Gauging the Odds of a Recession and What it Would Mean for Investors

In past quarters, inflation has been the big story in news headlines and in our own investment commentaries, but in recent months the increased likelihood of a recession has been moving to the front of the news cycle. In this article, we revisit thoughts from our latest quarterly commentary to review the chances we will experience a recession in the near term and what that could mean in the shorter and longer-term for the investment strategies we manage.

Assessing the Data

The current macroeconomic data are sending mixed signals. On the one hand, the U.S. economy has been more resilient than we (and many others) expected through the first half of the year. GDP has grown, and actually accelerated in the second quarter which surprised most analysts; the labor market has remained very strong, supporting consumer spending; and headline inflation has dropped meaningfully, thanks largely to a sharp decline in energy prices and consumer goods disinflation as supply and demand normalize after the pandemic disruptions.

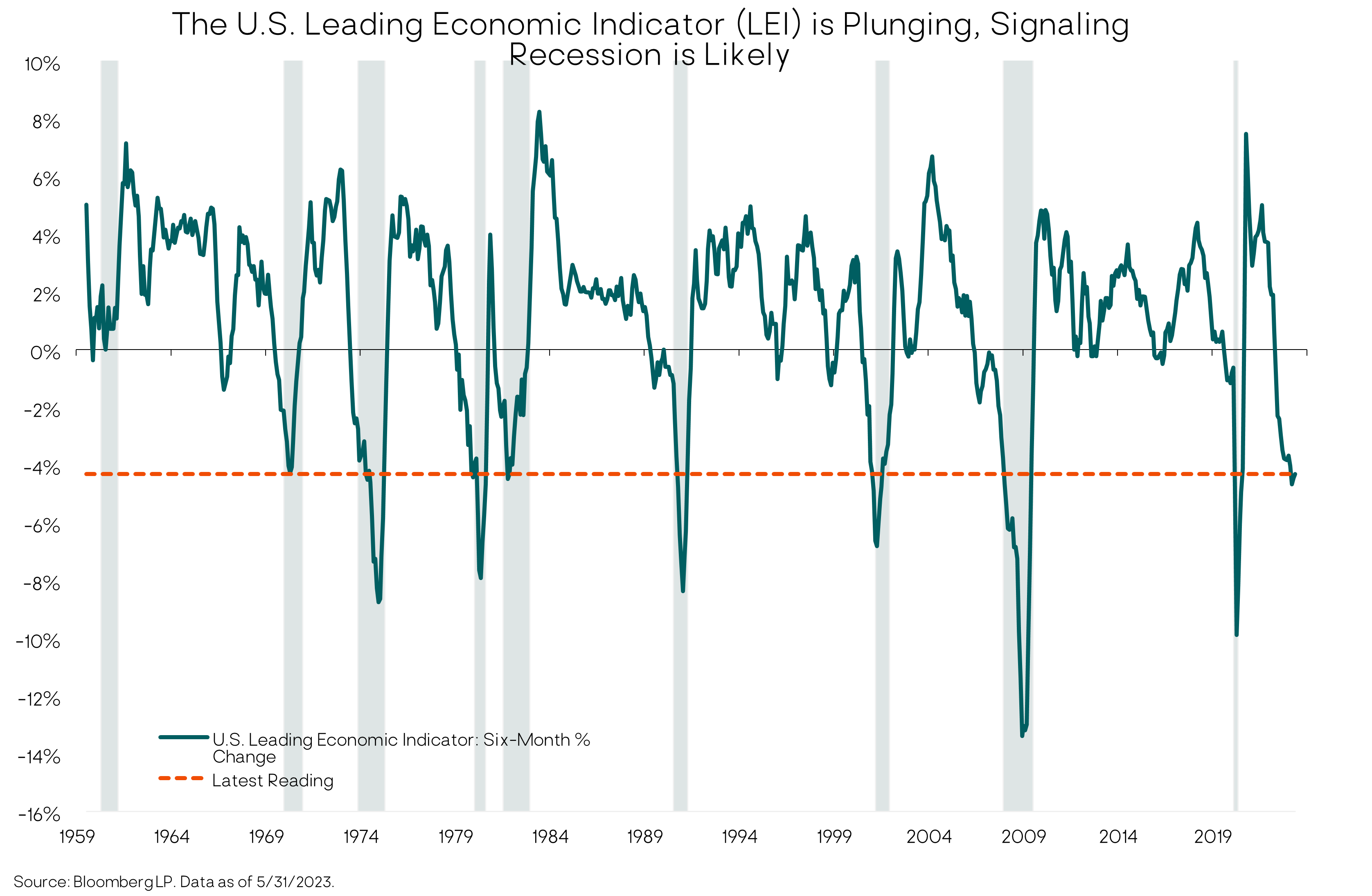

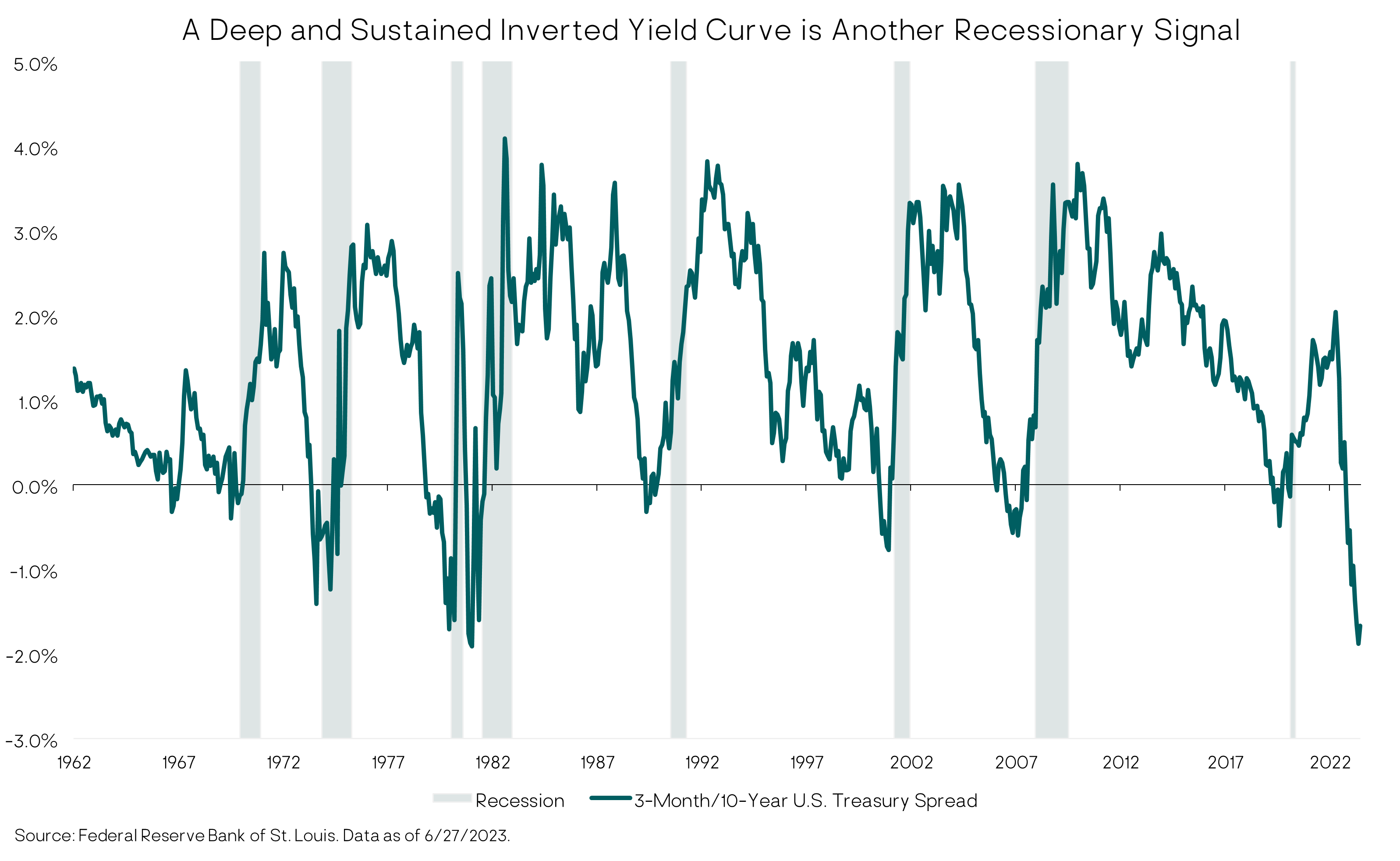

On the other hand, key leading indicators of an impending recession are still flashing red, e.g., Conference Board Leading Economic Index (LEI), deeply inverted yield curve, tightening credit conditions. And although the Federal Reserve paused its aggressive interest rate hiking campaign in June, core inflation (excluding food and energy) remains stubbornly high, with the Fed signaling it will resume rate hikes later this year, further raising the likelihood of a recession.

As we read the muddy economic tea leaves through our cloudy crystal ball, we maintain our view that a recession is the most likely outcome over the next few quarters. Historically, the odds are unfavorable for the economy avoiding a recession after the Fed has been aggressively tightening – after all, the purpose of tightening is to slow the economy. And we have yet to see the full impact of this cycle’s monetary tightening on the real economy since the effects are lagging. That said, we don’t expect a severe 2008 or 2020 type of recession. Household and corporate balance sheets are in good shape, and by raising rates to 5% the Fed now has room to cut them again in the next recession, softening the downturn.

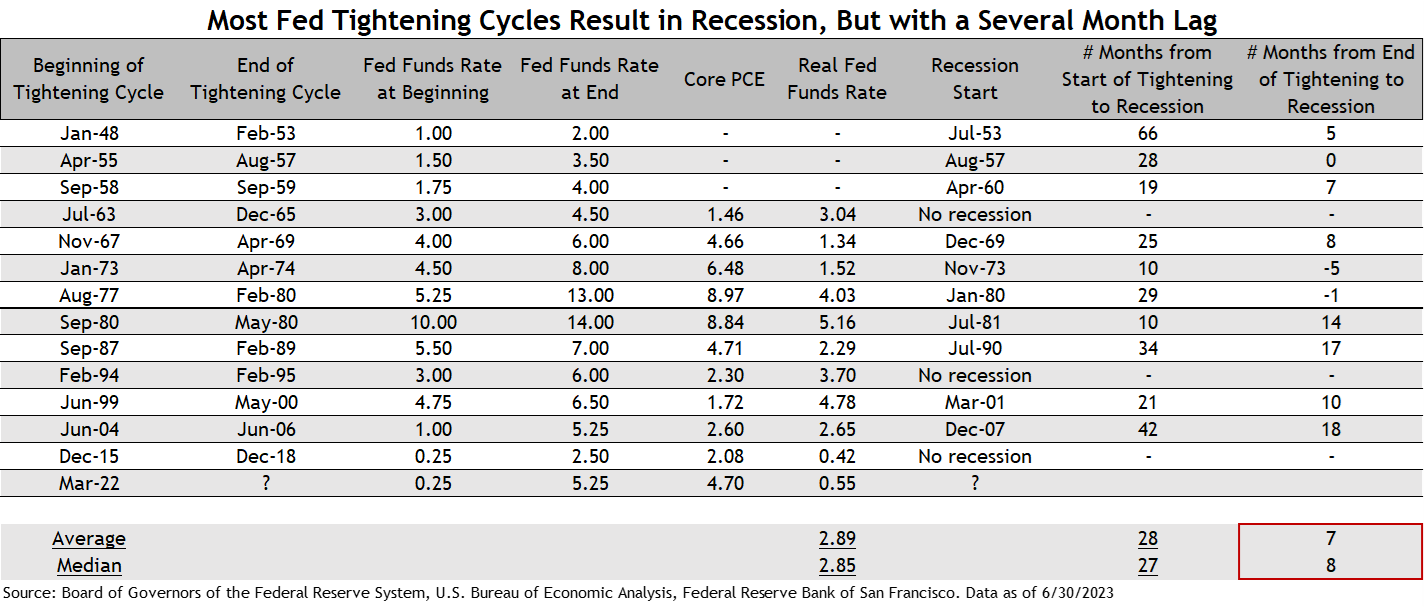

And a near-term recession is not a certainty. (1) There are not a lot of historical data points: this is just the 14th Fed tightening cycle since WWII. (2) Each cycle is somewhat different and this one considerably so due to the pandemic dislocations. And (3) there have been three instances (out of 13) where the Fed tightening cycle ended without a recession. (We discuss this further below.) So, a more benign near-term outcome is certainly possible, and the current growth and inflation trajectory is not inconsistent with that.

In gauging the likelihood of a recession, the interrelated variables are inflation, the labor market, Fed tightening, and the impact that has on the economy and in turn on corporate earnings. We’ll look at those in more detail before talking about how it informs our investment decisions.

Inflation

Despite the still-high core inflation readings, the Fed Open Market Committee (FOMC) unanimously decided not to raise interest rates at its June 14 meeting, after 10 consecutive rate hikes since March 2022 totaling five percentage points (500 basis points). The Fed had signaled this pause was likely coming and the financial markets were expecting it.

However, we don’t believe this pause signals a lessening of their resolve to fight inflation, so we consider it a “hawkish pause” because contrary to expectations the Fed projected 50 basis points (0.5%) of rate hikes later this year. The markets were expecting maybe one more hike at most.

Of course, as we’ve frequently noted, the Fed’s projections of its own behavior are often wrong. No one knows, not even the Fed itself, what it will do three or six months from now. There is too much uncertainty and variability in the economy, at least in the current macro environment.

The Fed also revised up its forecasts for GDP growth, employment, and core inflation for 2023, reflecting the resilience of the economy so far this year and consistent with its projection for further interest rate hikes later this year (the blue lines in the chart below).

At his post-FOMC meeting press conference, Fed Chair Jerome Powell conveyed a hawkish message to those expecting Fed rate cuts any time soon. “Nearly all committee participants view it as likely that some further rate increases will be likely this year,” he said. “Not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate if you think about it.” Nevertheless, the markets remain skeptical the Fed will actually hike rates twice more.

We think it will take a sharp economic downturn and surging unemployment for the Fed to start cutting rates. But they may continue to hold the Fed funds rate at current levels (or 25 basis points higher) if core inflation drops convincingly towards 2% over the second half of the year.

Meanwhile, the Fed is still hoping they can land the economy softly without causing a recession and a large increase in unemployment. This occurred in the 1965, 1995 and 2018 hiking cycles. But history is not on the Fed’s side. The challenge is daunting given the complexity of the task and the multitude of economic, geo-political and other variables far beyond the Fed’s control.

One can see from the table below that a recession has started an average of 7-8 months after the last Fed rate hike. Based on the historical average, if the Fed’s last rate hike is at the July FOMC meeting, the recession would begin in early 2024.

However, there has been wide dispersion. The lag has been as long as 18 months in the 2007-2008 financial crisis recession. (After they stopped tightening in June 2006, the Fed actually started cutting rates in September 2007 before the recession started in December 2007.) And in the two rate hiking cycles during the inflationary 1970s, both recessions began a few months before the Fed stopped hiking.

Source: Board of Governors of the Federal Reserve System, U.S. Bureau of Economic Analysis, Federal Reserve Bank of San Francisco.

We believe Powell would accept a recession in exchange for bringing inflation sustainably down to the Fed’s 2% target, although the political pressure (from both sides) will ratchet up as we get closer to the November 2024 election.

The Labor Market

Wages and salaries account for 60% of personal income, according to Ned Davis Research, so the strength of the labor market has been key to the strength in consumer spending and the economy’s resilience this year.

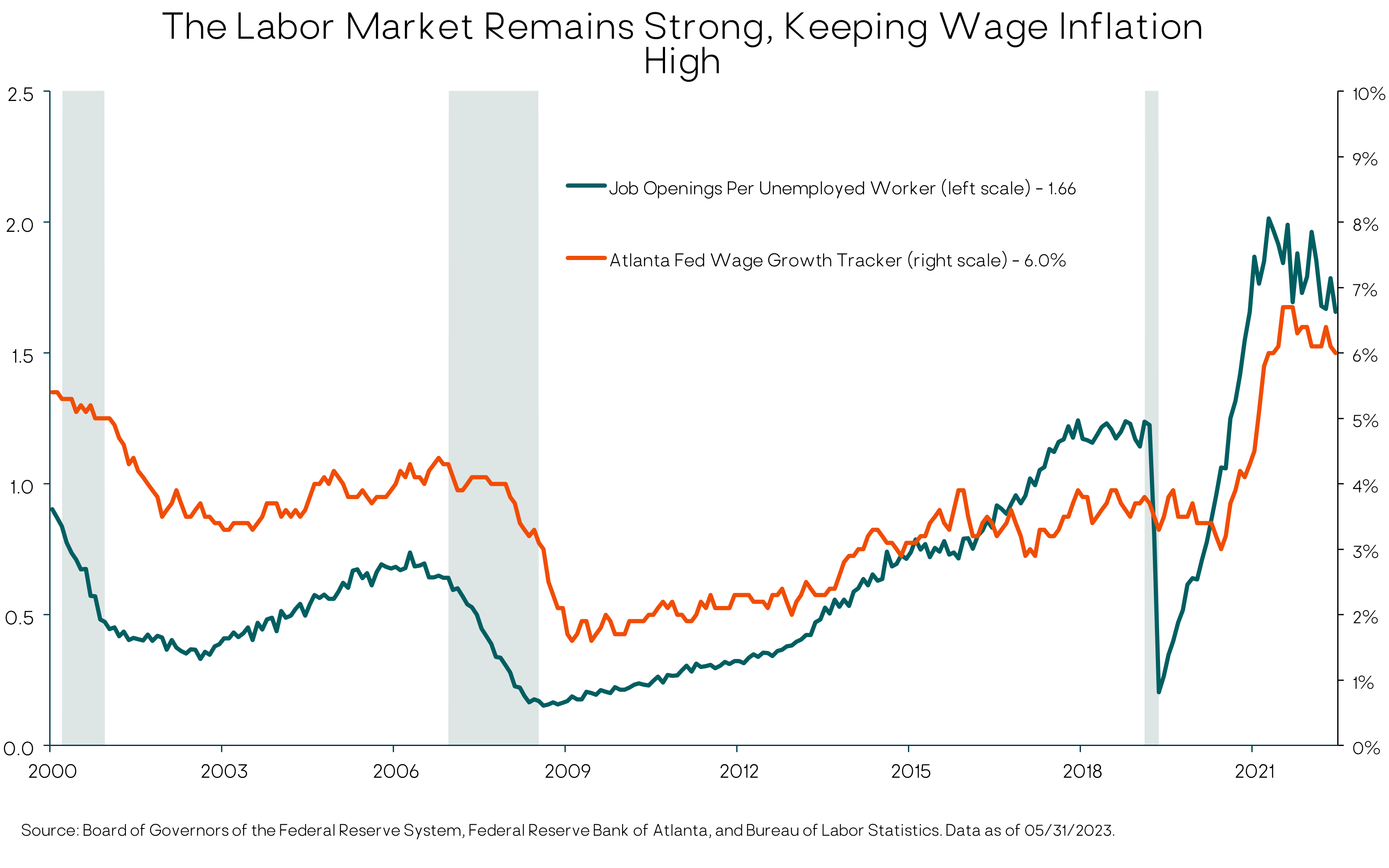

On the other side of the coin, the largest input cost for most businesses is wages. Wages in turn are partly a function of inflation expectations, which can feed into a self-reinforcing wage-price spiral — the Fed’s biggest fear.

The good news is that the risk of a wage-price spiral now looks very low. Much like the core inflation readings, wage inflation appears to have peaked and has started to fall. But is still too elevated at around 6%. Annual wage growth of around 3%-4% would be consistent with the Fed’s 2% inflation target, assuming productivity growth of 1%-2%.

The ratio of Job Openings to Unemployed workers is one measure of labor demand versus supply. It remains near all-time highs, with 1.8 job openings per unemployed worker. As shown in the chart below, there is a strong positive relationship between this ratio and wage inflation.

The Fed’s hope is that tighter monetary policy will reduce the number of job openings, relieving pressure on wages without causing a big increase in actual layoffs and unemployment. That’s a possibility given the unprecedented number of job openings relative to very low unemployment. But it’s not our base case.

We’d also point out the Fed itself is projecting roughly a one percentage point increase in the unemployment rate over the next year. The U.S. economy has never experienced more than a 0.5 ppt rise in unemployment from its cyclical low without the economy falling into a recession.

Economic Growth

So far this year, the U.S. and global economy have held up better than we expected in our base case, with sub-par (below-potential) growth but no recession. As shown in the chart below, this is due to the continued strength in the Services sector (a PMI above 50 is expansionary), while Manufacturing activity has been contracting.

However, the key economic leading indicators that have driven our base case U.S. recession expectation have shown no sign of improvement over the past quarter. In addition, we do not think the Fed is close to loosening monetary policy any time soon, barring a recession. And the full, lagged, economic effects of the Fed’s aggressive monetary policy tightening have not yet played out.

Revisiting our key leading indicators, the Conference Board Leading Economic Index (LEI) has declined for 14 straight months, the longest negative streak since the 2008 financial crisis, and its six-month rate of change is deeply in recessionary territory.

The second key recession indicator is the inverted Treasury yield curve – meaning short-term Treasury yields are above longer-term Treasury bond yields. An inverted yield curve is usually (but not always) a leading indicator of recession. As with the LEI, the depth and duration of the current inversion has never occurred without a subsequent recession in the U.S.

However, the timing from initial curve inversion to the onset of recession has been highly variable. According to BCA Research, across the eight U.S. recessions dating back to 1969, the average lead time from the initial yield curve inversion to the onset of recession has been 11.3 months; but it has varied from 5 months to 16 months (using the 10-year/3-month yield curve). The current inversion started in November 2022, so a second half 2023/early 2024 recession would be in line with the historical range.

Bank lending standards are another economic leading indicator. Lending standards impact overall credit conditions, which in turn impact economic growth via consumer and business borrowing and spending. Thankfully, the worse-case scenarios swirling during the regional banking turmoil in March have not come to pass. (We were not expecting the worst case given the Fed/FDIC’s quick responses.) However, lending conditions remain tight and at levels consistent with recession in the past. And at this late stage in the economic cycle, credit conditions are likely to tighten further. This will further weigh on business investment (capital expenditures, or CAPEX) and consumer spending.

Corporate Earnings

Although the markets can be driven by investor sentiment and momentum in the shorter-term, ultimately it is corporate earnings – “fundamentals” – and the price one pays for those earnings that drive stock prices and investor returns over the medium to longer term.

Our assessment, as well as that of many investment strategists we respect, continues to be that consensus/analyst earnings expectations for the remainder of 2023 are too high given the likelihood of an economic recession. Put differently: We do not believe the S&P 500 at current levels is adequately pricing in the likelihood and magnitude of a near-term earnings recession.

An economic recession implies a corporate earnings recession as profit margins compress and sales growth slows. In fact, it is the compression in profits that typically lead companies to lay off workers, which further exacerbates the recessionary impulse from shrinking demand for goods and services.

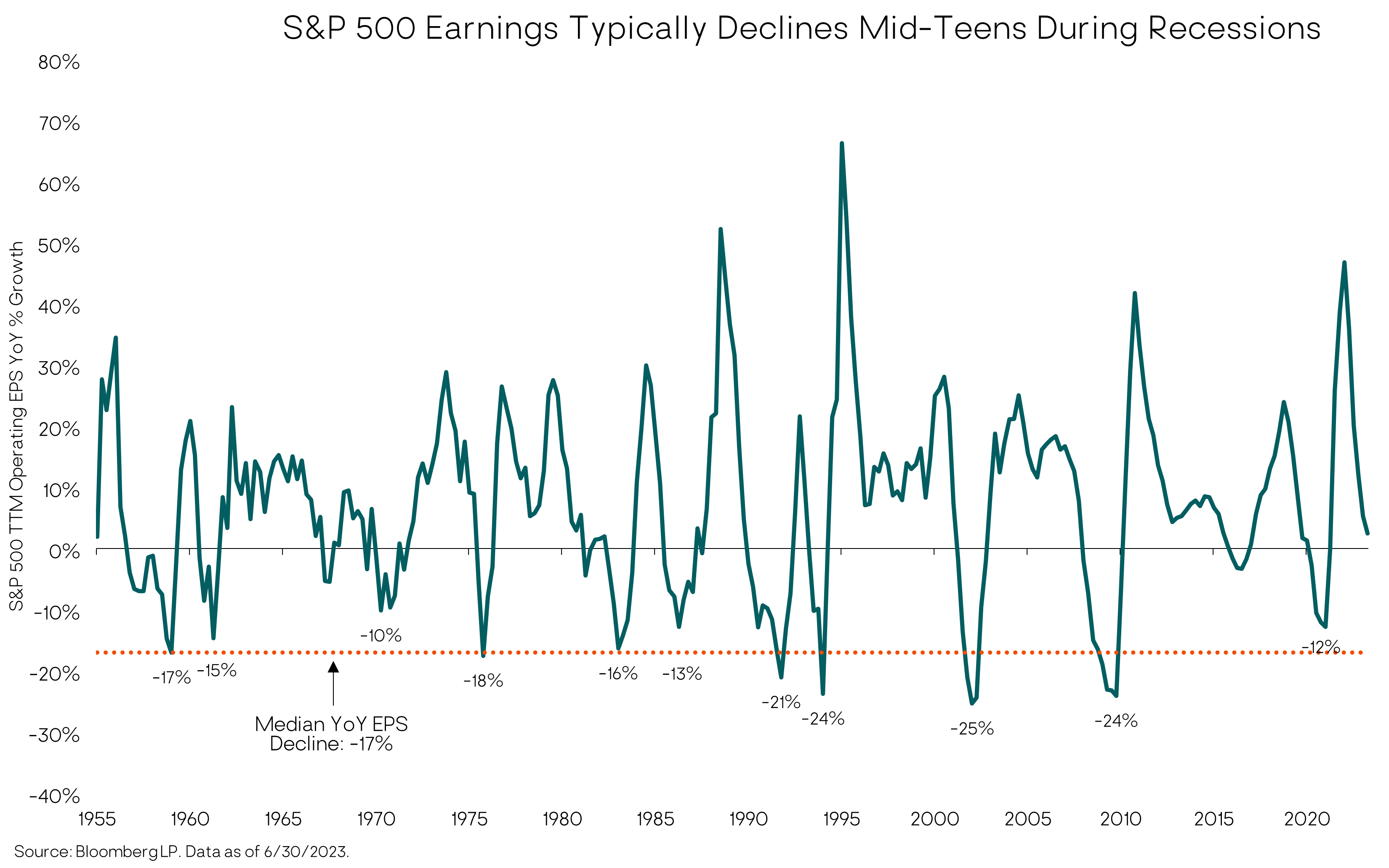

Even if this recession is relatively mild, earnings could decline by 10% or more. (The average historical earnings recession is negative 15-20%.) In contrast, the current consensus earnings forecast is for a slight increase in earnings through year-end, followed by double-digit growth in 2024; and analysts have recently been revising upward their earnings growth expectations. This is inconsistent with a recessionary scenario, in our view.

If and when actual earnings fail to meet expectations, we estimate the potential downside for the S&P 500 to be as high as 20-30% from current levels before the market cycle bottoms and the next bull market and economic recovery begin. That is the magnitude of decline we believe long-term investors need to be prepared for.

Timing and Outlook

In terms of timing, every U.S. bear market associated with a recession has bottomed during the recession – on average several months after the recession has started. Again, there is wide dispersion historically in terms of the exact timing, but in no cases did the S&P 500 hit its cyclical low prior to the onset of recession. On the positive side, the market typically starts recovering before the recession clearly ends – once all the bad news (and then some) is fully priced in and investors start anticipating the next up cycle.

Though we think it more likely than not that we will see a recession in a 12-18 month time frame, with commensurate short-term downside for stocks, as we extend our time horizon to the medium-term (five to 10 years), we see reason for optimism, or at least comfort. While the U.S. stock market in aggregate is vulnerable to earnings disappointment, there are companies and sectors within the U.S. market that are reasonably-priced, e.g., areas not swept up in the current AI frenzy. The fixed-income landscape is also attractive, thanks to higher yields and inefficiencies that can be exploited by skilled active managers.

We also see strong total return potential from developed international and emerging market stocks, which have been out of favor and underperforming for more than a decade. These markets are not “priced for perfection” as the U.S. market seems to be. Instead, they are susceptible to “upside risk” – better-than-expected earnings growth and valuation expansion. While foreign markets will get hurt in a near-term recession, we don’t want to try to time getting out and getting back in given their attractive five-year return outlook.

Closing Thoughts

Even if a recession is pushed out beyond the next 12 months, the business cycle has not been repealed. A “normal” business cycle recession is inevitable at some point. And as an investor, that’s to be expected. In fact, it is healthy to periodically clear out speculative excesses and reset expectations and market valuations. As with past cycles, we are confident the economy and financial markets will survive the next recession and go on to higher highs in subsequent cycles, albeit with bumps and dips along the way.

Earning superior long-term returns does require one to take calculated risks when opportunities present themselves, but to also exercise caution during periods of market exuberance. At present, we remain patient and are confident that our research will enable us to identify these opportunities when they occur, while helping us remain patient in the meantime.