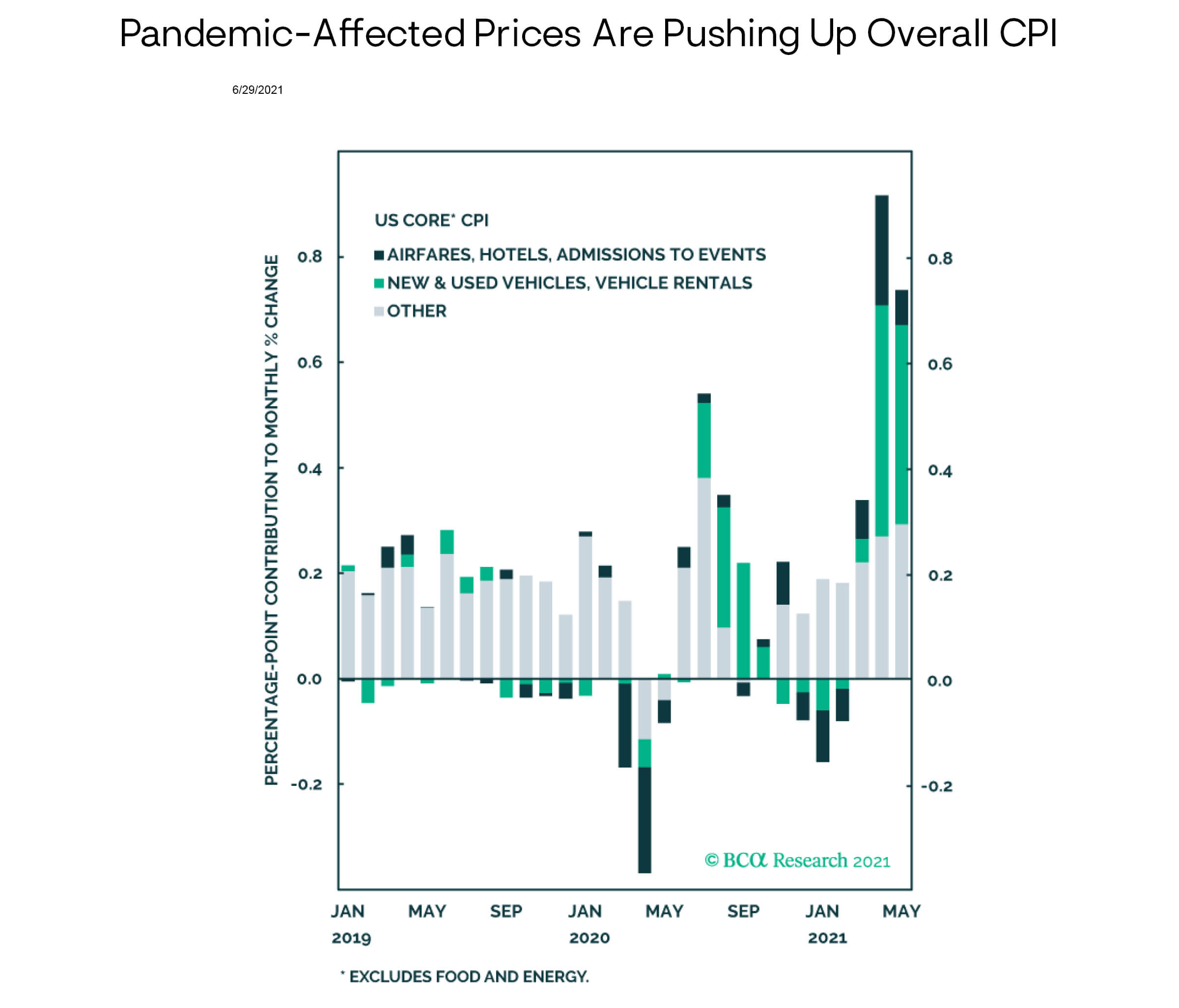

Having said all this, there is no question the recent CPI inflation numbers have been surprisingly high. So, let’s dig further into those numbers. As the “Pandemic-Affected Prices” chart below from BCA Research shows, more than half of the monthly increases in core CPI in April and May are explained by (1) higher vehicle prices (which is largely due to semiconductor chip shortages constraining new auto production and causing spiking demand for used cars), plus (2) the sharp rebound in the prices of travel and leisure services most deeply hurt by the pandemic (airfares, hotels, and public events).

To cite an extreme example, used car prices rose 10% in April and another 7% in May, contributing more than one-third of the total monthly CPI rate. According to The Economist, used pickup truck prices at auction are up 70% in the past 12 months. Clearly, this type of price inflation is unsustainable.

It’s important to reiterate that this chart is showing month-over-month core inflation rates. So, these rates are not subject to the year-over-year “base effects” from comparison to the depressed price levels a year earlier during the height of the pandemic lockdown–driven deflation.

However, the monthly inflation rates do reflect the current—and almost certainly temporary—supply/demand dislocations in the economic sectors recovering most sharply from the pandemic shock. So, while technically not “base effects,” it is still very much “pandemic disruption effects” that we are seeing in the recent monthly CPI numbers.

We can’t draw any definitive conclusions yet. But fundamental “Econ 101” supply and demand analysis suggests these segments are very unlikely to see sustained, material price increases as post-pandemic economic life normalizes over the coming months.

We agree with this summation from Ned Davis Research: “As supply chain issues and production bottlenecks ease over time and as consumer demand shifts toward more services that were foregone during the pandemic, goods price inflation should moderate, easing the pressure on overall inflation.”

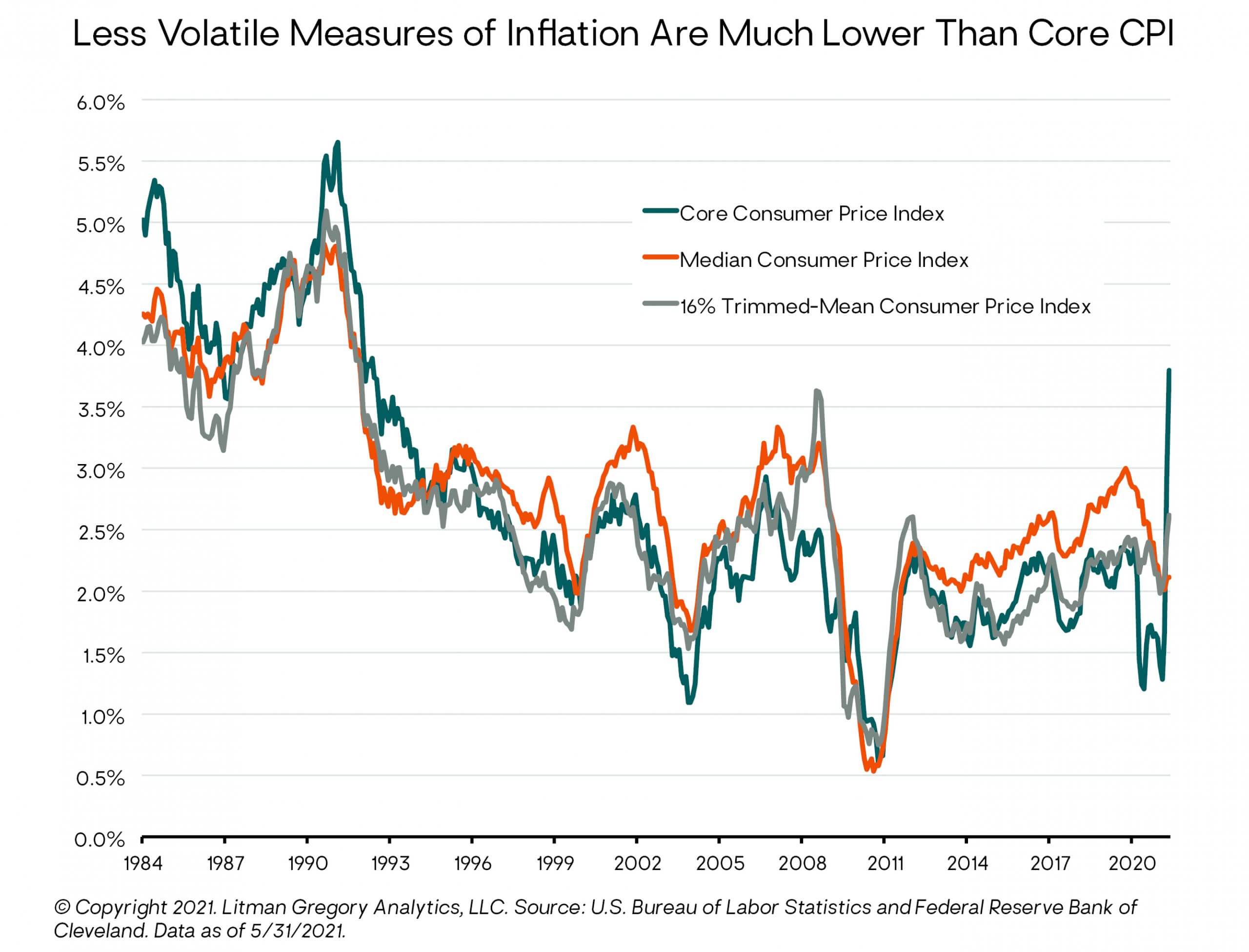

Indeed, other measures of core inflation that remove the impact of volatile inflationary and deflationary outliers to try to represent the underlying structural inflation trend are running well below the 3.8% May core CPI and even the 3.0% core PCE (personal consumption expenditures). Two such measures are shown below: the median CPI (up 2.1% year over year in May) and the trimmed-mean CPI (up 2.6% year over year).

However, arguing in favor of higher inflation, we note that “Other” CPI segments—the grey bars in the BCA chart above—have also generated higher-than-normal inflation over the past two months and are in an upward trend. So not all of the recent rise in inflation can be pinned on temporary or transitory factors.

It’s also possible supply shortages and bottlenecks don’t resolve as quickly as expected; or that wage increases accelerate despite the apparent labor market slack; or that the economic slack is actually tighter than it appears; or that the Biden administration pushes through another huge debt-financed and central bank QE-supported fiscal spending program; and that longer-term inflation expectations start to become unanchored from around 2%. Any of these would be inflationary and could lead us to change our views.

As multi-asset portfolio managers and risk managers, we remain open to a higher-inflation scenario outside of our base case. If the Fed continues on its current stated policy path (as we expect) and the global recovery continues, we do expect U.S. inflation over the next five-plus years to exceed the 1.7% average core PCE inflation of the past 20 years. But that is far from saying we expect to see a high-inflation regime (say, on the order of 4% to 5% or higher sustained annual CPI inflation). In any case, we hope to get more clarity on this question over the next few quarters as additional wage, price, and inflation expectations data come in.

Our Financial Markets Outlook & Portfolio Positioning Allows for a Range of Scenarios

We believe our portfolios are well-positioned for continued strong performance in our base-case scenario of an ongoing global economic recovery as the world emerges from the pandemic. But we also own asset classes that should do fine in the event of unexpectedly strong inflation. And, as always, in our more conservative balanced portfolios we maintain meaningful positions in assets like core bonds that provide ballast and strength in the event of a deflationary surprise or shorter-term exogenous shock.

Base Case

First, regarding our base-case economic/market view, looking out over the shorter to medium term, we expect

- continued positive returns for equity and credit markets on the back of strong early- to mid-cycle economic and corporate earnings growth along with still-accommodative government policy;

- outperformance from non-U.S. equity markets that are more economically sensitive and have lower valuations than the S&P 500, and that have lagged the United States in rolling out widespread vaccinations but are now catching up;

- a continued market rotation generally toward cyclical/value stocks from defensive/growth stocks; and

- poor core bond returns, as Treasury yields are likely to be pressured somewhat higher from current low levels due to stronger global growth and reflation.

After our recent incremental increase to our target allocation to U.S. stocks (and incremental decrease in our target allocation to flexible bonds), most of our balanced portfolio strategies are now neutral or slightly overweight to equities. Within our equity allocation, we maintain a tactical overweight to emerging-market (EM) stocks. Our analysis suggests they have superior return potential—low double digits annualized in our base case—over our five-year medium-term horizon. But we are prepared for their higher volatility as well, particularly as vaccinations and immunity in many emerging economies are lagging the rest of the world.

Overall, we see upper-single-digit expected annual returns for our global equity allocation in aggregate. This is higher than the other public asset classes we follow. Of course, equities also come with higher short-term volatility and the potential for double-digit drawdowns.

Along these lines, absolute valuations for U.S. stocks are historically very high and embed a lot of good news/high expectations for continued strong U.S. corporate earnings growth. This raises the potential for a typical “mid-cycle” market correction (a 10%-plus decline) should actual S&P 500 earnings growth fail to meet such lofty expectations. The fiscal drag heading into 2022 could be a catalyst.

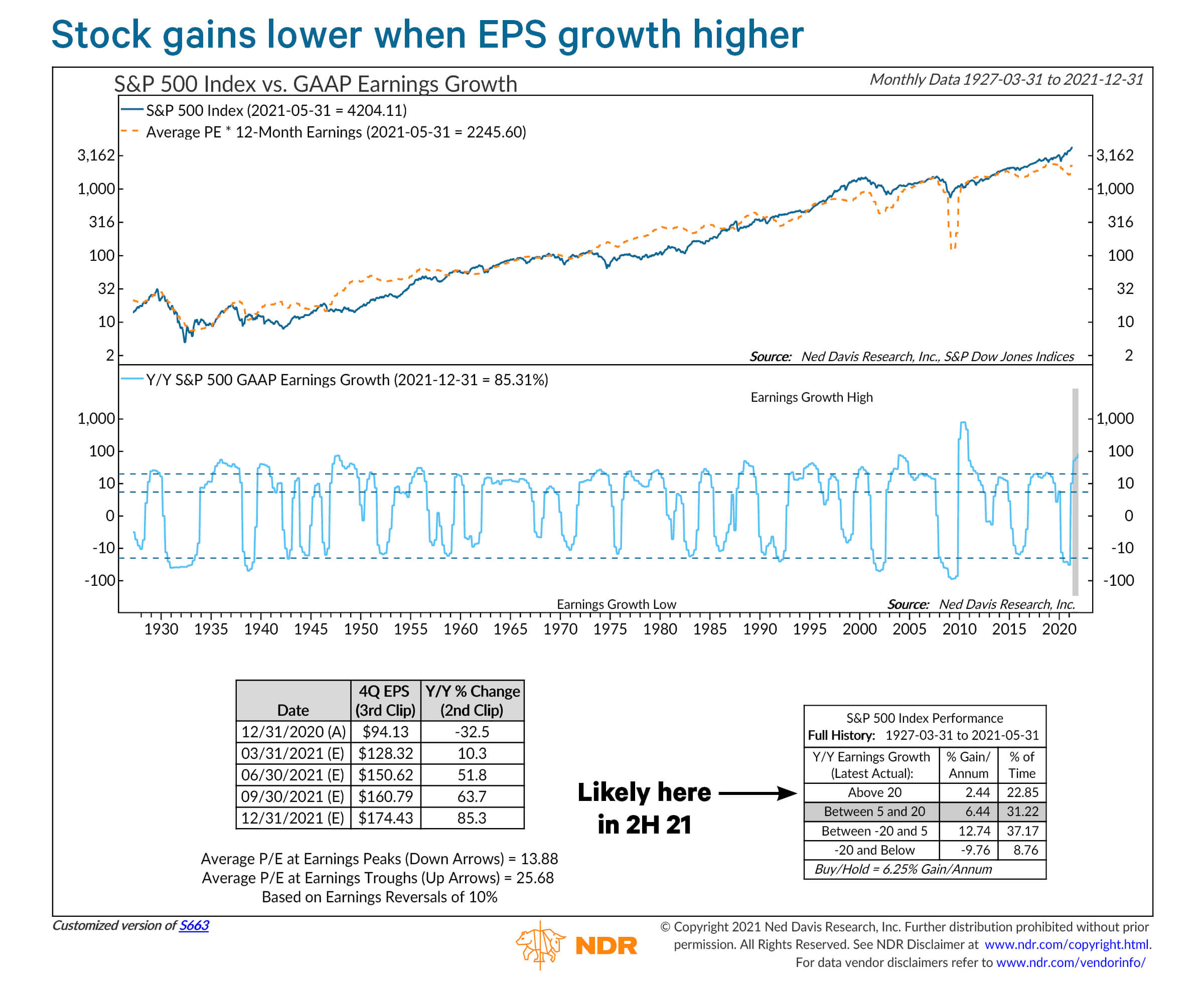

We’ve shown the following chart from Ned Davis Research before. It is a good reminder that stocks typically deliver lower-than-average returns once earnings growth has reached elevated levels. We are there now.

However, absent a recession—and barring an unexpected external shock, the probability of a recession seems very low over the next 12 months at least—any market correction shouldn’t be too severe or too lengthy, although it certainly won’t feel good as it happens. We’d then expect the bull market to resume, until ultimately topping out amidst unsustainable excesses and imbalances—as cycles typically do, with the market herd proclaiming, “It’s different this time!”

As the U.S. stock market progresses further into a mid- to late-cycle phase, it is typical for high-quality stocks (for example, those with high and stable profit margins and return on equity) to outperform low-quality, more-speculative names. So, while we believe selective cyclical/value stocks still have room to run, we also want to remain well-balanced across our equity style/factor exposures, including quality and growth stocks.

Our reflationary base-case scenario should also be positive for our flexible bond strategies and floating-rate loans. Broadly speaking, these strategies have exposure to corporate credit and collateral that benefit from stronger economic conditions. These strategies generally are also not too sensitive to rising Treasury bond yields (within reason), as compared to the core bond index’s high duration. We think low- to mid-single-digit total returns are reasonable to expect for our active flexible bond managers vs. very low single digits for the core bond index.

The High-Inflation Scenario

But what if inflation picks up more than we expect in our base case? First, we have the ability to tactically adjust our portfolio allocations if our assessment of macro and market conditions is shifting meaningfully toward high inflation risk.

But even as currently positioned, most of the “reflationary” assets we own have historically also performed well (or relatively well) in inflationary environments, including emerging-market equities, cyclical/value stocks (such as financials, energy, materials, and industrials), and trend-following managed futures strategies. Our private real estate investments should also perform well.

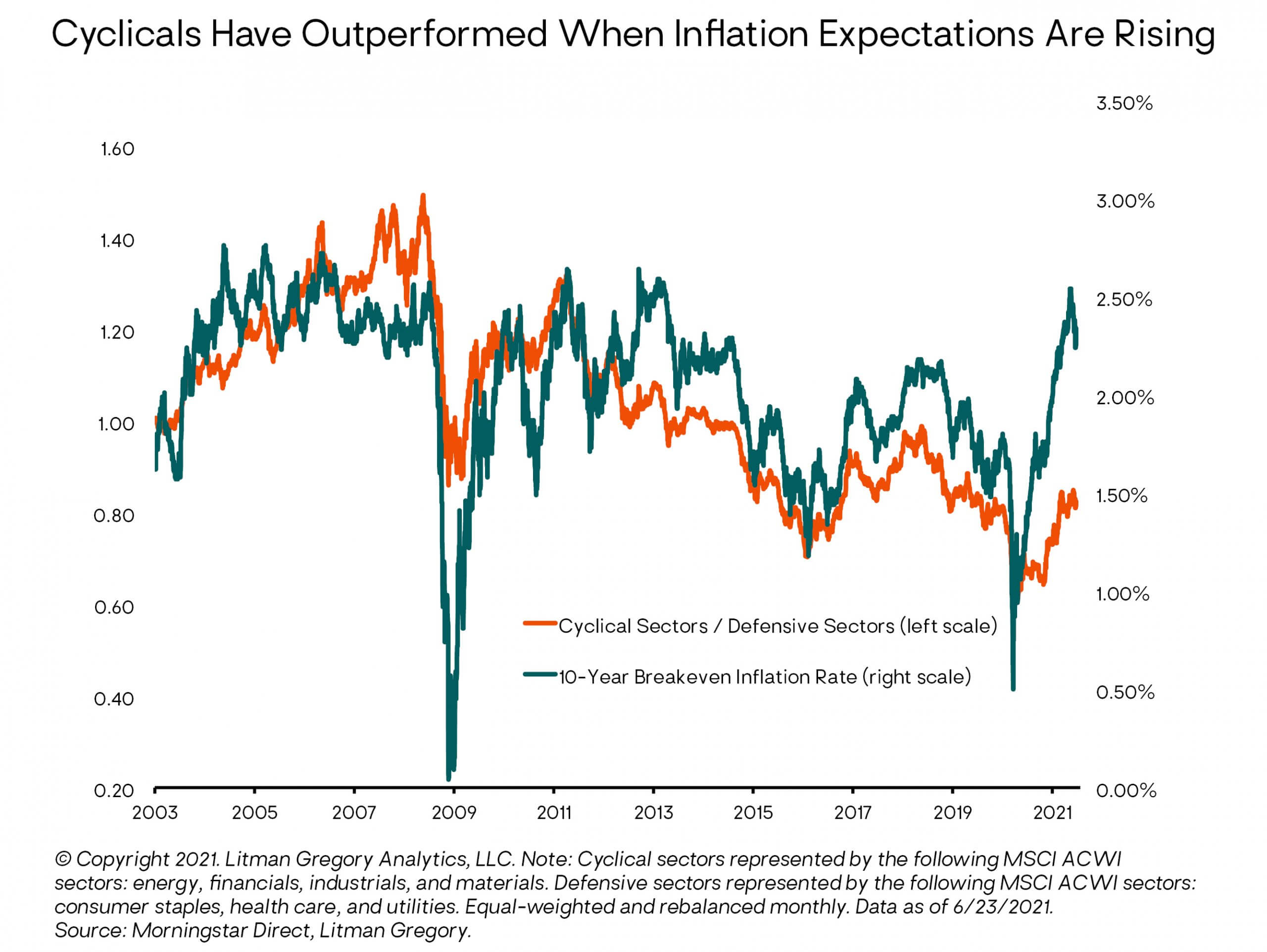

For example, the chart below shows that global cyclical stocks have outperformed global defensive stocks during recent periods of rising inflation expectations. (Inflation expectations here are proxied by the “breakeven inflation” rate, defined as the 10-year Treasury bond nominal yield minus the 10-year TIPS real yield.)

Another historical analysis by Goldman Sachs shows that since 1980 value stocks have tended to outperform growth stocks when economic growth is above average. Value stocks also have done better, on average, during periods of accelerating economic growth and rising interest rates. All of these are consistent with a higher inflation period.

Brandes Investment Partners recently published an analysis showing that since 1985, global and U.S. value stock indexes have materially outperformed the comparable growth indexes when inflation is above average or increasing, and vice versa when inflation is below average and decreasing.

Similarly, long-term historical analysis presented by Larry Swedroe found value stocks have generated their highest excess returns over the broad market index when inflation was greater than 3%. He also notes that during the high-inflation era of 1968 through 1981, when U.S. CPI averaged 7.6%, value stocks (low price-to-book) gained 12.6% annualized, more than doubling the S&P 500 index’s 6.0% nominal return and beating the growth index by even more.

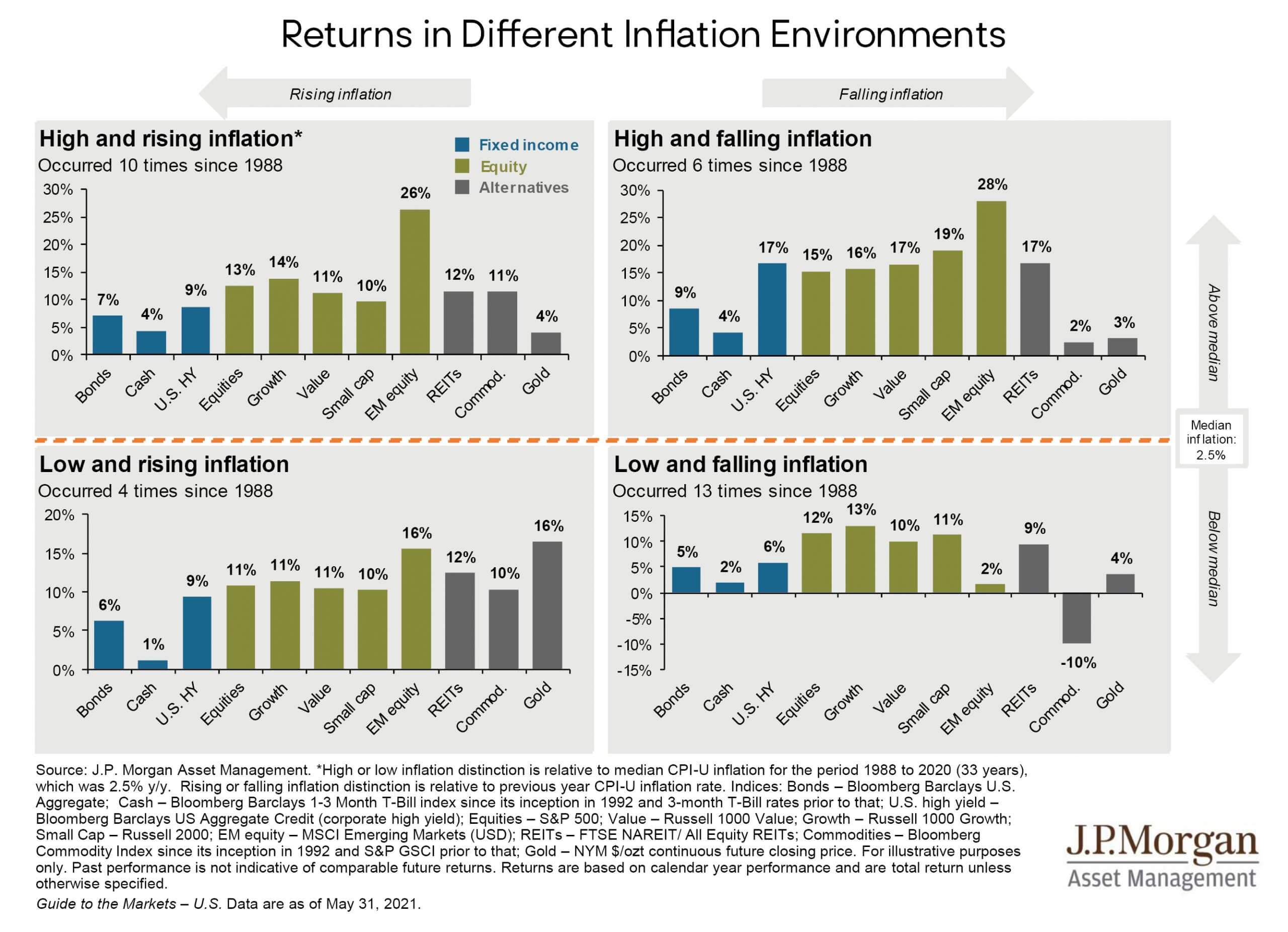

The following charts from JPMorgan Asset Management show various asset class returns since 1988 across different inflationary environments. It uses 2.5% inflation as the dividing line between low and high inflation. These results are also very time-period dependent. So, we would certainly not rely on them as a forecast of future returns—especially not for core bonds, given today’s low yields. But in relative-return terms looking across assets, there may be some information value in this history, for example with respect to emerging-market stocks versus U.S. stocks.

Over longer-term investment horizons, stocks have been excellent at generating returns above inflation, although equity valuations and returns typically take an initial hit as the market adjusts to a higher inflation regime. This is a risk right now, particularly for long-duration U.S. growth stocks, which have benefited disproportionately from the past 10-plus years of disinflation and valuation-multiple expansion compared to cyclical value stocks.

Finally, if we were to experience sustained high inflation, we would expect our trend-following managed futures strategies to do quite well. As shown in research papers from AQR and Man Group/AHL/Duke University, trend-following strategies have historically delivered strong returns in inflationary periods, such as 1973–1982 in the United States.

Not only that, a study by AQR shows trend-following strategies benefit from sustained inflation surprises in either direction. That is, they perform well in environments where inflationary or deflationary surprises are large and persistent. This is a key reason why managed futures strategies have historically been such powerful portfolio diversifiers relative to traditional stock and bond holdings and why we include them in our balanced portfolios.

The Disinflationary Scenario

So far, we’ve mostly focused on the risk of higher-than-expected consumer price inflation, which could jolt financial markets, hurting both core bonds and stocks (at least in the shorter term before earnings start to catch back up). But we also are cognizant of risk on the other side of our base case: unexpectedly weak economic and earnings growth in the coming quarters. As we’ve noted, a lot of good economic news is baked into U.S. stock market prices and valuations.

A shorter-term deflationary scenario could be caused by an external shock, such as a COVID-19 variant resurgence or some type of negative geopolitical shock, such as a widespread cyberattack on the economy or government. In the event there is some backsliding in the global growth outlook for whatever reason, defensive assets will perform better than reflationary assets.

To provide some insurance against that type of event we maintain positions in core bonds, defensive/higher-quality/growth U.S. equities, and alternative strategies that provide portfolio ballast. Again, we think a deflationary shock would be a relatively short-term event. And we’d expect another massive government policy response (fiscal and monetary).

Given the uncertainties, we believe long-term investors should balance the upside returns in a reflationary scenario with downside risks from an inflation surprise in either direction. We incorporate inflation and deflation risks around our sanguine base-case outlook into our thinking. We have exposure to defensive assets (to varying degrees depending on the client’s risk level), but in general our portfolios are tactically tilted toward reflationary return-generating assets.

Closing Thoughts

It is still too early to say whether and to what extent the past two months’ inflation reports are harbingers of a sustained period of meaningfully higher inflation. Or whether, as the Fed believes (and hopes!), most of the recent sharp price increases will prove transitory, as current supply shortages catch up to demand and increasing productive capacity comes online as the pandemic recedes.

Our current base case is that inflation does not get out of control. But we update our tactical views as new information becomes available. And structurally, our portfolios are well-diversified across a range of macro scenarios around our base case.

As COVID-19 vaccinations and immunity spread across the globe, we continue to expect a strong global economic recovery. This should bode well for riskier but higher-returning asset classes over the near term (next 12 months) at least. While the Fed is now signaling it is moving closer to beginning to taper its QE asset purchases, monetary policy and interest rates should still remain accommodative for a while.

The path of fiscal policy in the United States is less certain, given the political dynamics and polarization. The expiration of the pandemic support programs will turn from a fiscal boost to a fiscal drag later this year and in 2022. But this should also lead to increased labor supply, mitigating wage inflation pressures.

With the likelihood of a U.S. recession very low—absent a severe external shock—we see low risk of a bear market. Of course, 10%-plus stock market corrections can always occur. And as we move further into the U.S. earnings cycle, the odds of a typical mid-cycle market correction increase. But despite elevated S&P 500 valuations and a likely deceleration in S&P 500 earnings growth, we believe global equities have additional return potential in this cycle. More specifically, we continue to see superior shorter- to medium-term return prospects in international and emerging-market equity markets, where earnings have more room for positive surprises and valuations are more reasonable. As always, though, equity investors should be prepared for a bumpy ride.

—Jeremy DeGroot, CFA, Chief Investment Officer (7/6/21)