Real Estate Is Included in the Foundation of Our Highest-Conviction Portfolios

Litman Gregory has long used real estate investments in the portfolios we manage for our clients. For many investors, real estate is simple in concept: it involves owning properties that generate rental income and that one hopes will appreciate in value over time. These two components deliver a return to a real estate owner or investor. But beyond those basics there’s a lot more going on “under the roof.” In this research update we take the chance to share an in-depth explanation of how we analyze and utilize real estate investments in client portfolios.

Our Underlying Assumptions About the Real Estate Market

There are several foundational assumptions that inform how we think about investing in real estate. First, real estate will typically have significant areas of inefficiency. This is because the size of the private real estate market is massive, and because there is a huge amount of variation in the factors that affect individual properties; literally every property is unique. Another factor is the nature of investors in real estate: institutions are major players in larger, high-class properties but there are many market niches that are collectively large but that individually fall under the radar of institutions. Inefficiency is common in those areas. There is also a wide range in the level of skill, experience, and resources of real estate investors. Less sophisticated amateur and semi-professional investors can contribute to inefficiencies.

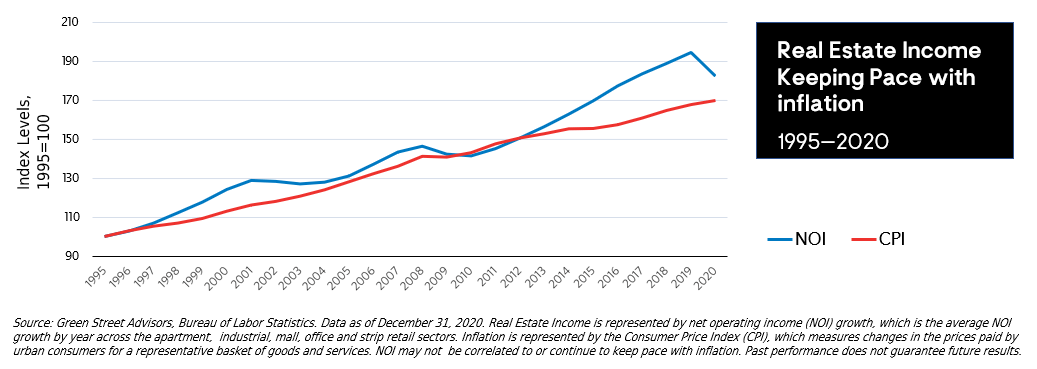

Private Real Estate Historically Has Acted as a Hedge Against Inflation

We believe skilled investors can take advantage of market inefficiencies and deliver very attractive returns while successfully managing risk. We seek to identify and allocate to these investors.

Our Investment Philosophy for Real Estate

An investment in a real estate partnership is relatively illiquid and an investor should expect additional compensation for that versus a combination of more liquid stocks and bond investments. We look for real estate investment managers who specialize in inefficient areas of the market that allow them to be opportunistic. We want to see they have return drivers that are within their control rather than external such as broader market forces. These “controllable” return drivers can result from their superior expertise within their specialized areas in terms of buying and operating properties.

Two of the real estate firms we have selected for our clients are good examples. One firm focuses on inner city properties in rent-controlled areas where supply/demand dynamics are favorable and there are not many sophisticated investors. They have very strong expertise in their neighborhoods, have a strict and well-informed valuation discipline, and excel at managing properties with challenges that more mainstream buyers avoid. Another firm we like is more of an opportunistic real estate investor. They have a deep and valuable network for co-investment real estate opportunities that has been cultivated over many years. As a value buyer, they seek to take advantage of complex and dysfunctional ownership structures where eliminating the dysfunction allows the properties to be managed in ways that unlock value and significantly improve outcomes.1

Assessing Risk in Real Estate Investing

There are certainly risk factors that are unique to real estate, and we will cite a few. It is first and foremost a levered asset class, so a major economic downturn could negatively impact property values and have a magnified impact on returns due to leverage. Historically, an investment can recover but overall rates of return over the life of the investment can be negatively impacted. Investors also take on regulatory and political risk, such as legislative actions that can impact values. In a low-interest-rate environment, valuation risk in private real estate can be relatively high, as it would be with most other asset classes.

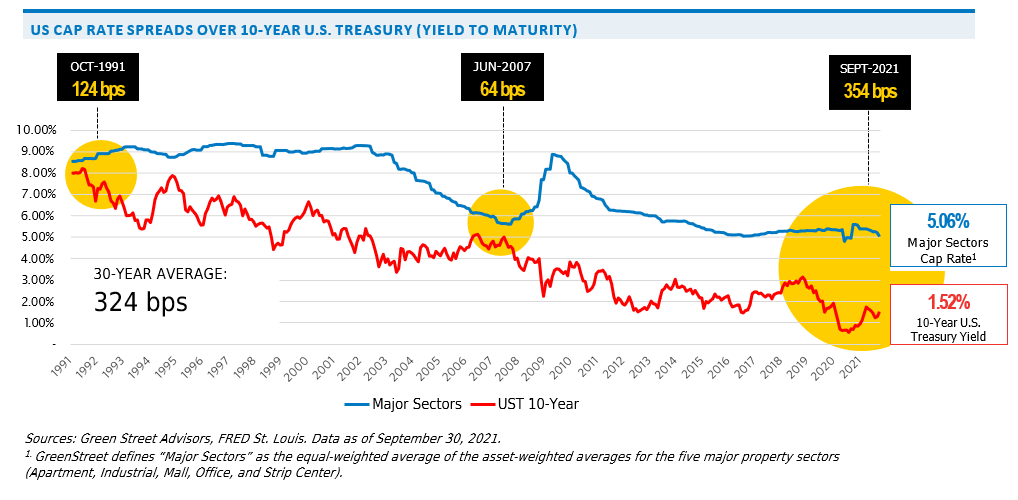

A way to measure valuations is through the cap rate, which measures the income on a property relative to its purchase price (in effect a “rental yield”). The means by which cap-rates can increase is a decline in property values, and the risk of cap-rate expansion is elevated in an environment of rising interest rates. However, higher rent growth can offset cap-rate expansion. When combined with owning property in locations where supply/demand dynamics are positive, rent growth has the potential to outweigh the negative impact on returns from cap-rate expansion. This is a key attribute of private real estate and an important reason why this asset class has historically served as a relatively good inflation hedge.

Having said that, in most longer historical periods (10 years and beyond) the primary return drivers for real estate and operators like those mentioned above are relatively reliable, given they follow a very disciplined approach that leverages their unique knowledge and skill.

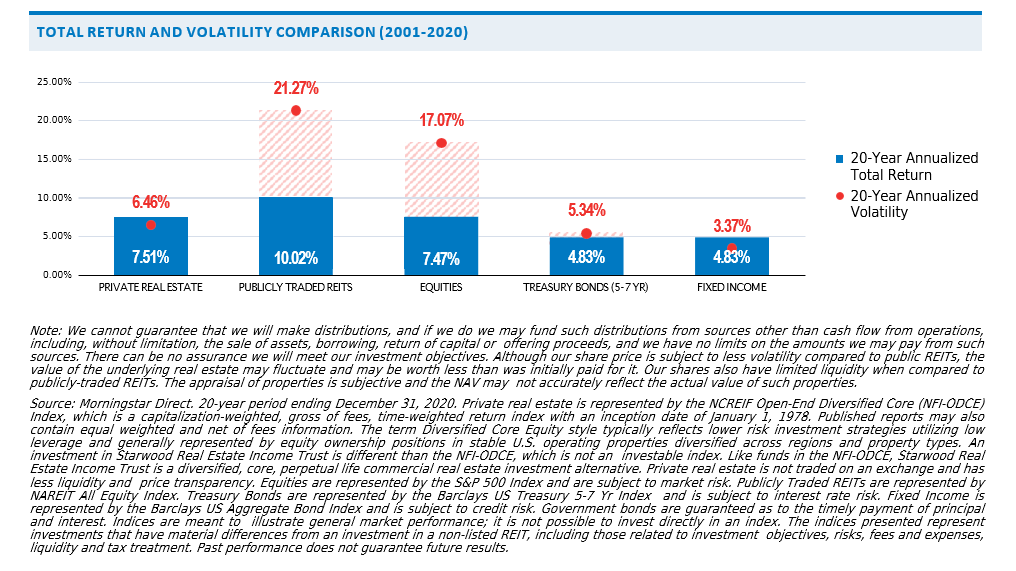

Over the Past 20 Years, Private Real Estate Has Delivered Attractive Returns, With Low Volatility

In contrast to real estate investors in smaller, niche opportunities are the very large institutional operators. They may have a high level of skill and resources but the need to put enormous amounts of capital to work generally requires them to focus on very large institutional properties and compete against similar firms with similar expertise. They can provide very broad “beta” (or market performance) exposure to large areas of the overall real estate market but there is far less opportunity to generate good returns by exploiting inefficiency and being opportunistic.

That said, we will also invest selectively with more “blue-chip” or “core” real estate-oriented firms; those typically have lower leverage and invest in stable, high-quality properties and carry lower execution risk (since they are not doing value-add or development strategies) that are theoretically lower risk with a narrower (and lower) potential return range than what one should expect from a niche strategy.

Looking to Add Portfolio Through Real Estate Investment Strategies

We seek direct real estate investment funds that have the potential to capture some return premium above the asset class return. This requires some value-added component either from portfolio positioning or individual investment opportunities or both. We seek operators with experience, a track record, meaningful investment by the General Partner, and a demonstrated commitment to their performance. Management fees, and profit sharing should be within industry standards (including preferred returns). These types of funds are interesting as a portfolio diversifier, especially when real estate as an asset class is attractive relative to core financial assets, and they offer a risk/reward relationship that falls between stocks and bonds. When that is the case, we incorporate these larger more “blue chip” strategies in our real estate allocation to complement value-added and opportunistic funds that we favor.

Private Real Estate Offers Strong Relative Value

We believe there is a strategic case to owning private real estate in portfolios—partly because of its relatively low correlation to stocks and bonds and its potential to hedge inflation. Selective investment in real estate in the right areas allows us to build better diversified portfolios with unique return drivers that add long-term value. As such, we view it as an important tool in our investment toolkit and we devote research resources here as part of our effort to deliver better returns for clients.

And as always, please feel free to reach out to your Litman Gregory advisor to discuss your own portfolio and investment situation. We welcome your questions.

—Litman Gregory Investment Team