Third Quarter 2023 Investment Commentary

Please note that this quarterly market commentary was written in late September with final details compiled in early October.

Third Quarter 2023 Market Recap

After a strong first half to 2023, global equity markets declined in the third quarter. U.S. stocks (S&P 500 Index) reached a 2023 high at the end of July, but from its intra-quarter high the index declined 6.3% through the end of September. This was the second meaningful decline this year; the S&P 500 fell 7.5% in February and March during the regional banking failures. Despite the decline, the index is still up 13.1% year to date.

U.S. small-cap stocks (Russell 2000 Index) also had momentum early in the quarter but changed course and ended the quarter down 5.1%. Year-to-date, small-cap stocks are still up 2.5%, but meaningfully trail U.S. large-cap stocks (Russell 1000). On a style basis, growth stocks lagged value stocks during the quarter.

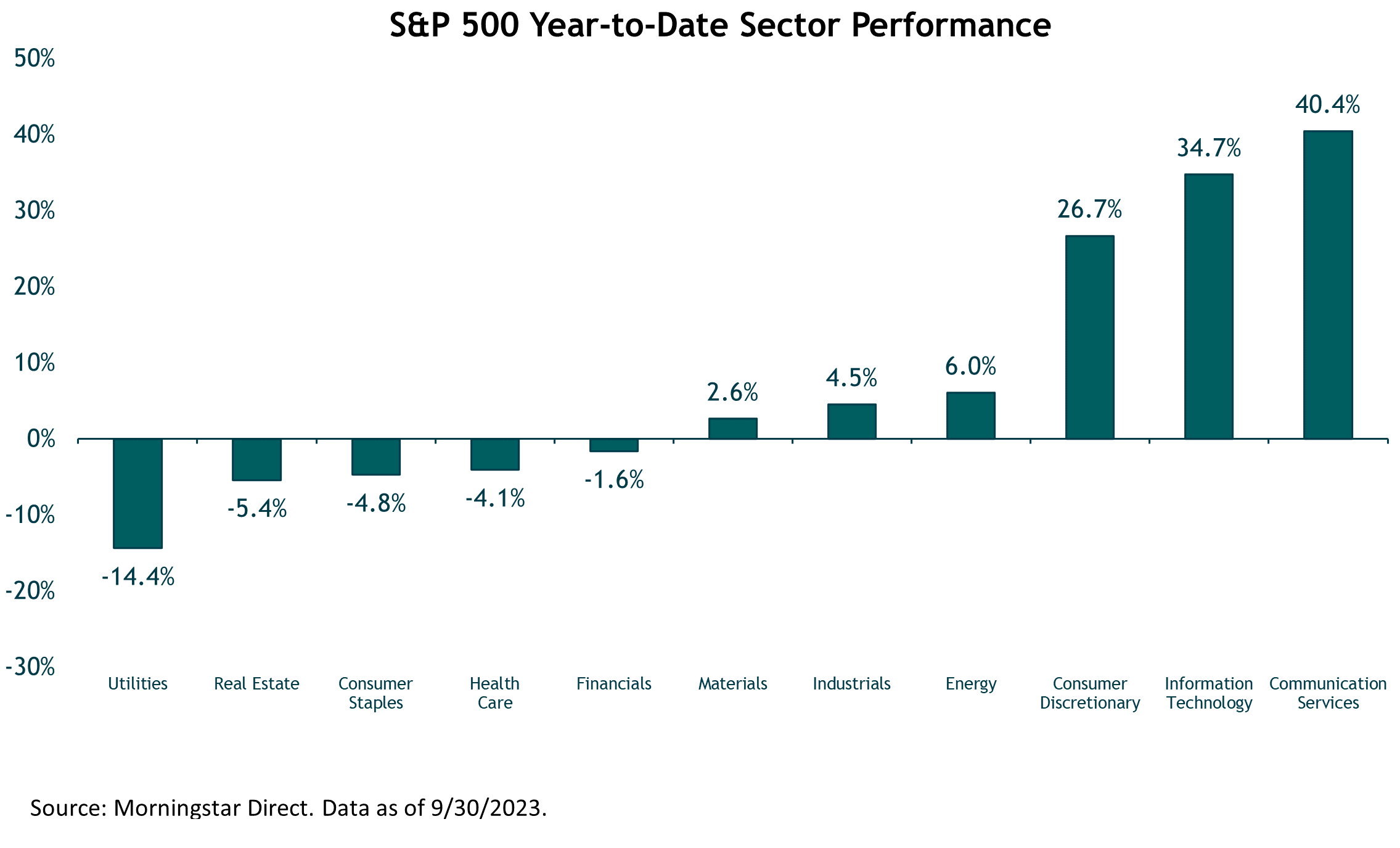

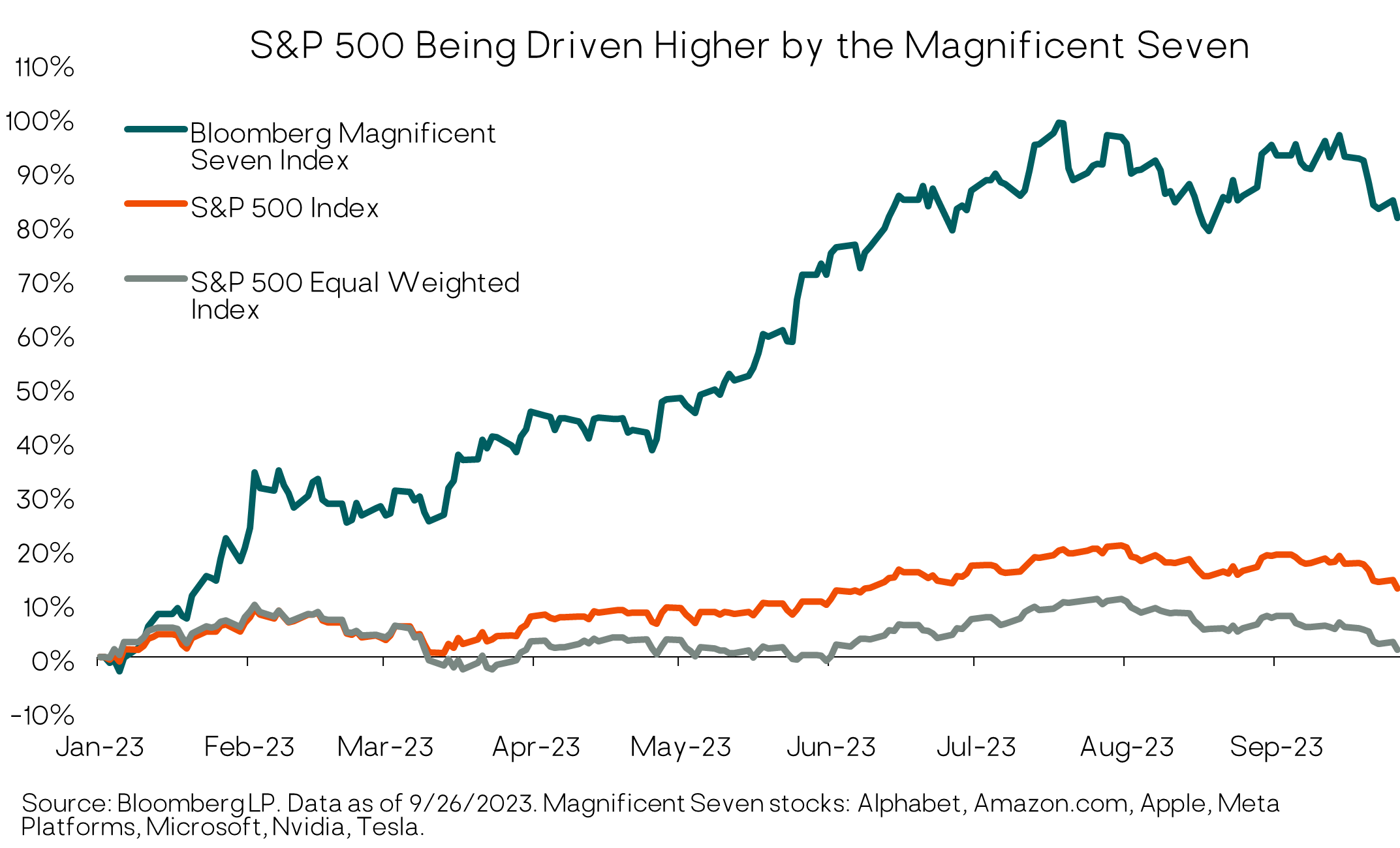

With virtually all segments of the U.S. stock market posting year-to-date gains through September, one might think that we’re in the midst of a broad-based rally. However, stock market gains have remained unusually narrow, with a relatively small number of the largest stocks in the index leading the way. The chart below shows the sector performance within the S&P 500 year to date. The standout performers are those sectors with the largest companies, while most other sectors have had relatively flat performance. Consumer discretionary has been driven higher by a 51% gain from Amazon and a 103% return from Tesla. The information technology sector has outperformed thanks to Apple (32%), Microsoft (33%) and NVIDIA (198%). Communication services has been propelled higher by a 48% return for Alphabet (Google) and 149% from Meta Platforms (Facebook). These seven mega cap companies comprise what has been referred to as the “Magnificent Seven” and make up close to 30% of the index with a combined market value of $10.7 trillion! These “magnificent seven” have increased more than 80% this year. The other 493 stocks in the index are basically flat for the year.

Within foreign markets, developed international stocks (MSCI EAFE Index) declined 4.1% in the quarter, and are up roughly 7.1% year-to-date. Emerging-markets stocks (MSCI EM Index) fell 2.9% in the quarter and are up 1.8% this year through September. The U.S. dollar (DXY Index) surged over 3% during the quarter, resulting in a headwind for foreign markets. Both developed international and emerging-markets stocks outperformed the S&P 500 in local currency terms, but underperformed U.S. equities after converting returns to U.S. dollars.

Moving to the fixed-income market, core bonds (Bloomberg U.S. Aggregate Bond Index) fell 3.2% in the quarter as interest rates rose. The benchmark 10-year Treasury yield climbed nearly 70bps in the quarter, ending the period with a 4.59% yield, its highest level since 2007. High-yield bonds (ICE BofA U.S. High Yield Index) managed to eke out a small quarterly gain and are up 6% for the year-to-date period.

Finally, multi-alternative strategies (Morningstar Multistrategy Category) and trend-following managed futures (SG Trend Index) demonstrated their diversification benefits. Multi-alternative strategies returned 0.2% and managed futures gained 3.8% in the third quarter, while equities and most of the bond markets were down.

Macro Outlook for the Next 6-12 Months

As was the case last quarter, the big question remains as to whether we will have an economic soft landing or a hard landing, and what the timing of this may be. It goes without saying that either answer will likely lead to meaningfully different market outcomes. If the Federal Reserve (the “Fed”) can manage to guide the economy to a soft landing, we would expect to see the market’s gains broaden out beyond the large-cap technology-related sectors. Conversely, an economic hard landing could lead to broader-based stock market declines.

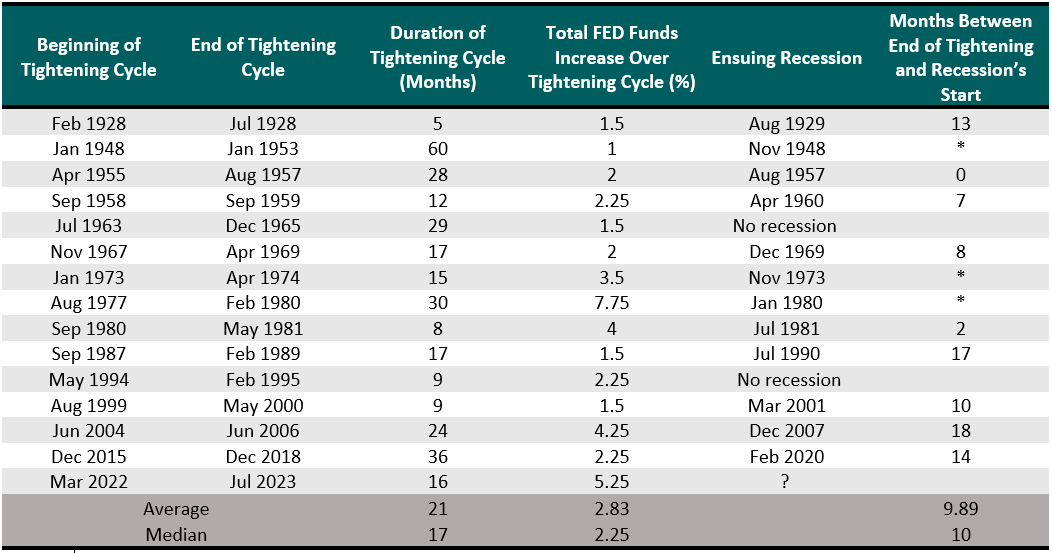

There are reasons to be cautious. We have seen one of the quickest and sharpest tightening cycles in history, and lending standards have tightened considerably. Both factors can create recessionary conditions, particularly as the Fed has a history of raising interest rates too far, tipping the economy into recession. Since 1931, there have been 19 interest rate hiking cycles and in only three instances did the economy avoid a recession.

We have already seen some negative impact of rapidly rising rates. Earlier this year, higher rates played a key role in regional bank failures, which led to a drying up of liquidity in parts of the real estate sector, pushing those property values sharply lower. We have also seen corporate earnings decline, and as a result there has been an increase in bankruptcies, particularly among non-public, loan-only issuers (as opposed to issuers of both loans and bonds) that were already struggling. On the consumer front, there is some evidence that low-income consumers are facing stress, while middle-income consumers are becoming increasingly reliant on credit card debt.

With tighter monetary and credit conditions, it’s likely that the impact of higher rates is just beginning, and we expect it could create a drag on consumers and corporations. Higher rates should result in less spending, which eats into consumption. It’s also possible, if not likely, that bank lending will remain constrained in the near- to intermediate- term, further constraining growth.

With the Fed in inflation-fighting mode, and interest rates high, our base case economic scenario assumes that there will be a recession in the next 12-18 months, particularly if rates nudge even higher and remain elevated. There are many market indicators that support the recession outlook. The Treasury yield curve has been and remains steeply inverted, and this has historically been a good (but not bulletproof) predictor of recession. The Conference Board’s Leading Economic Index (LEI) fell again in August and has declined for nearly a year and a half straight, indicating the economy is heading into a challenging growth period and possible recession over the next year. Meanwhile, there is some clear evidence that the tighter monetary policy is impacting the housing market and lending conditions, which impacts business investment.

For the Fed to cut interest rates, it’s likely they’ll want to see cracks on the labor front. We are seeing some early signs of slack, but overall, conditions remain relatively tight and unemployment numbers are relatively low. This labor backdrop is generally good for consumer spending, which makes up roughly two-thirds of U.S. GDP, and if this persists, it could extend the current cycle. Strong employment is typically correlated with wage growth, and high wages generally add to inflationary pressures. It’s quite possible that until employment metrics erode, we could see rates remain at or near current levels.

While we anticipate a recession, our base case is that it will be relatively mild. One consideration is that the economy has been experiencing a “rolling recession,” where slowdowns are spread across industries over time, dampening the impact compared to a more typical recession where multiple industries experience a simultaneous slowdown. For example, housing has already experienced a slowdown and detracted from GDP for several consecutive quarters. Some market observers have also seen what they refer to a “richession,” as job cuts have occurred in higher-paying industries like technology, where employees generally have a financial cushion to withstand a period of unemployment and therefore are better positioned to sustain spending and helps support the economy.

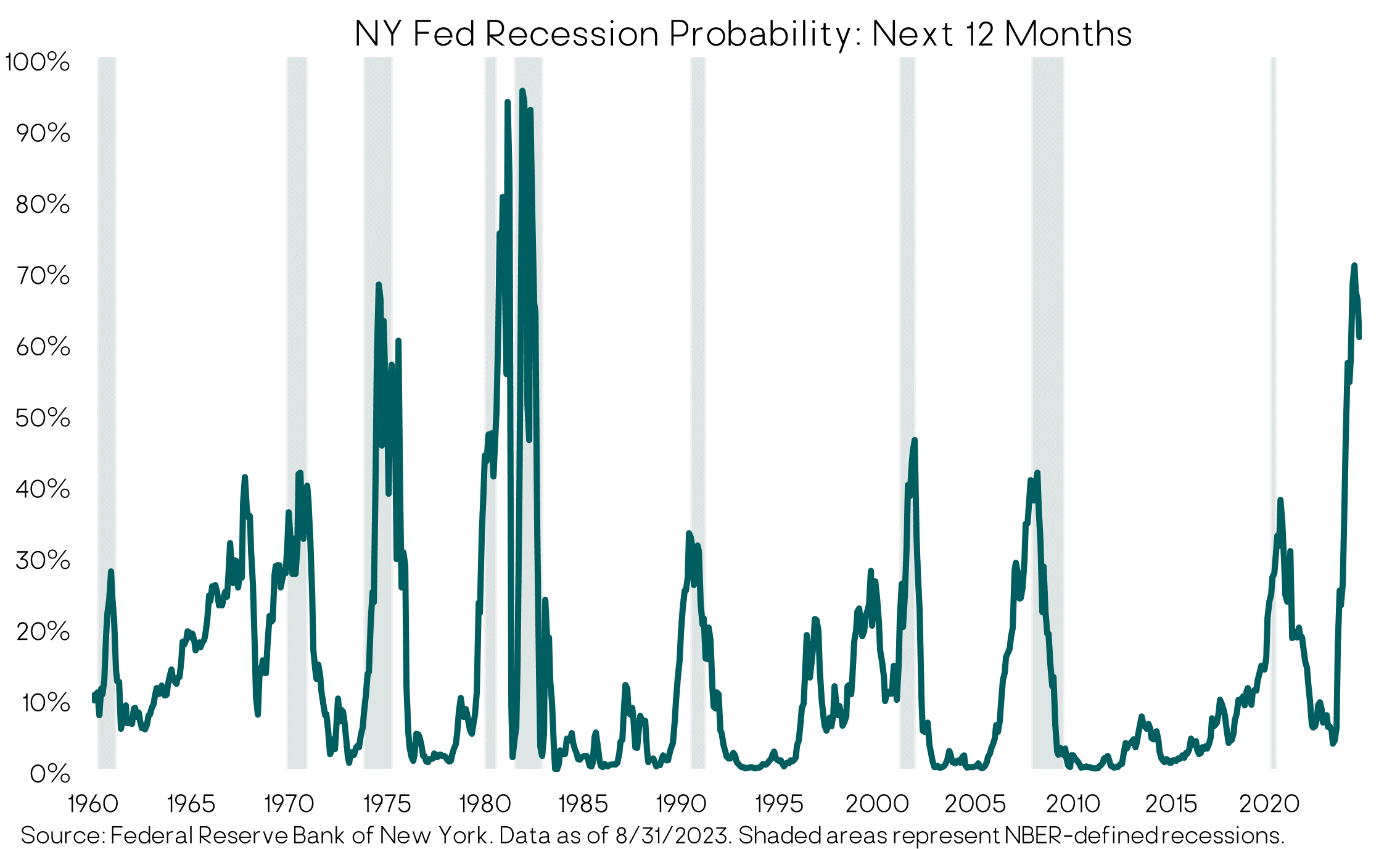

A perhaps counterintuitive point is that because a recession has been widely anticipated for so long now, it may actually reduce the risk of a deep recession. According to New York Federal Reserve data there has been a 60% chance of recession occurring in the next 12 months (see chart below). Historically, probabilities at these levels are associated with recessions. Amid all this built-up anticipation, some companies, especially tech, have laid off workers and slowed hiring. These corporate moves help to loosen the labor market and potentially ease inflation pressures.

What about Inflation?

Inflation has come down meaningfully from its June 2022 high of 9.1%, thanks in part to the Federal Reserve’s rapid interest rate hikes. At this point, it is clear the rate-hike regime is close to an end. In late September, the Federal Reserve maintained the target range for the federal funds rate

Rate at a 22-year high of 5.25%-5.5%, following a 25 basis points (bps) hike in July. The September pause that followed was in line with market expectations. But Fed Chair Jerome Powell signaled there could be another hike this year saying that the FOMC cannot allow inflation to get entrenched in the U.S. economy, and they will do what it takes to get it down to their target of 2% over time. The most recent year-over-year inflation number was 3.7%, almost twice the Fed’s long-term target. Projections released in the Fed’s dot plot showed the likelihood of one more 25 bps increase at the November 1 meeting, then two cuts in 2024.

While the Fed continues to be concerned about inflation, there are signs that the effects of Fed policy are working their way through the system. We believe that the Fed has gotten the upper hand on inflation and that the remarkable impact that the pandemic had on prices due to supply shortages and the dramatic shift in consumer behavior is clearly over.

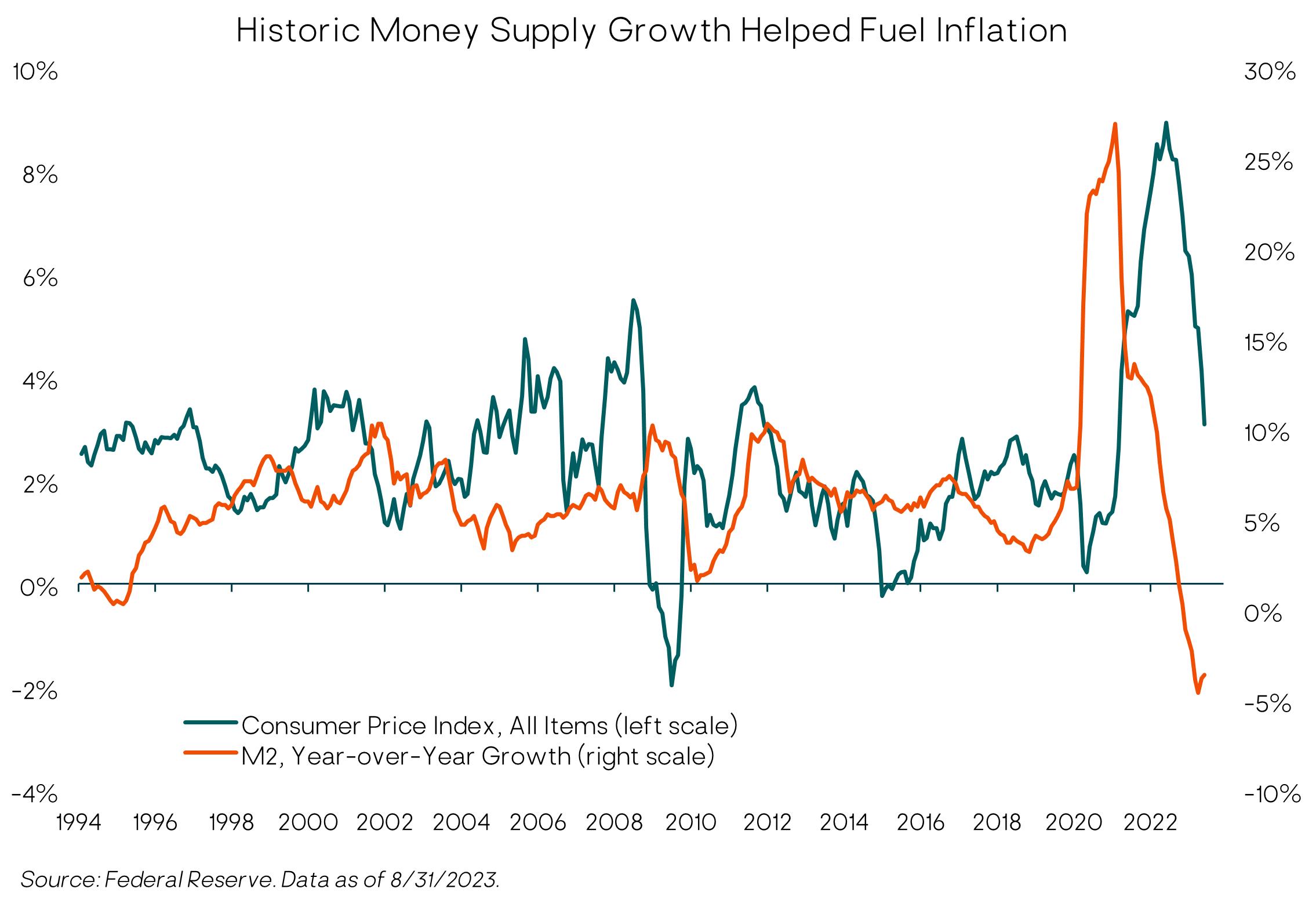

While there are a variety of opinions around inflation, it seems clear that one driver was the massive amount of money supply growth that started in early 2020. Pandemic-related stimulus payments were in the trillions of dollars. The chart below shows the dramatic increase in Money Supply (or M2) that occurred during that time. Arguably, the supply chain issues and the flood of money that went into the economy is what pushed inflation to unexpected levels. If we compare the year-over-year money growth to year-over-year core consumer price index (CPI), one could surmise that inflation is a lagging indicator and inflation could continue to decline from current levels.

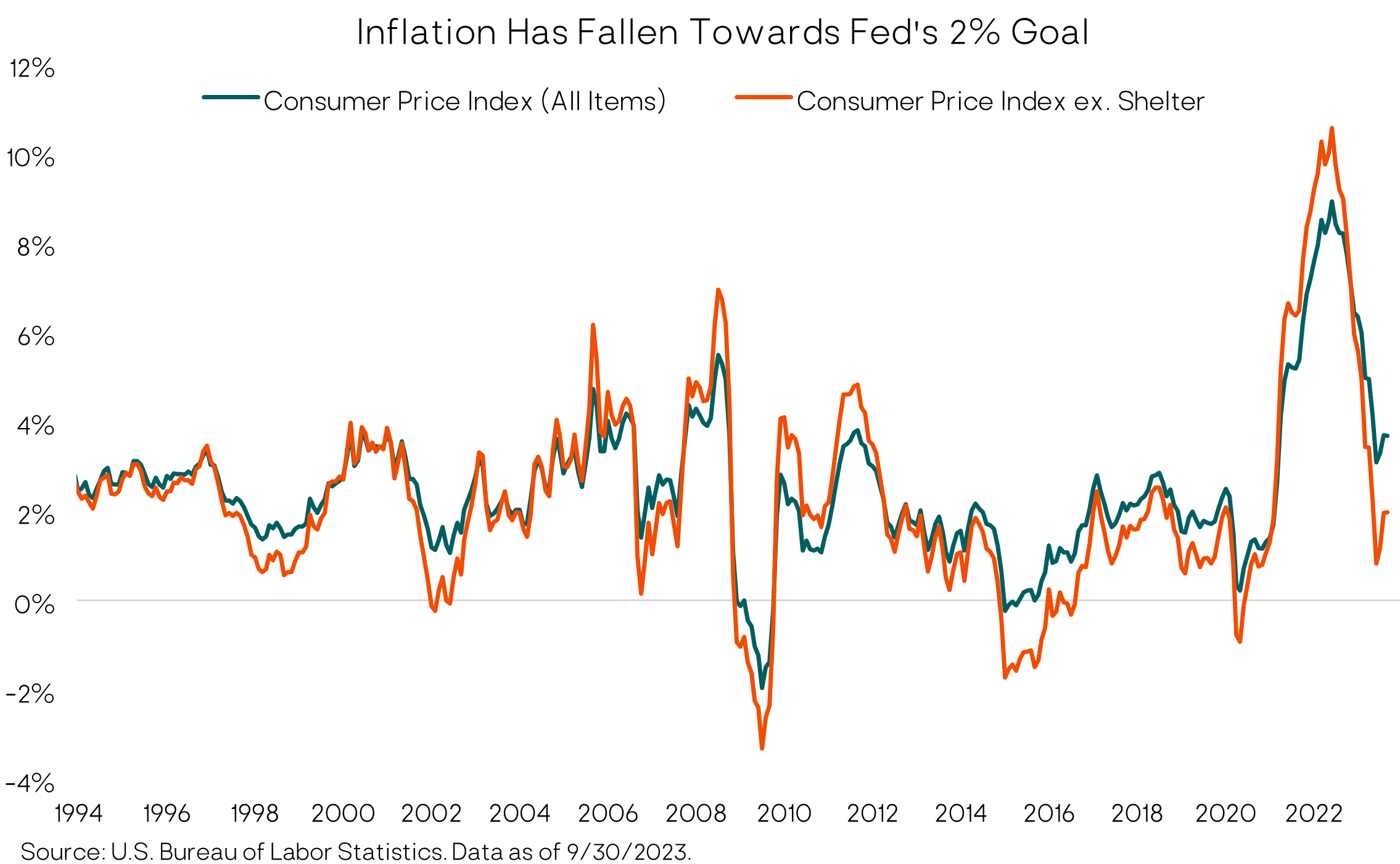

The chart below illustrates the year-over-year inflation and year-over-year inflation excluding shelter costs, which is a key CPI input. While year-over-year inflation recently came in at 3.7%, this number drops to 1.97% when excluding shelter. We also look at more recent trends by annualizing the latest six months of inflation data, to get a sense for shorter-term trends. Annualizing the latest six months, inflation is 3.0% and inflation ex-shelter is 1.8%. These levels are not far from the Fed’s goals, and suggest that the Fed’s policy has been working, and with time inflation could continue to fall, particularly if shelter continues to decline.

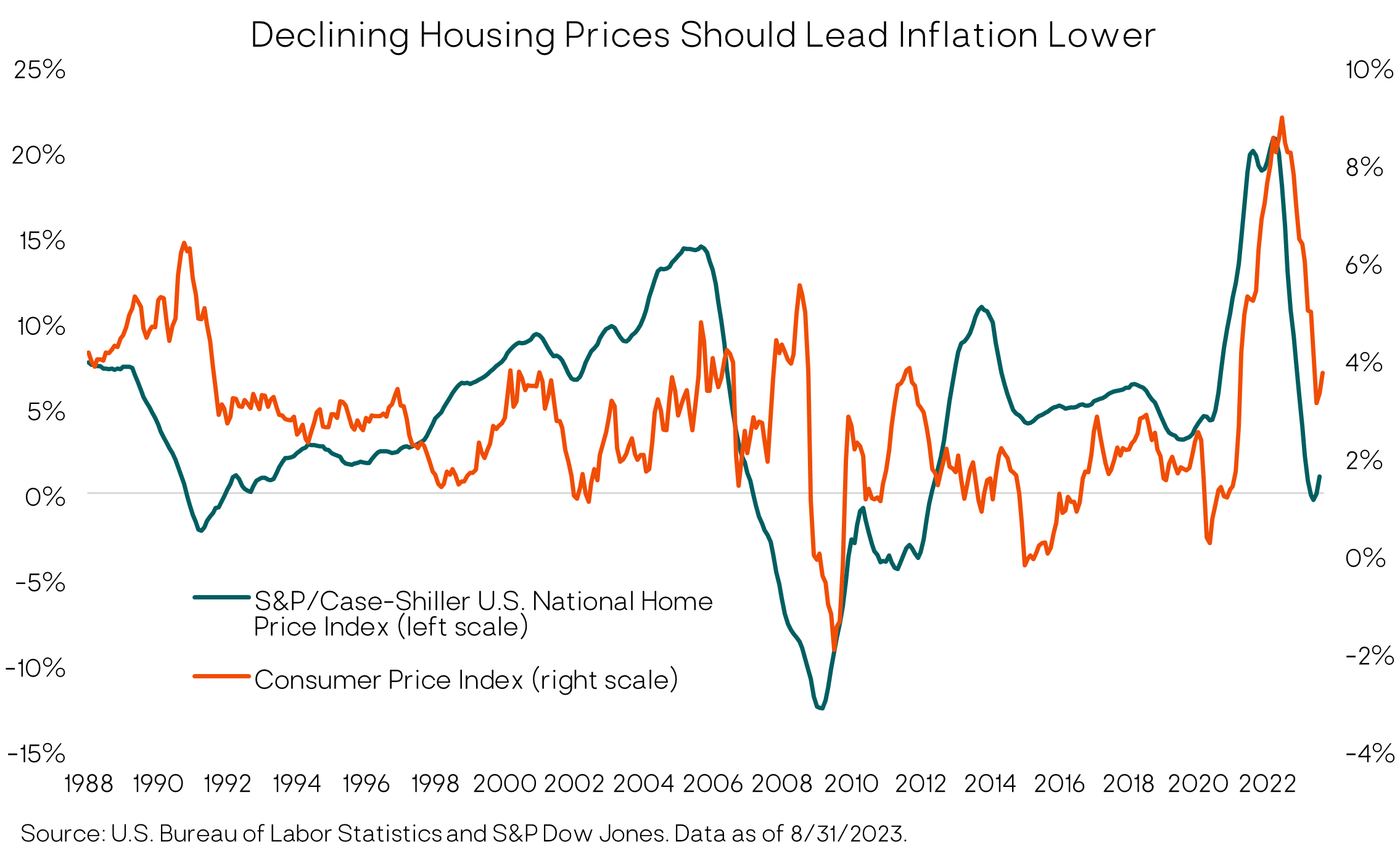

Looking at the cost of shelter, below is a chart showing the year-over-year change in housing prices overlaid with the change in the CPI. The trend has typically been for housing prices to gain or fall ahead of CPI shifts in direction. With housing or shelter making up 35% of CPI, this suggests that inflation may continue to decline in subsequent months since housing prices have been on the decline.

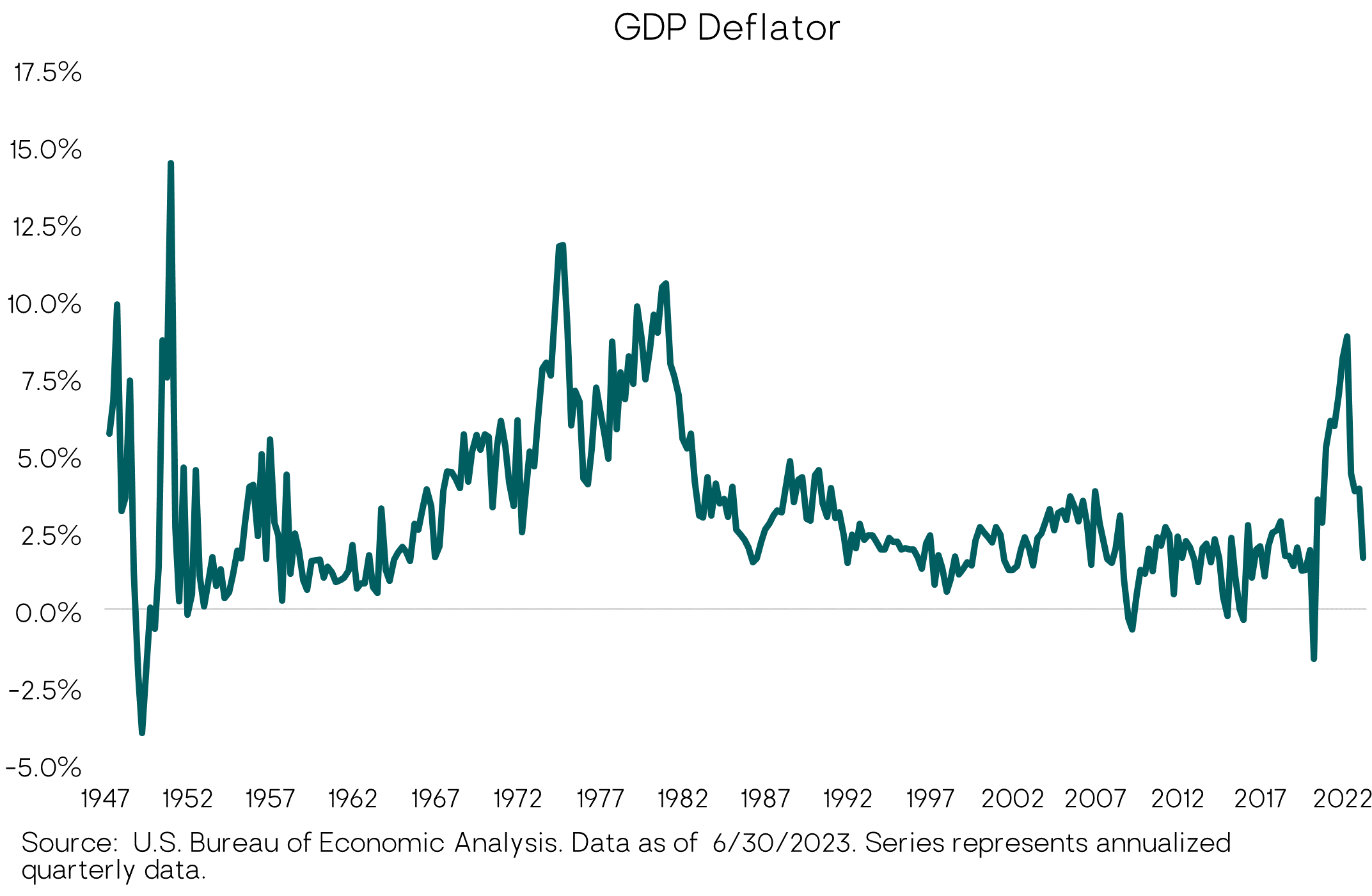

Another metric is the GDP Deflator, which is a broad measure of the changes in prices for all goods and services produced in an economy. By comparison, CPI is based on a fixed basket of goods. (Both measures have their pros and cons.) The chart below illustrates the quarterly annualized rate of inflation according to the GDP deflator, and the most recent reading was 1.7%.

While we expect inflation to grind lower over the course of 2024, we don’t expect inflation to return to the persistently low levels we saw pre-pandemic. Of interest to note, the pandemic has had an impact on economic data in that some of the traditional economic indicators are now proving less reliable than in prior cycles. For example, the level of volatility we’ve seen within the services component of inflation, which is usually relatively stable, was unprecedentedly volatile during and after the pandemic. We saw a dramatic drop in services during the lockdowns and then a record spike. Because of this, we think it’s likely there will be some near-term seasonal impacts, resulting in some pockets of higher inflation, although not necessarily reaching concerning levels.

Although we expect near-term inflation to remain under control, longer-term we expect there will be upward pressure on inflation, and it will be more volatile than it has in the past, making it more of a moving target. One factor we must consider is shifting geopolitics. The global economy is undergoing a transformation with the shifts to supply chain resilience, clean energy transition, and artificial intelligence, among others. Christine Lagarde, President of the European Central Bank (ECB) in an April 2023 speech said, “We are witnessing a fragmentation of the global economy into competing blocs, with each bloc trying to pull as much of the rest of the world closer to its respective strategic interests…” and that this fragmentation could have two profound effects: More instability as global supply chain elasticity wanes and the potential for more geopolitical tensions. She also cites an analysis suggesting that if the global value chains fragment along geopolitical lines, “the increase in the global level of consumer prices could range between around 5% in the short run and roughly 1% in the long run.”

Financial Markets Outlook for 2023 and Beyond

Equity Markets

The aggressive rate hiking cycle that started roughly 18 months ago was finally put on pause in late-July—although it is generally expected that one more 25 basis point hike could still happen. Since March 2022, the Federal Reserve increased rates from zero to a target level of 5.25%-5.5%. Around the same time that the Fed hiked rates for what might be the final time in this cycle, the S&P 500 also hit an intra-year high and started to decline. As mentioned earlier, since the end of July, the S&P 500 has fallen 7.5%, and yet the Index remains up a solid 13.1% so far this year—defying many expectations in what was widely anticipated to be a year in which the economy hit the skids.

Also noted earlier, despite stalling over the third quarter, the year-to-date outperformance of the seven largest stocks in the S&P 500 continues to represent most of the U.S. equity returns. Given this trend, it is unsurprising to see a record low percentage of S&P 500 stocks outperforming the index. Ned Davis Research data shows just 28% of S&P 500 constituents have a return better than the 13.1% index return this year.

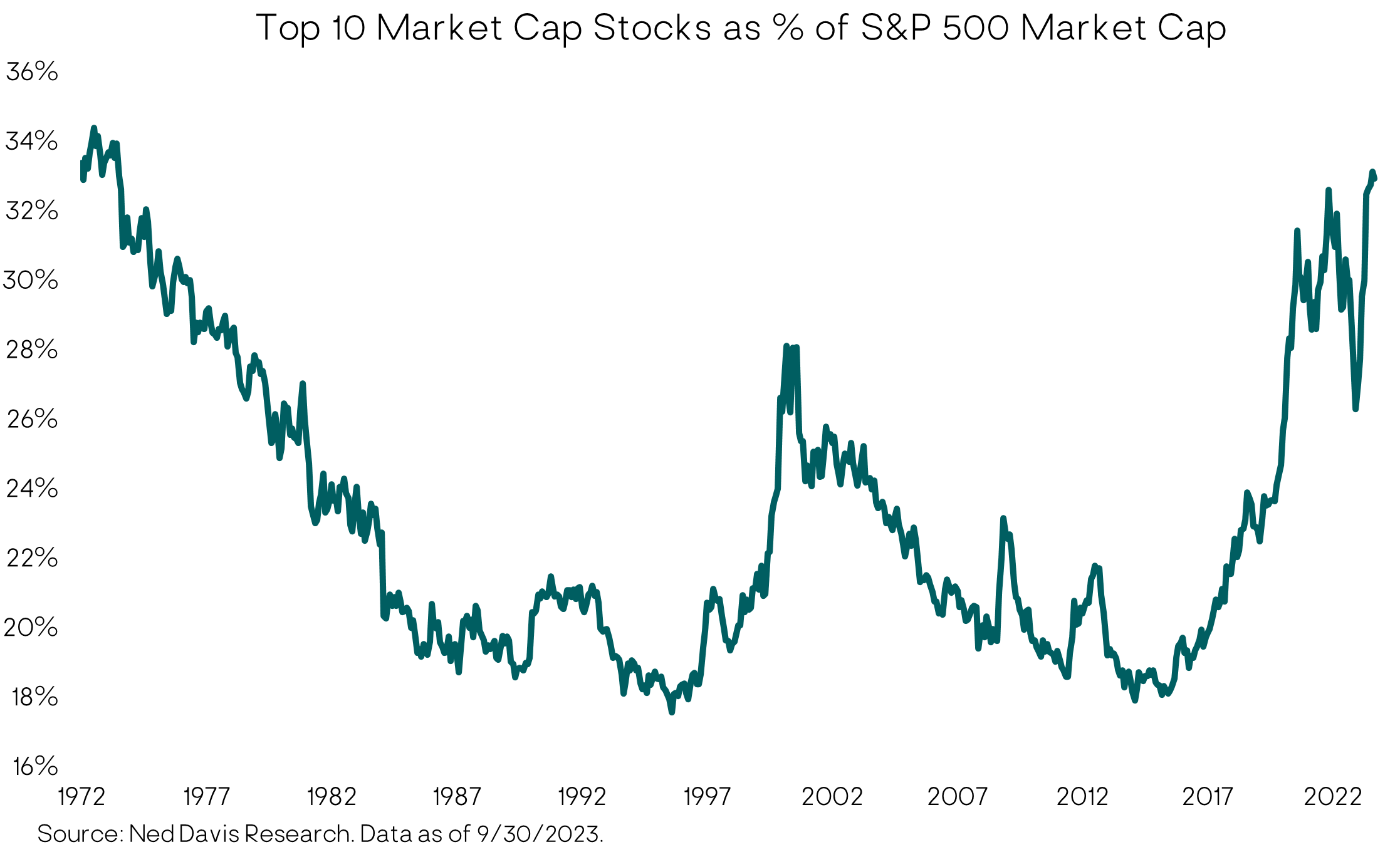

The concentration within the S&P 500 has soared past where it was in 2021 and the tech bubble of the late 1990s and is closing in on a level last seen during the early-1970s—a period known for the leadership of the “Nifty Fifty” stocks. The chart below shows the top 10 stocks recently accounting for one-third the total market capitalization of the S&P 500.

Profits Troughing?

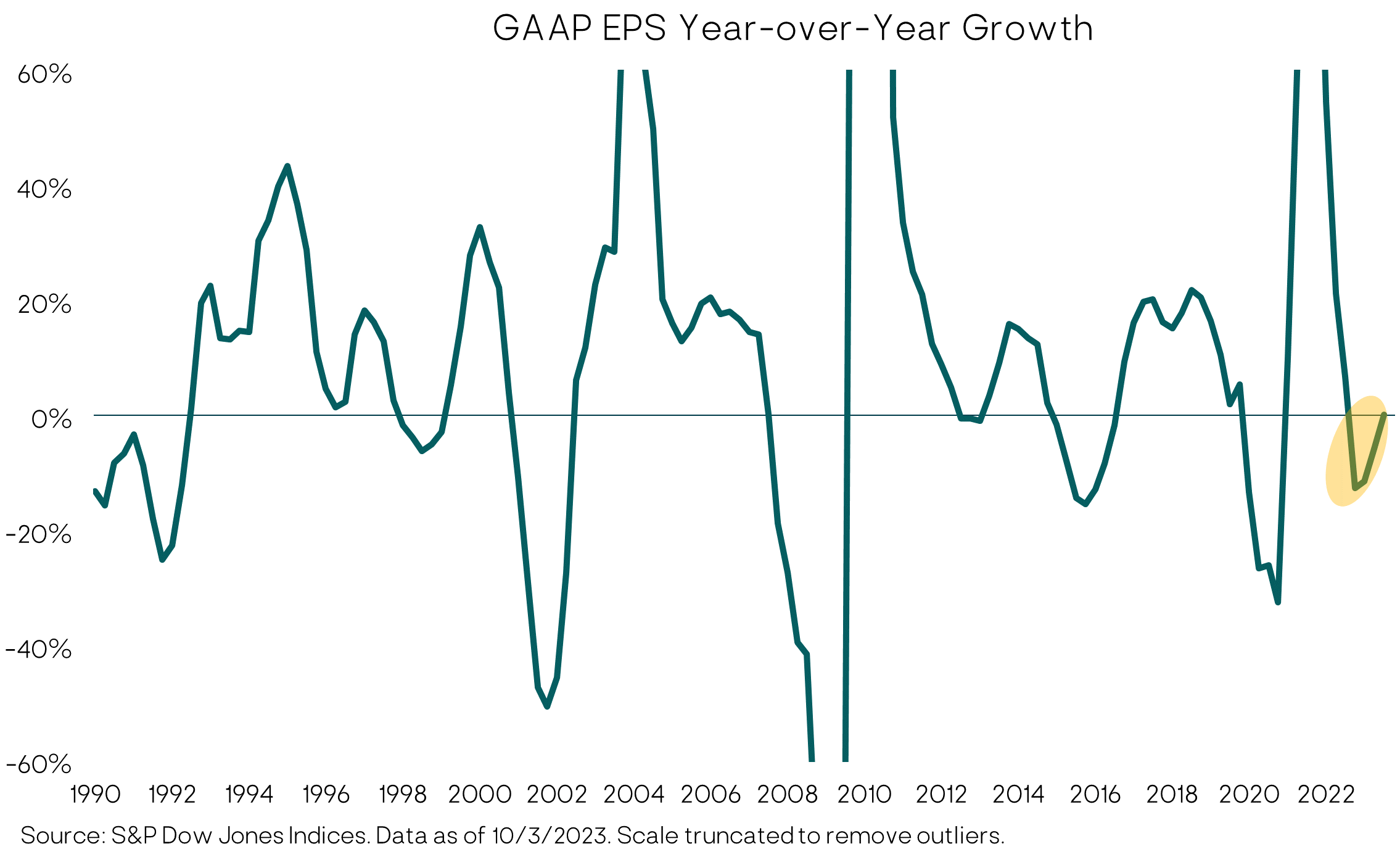

Last year S&P 500 profits (as measured by GAAP) fell by nearly 13%. Consensus going into 2023 was that the U.S. would experience a recession and that corporate profits would likely fall further in that scenario. With the recession having been avoided (for now), profits are showing signs of troughing. Should the current consensus numbers for the third quarter be accurate, earnings will be flat year-over-year. And the fourth quarter has the potential for year-over-year growth in the double-digit range.

Better than expected profit growth in recent quarters has been bolstered by strong revenue growth. S&P 500 sales figures (which are nominal) are growing at a double-digit pace thanks to stronger than expected consumer and price increases that are still being pushed through. Profit margins have fallen back to 10%, which was where they stood prior in 2019. But despite lower margins, companies may experience decent earnings growth if revenues remain robust. Not until there is a recession will revenues and GDP likely take a hit.

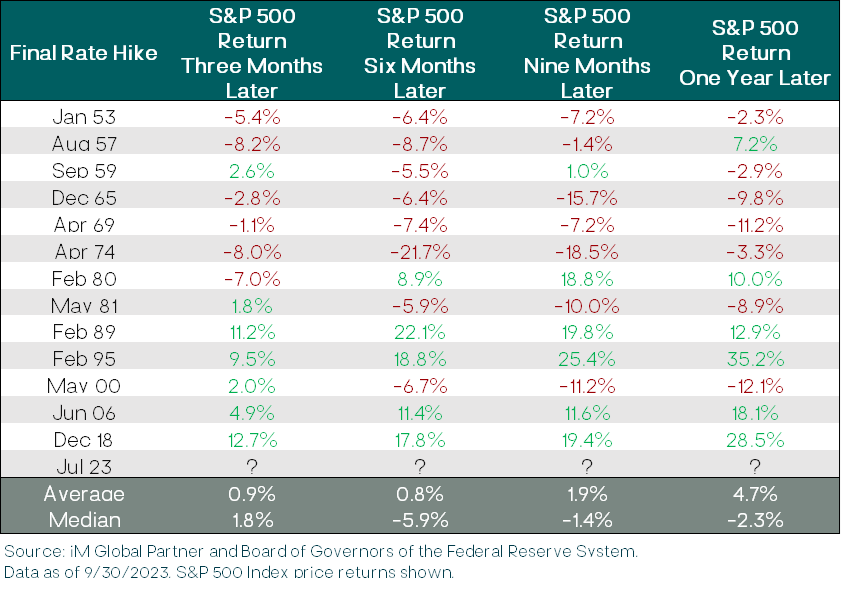

If The Fed Has Paused, What’s Next for Stocks?

Historically, the track record is mixed for what happens for stocks over the next six to 12 months following a pause in a Fed tightening cycle. The table below shows the tightening cycles over the last 70 years. On average, the market has been flat over the subsequent six months and up mid-single digits over the next one year. However, to be fair, the “on average” outcome does not actually happen in markets as there is a wide variation of outcomes depending on a multitude of factors. Even a short six-month time frame shows returns ranging from negative 20% to positive 20%.

Equity returns following the end of a tightening cycle have differed depending on the inflation environment. Most of the negative outcomes in the table below occurred during bouts of elevated inflation (particularly through the 1960s and 70s). When there is higher inflation, the Fed will typically maintain a more restrictive policy—i.e., it will take them longer to pivot and cut rates. On the other hand, when inflation is not historically elevated, the Fed can move to a more accommodative stance much sooner. This can be seen in the table for the post-80s period, where there is a much shorter time between the final rate hike and the following rate cut.

Today, inflation remains elevated but on a clear downward path. However, the S&P 500’s current 7.5% drawdown that started right around the day of the (potentially) final rate hike could be a sign that equity markets are finally starting to believe the Fed’s “higher for longer” mantra could result in a recession rather than a soft landing.

International and Emerging-Markets Stocks

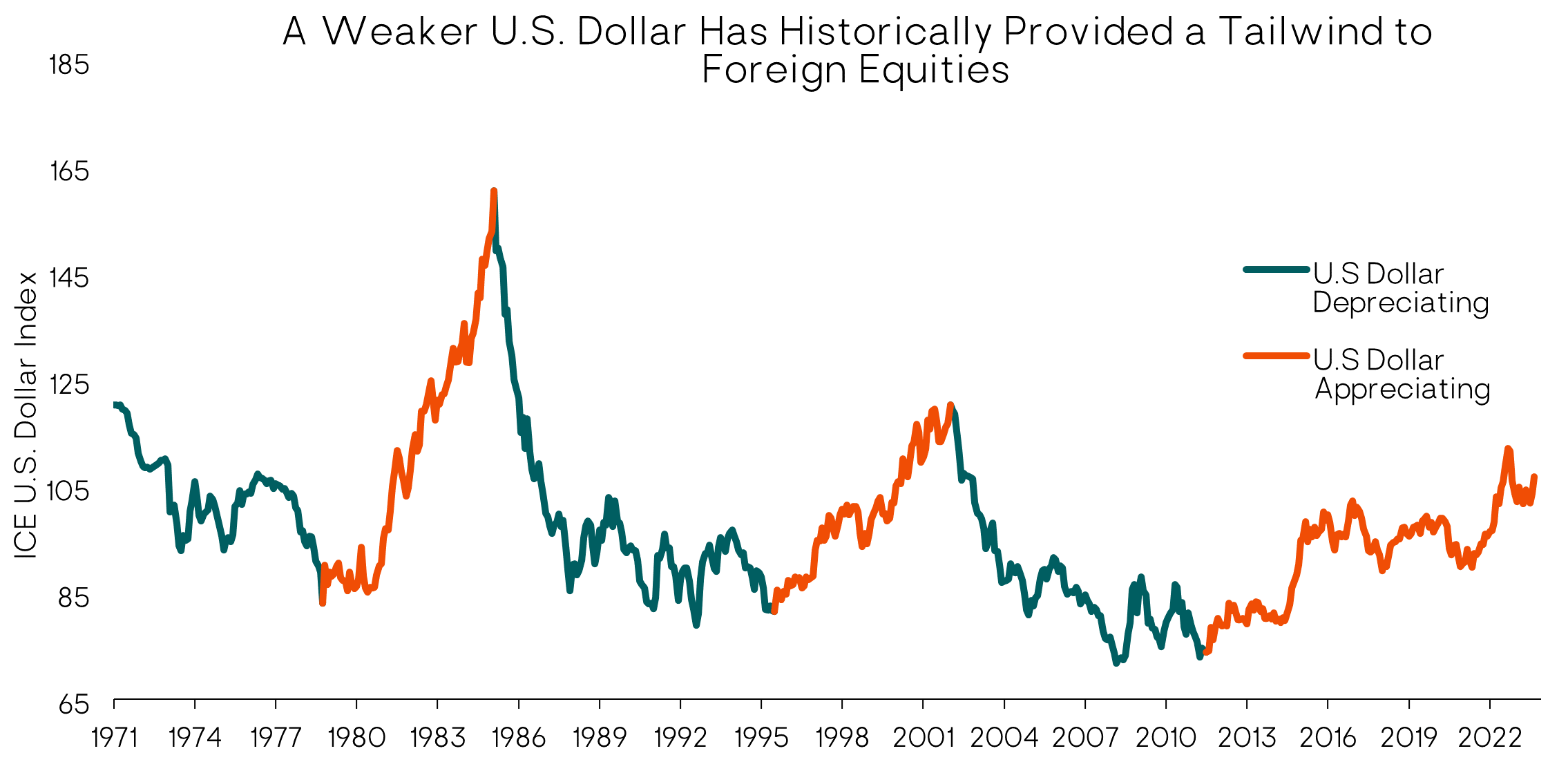

The U.S. dollar (DXY Index) appreciated 3.1% during the quarter and was a major headwind for unhedged foreign assets. The local currency indexes for MSCI EAFE and MSCI Emerging Markets showed only small losses of a little more than 1%, meaning they both outperformed the S&P 500 during the quarter net of the U.S. dollar impact.

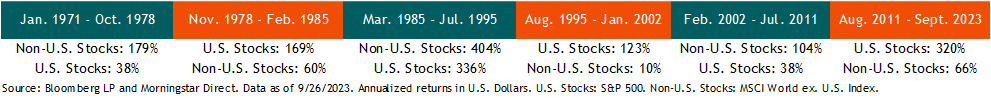

In the current regime of U.S. dollar strength that started in 2011, U.S. stocks have significantly outperformed foreign stocks. There was a short reprieve from dollar strength from 2017 into early 2018 during which European stocks outperformed by nearly four percentage points and emerging-market stocks did nearly 20 percentage points better. When the dollar declines again, we would expect foreign equities to outperform U.S.—much like in other cycles over the past 50 years.

While U.S. earnings are potentially troughing—or, at a minimum, the rate of decline slowing—earnings overseas are at different points. Earnings in Europe remain close to cycle highs despite a stagnant German economy. Emerging markets, on the other hand, have seen their earnings fall roughly 17% from their high in early 2022. China has struggled to meaningfully reignite its economy, and consequently, earnings have not moved much higher from their cycle lows. Given China’s weight in the broader index (roughly 30% of MSCI EM), their sluggish earnings continue to weigh on index level earnings.

The Chinese stock market (MSCI China) has bounced higher from its lows almost one year ago. However, Chinese stocks remain more than 50% lower than where they stood in early 2021. Since 2021, China has experienced a number of rolling crisis’s—from their property bubble to regulatory crackdowns on for-profit education and technology companies to a zero-COVID policy that lasted into late 2022. The government has resisted their old stimulus playbook of showering money into capital intensive investments. Instead, Chinese officials have used targeted easing policies, such as lowering key interest rates. As China moves away from investment-led economic growth, there will be a high bar for the government to undertake the same level of stimulus as in years past.

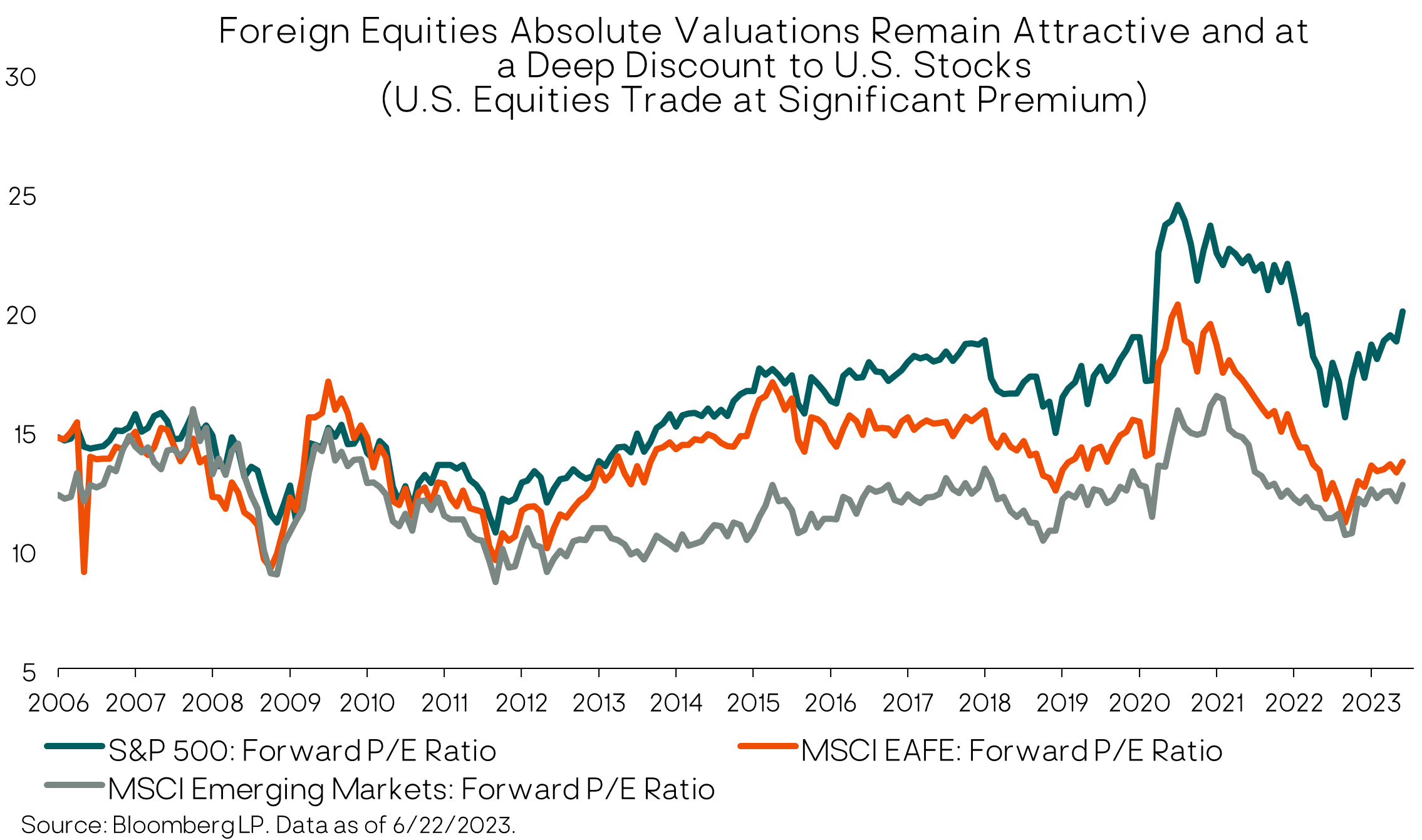

Valuations of foreign equities remain attractive relative to U.S. valuations. The S&P 500 trades at roughly a 19x forward P/E compared to just over 12x for emerging markets and 13.5x for European stocks. U.S. stocks are trading at their largest premium in the current cycle of outperformance by U.S. stocks.

Fixed-Income

Inflation and Fed policy will continue to be major drivers of bond market returns. Our expectation is that the yield curve will continue to flatten and perhaps even steepen out over the course of 2024, meaning longer-term bonds will again offer higher rates than short-term bonds, particularly if signs of economic weakness prompts the Fed to lower short-term rates. But for now, investors continue to benefit from today’s higher yields and an inverted yield curve. Despite higher short-term rates, our exposure to core bonds includes some exposure to the longer end of the yield curve. The Bloomberg U.S. Aggregate Bond Index, generally representing core bonds, is currently yielding 5.4%, which is above the current 3.7% inflation level. So, bonds are finally providing a positive real (after-inflation) yield. We also continue to like core bonds as a ballast to equities within balanced portfolios, as they will likely provide protection via price gains in the event of declining rates during a recession.

We also continue to be positive on corporate bonds. Overall, credit fundamentals (which reflect the creditworthiness of bond issuers) are still holding up despite higher debt costs. Interest coverage, the level of leverage, and cash levels all look better than in historical periods heading into a recession.

In addition to core bonds, we continue to seek meaningful exposure to higher-yielding, actively managed, flexible bond portfolios run by experienced fund management teams with broad opportunity sets. There are several fixed-income sectors outside of the traditional parts of the bond market that provide attractive risk-return potential, and some of these are currently yielding in the high single digits.

Marketable (Liquid) Alternatives Investments

We continue to maintain our core positions in multi-alternative strategies and trend-following managed futures. In particular, managed futures stand a reasonable chance of generating positive absolute performance during periods of losses for equities and/or bonds, and in the case of standout years like 2022, sometimes huge spreads of as much as 50 percentage points of difference. This can create valuable opportunities to add to beaten down assets, in addition to the psychological benefits of having something in a portfolio that’s “working” even when almost everything else is showing losses.

Closing Thoughts

As we look ahead, a mild recession is still within our base-case economic scenario looking out to 2024. Of course, the timing and magnitude of the Fed’s response to economic data will be critical to the outcome. Currently, the Fed is signaling 50 basis points of rate cuts in 2024, but it’s quite possible that they will cut rates more meaningfully. Therefore, we can’t rule out the possibility that the Fed does thread the economic needle and successfully guides us to the rare soft landing. Given the uncertainty, we expect volatility, and we think that it will be more critical than ever to keep our portfolios diversified, while also being ready to take advantage of market dislocations. We thank you for your continued confidence.

– Litman Gregory Wealth Management

Important Disclosure

This report is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The opinions expressed herein represent the current views of the author(s) at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such.

The information presented in this report has been developed internally and/or obtained from sources believed to be reliable; however, Litman Gregory Wealth Management, LLC (“Litman Gregory” or “LGWM”) does not guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after the date indicated.

Any forward-looking statements speak only as of the date they are made, and LGWM assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements.

In particular, target returns are based on LGWM’s historical data regarding asset class and strategy. There is no guarantee that targeted returns will be realized or achieved or that an investment strategy will be successful. Target returns and/or projected returns are hypothetical in nature and are shown for illustrative, informational purposes only. This material is not intended to forecast or predict future events, but rather to indicate the investment returns Litman Gregory has observed in the market generally. It does not reflect the actual or expected returns of any specific investment strategy and does not guarantee future results. Litman Gregory considers a number of factors, including, for example, observed and historical market returns relevant to the applicable investments, projected cash flows, projected future valuations of target assets and businesses, relevant other market dynamics (including interest rate and currency markets), anticipated contingencies, and regulatory issues. Certain of the assumptions have been made for modeling purposes and are unlikely to be realized. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used in calculating the target returns and/or projected returns have been stated or fully considered. Changes in the assumptions may have a material impact on the target returns and/or projected returns presented.

A list of all recommendations made by LGWM within the immediately preceding one year is available upon request at no charge. For additional information about LGWM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request to compliance@lgam.com

LGWM is an SEC registered investment adviser with its principal place of business in the state of California. LGWM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which LGWM maintains clients. LGWM may only transact business in those states in which it is noticed filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by LGWM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

Estimated Returns Disclosure

Scenario Definitions:

Downside: The economy falls into a deep and sustained recession for any of various reasons, such as deleveraging/deflation, unexpected systemic shock, geopolitical conflict, Fed or fiscal policy error, etc. At the end of our five-year tactical horizon, S&P 500 earnings are below their normalized trend and valuation multiples are below-average reflecting investor risk aversion. Inflation and 10-year Treasury nominal and real yields are very depressed.

Base: Consistent with long-term economic and market history, reflecting economic and earnings growth cycles that are interspersed with recessions around an upward sloping normalized growth trendline. Inflation is at or moderately higher than the Fed’s 2% target level and 10-year Treasury real yields are around zero percent to slightly positive. For the S&P 500, we now bookend our base case with a lower-end and upper-end estimate:

-

At the lower end of our base-case fair-value range, reflation efforts are successful and nominal economic growth is higher than the average. However, the economy overheats, and valuation multiple and some margin compression largely offset the favorable macro backdrop.

-

At the upper end, reflation efforts are also successful, nominal economic growth is higher than observed since the 2008 financial crisis on average, profit margins move slightly higher, and valuation multiples are also slightly higher than the recent historical average.