How Much Do Elections Matter?

This year’s presidential race has generated more interest, expressions of concern, and questions from clients than any we can remember. Some want to know how the election impacts our investment views and how we might adjust our positioning in anticipation, while some have asked how we factor elections into our analysis and portfolio construction more generally.

First and foremost, we never try to bet on outcomes. What we do try to do, regardless of market or election cycle, is maintain an investment discipline that is long-term in focus, based on analyzing valuations and fundamentals, and that attempts to limit downside risk. Viewed through that lens, what are we watching, analyzing, and positioning for?

1. Market volatility

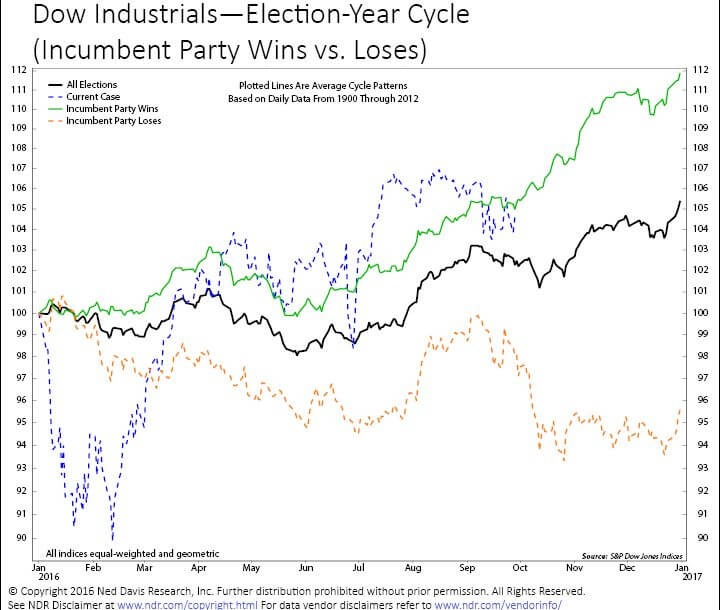

Along with sudden shocks (e.g., terrorist strikes), unexpected developments (such as the Brexit vote results), and lately, central bank actions, presidential elections can certainly drive short-term market swings. But the longer-term impact is a different story. The following chart from Ned Davis Research contains data on election cycles from 1900 through 2012. It shows that during presidential election years financial market swings have tended to be magnified in the final weeks of the campaign. This has been particularly true in years when the incumbent party lost. Once voting was over, markets have rallied going into year-end.

2. Economic fundamentals—long-term outlook

Over a full market cycle, returns are driven by fundamentals, not temporary shifts in investor sentiment, short-term momentum trading, flights to safety, or political rhetoric. While the U.S. economy could hardly be called robust, growth is positive, unemployment is down, and wages are up. Consumer spending is increasing, and confidence recently hit a 12-month high. None of these are likely to change overnight based on what happens in November. Yes, fiscal policy can impact all of them in the long-term, and there are important differences in the candidates’ policy stances, but presidents don’t get to decide these things in a vacuum. Without knowing which policy proposals will eventually be enacted, when, or how, making preemptive changes to portfolios is more likely to hurt than help.

3. Downside risk

It’s unclear how much markets are pricing in current polling data, but the election’s outcome could still turn out to be surprising. Even if market prices accurately reflect the results, how they would react over the short and longer terms is a different story. We are more focused on the impact of U.S. interest rates rising over the next several years. With the Federal Reserve and other central banks’ policies playing outsized roles in recent years—pushing stock prices higher and spurring bond yields to record lows—we see downside risks as they begin to pull back. We have already seen short-term spikes in yields push bond prices down and drive stock market swings in anticipation of rising interest rates. With the S&P 500 currently valued at a historically high earnings multiple (price-to-earnings ratio) that is not supported by strong corporate earnings trends, a rise in U.S. interest rates from their abnormally low levels is just one thing that could put downward pressure on prices.

Dealing with uncertainty

How do we deal with uncertainty? Whether election-driven or otherwise, we deal with it by not making sudden moves in or out of markets based on headlines. Instead, we develop and assess a range of scenarios, then construct diversified portfolios that are positioned to meet our clients’ longer-term goals, while minimizing the impact of temporary market falls.

While elections do matter, investing at reasonable valuations, balancing risk against potential reward, and not letting anxiety drive your decisions matter more.

Do you have more questions about the topics covered in this post? Call your Litman Gregory Investment Advisor or contact us here.

Important Disclosure

This written communication is limited to the dissemination of general information pertaining to Litman Gregory Wealth Management, LLC (“LGWM”), including information about LGWM’s investment advisory services, investment philosophy, and general economic market conditions. This communication contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice and should not be considered as a solicitation to buy or sell any security or engage in a particular investment strategy.

There is no agreement or understanding that LGWM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information.

Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this newsletter will come to pass. Individual client needs, asset allocations, and investment strategies differ based on a variety of factors.

Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management feeds or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio.

Nothing herein should be construed as legal or tax advice, and you should consult with a qualified attorney or tax professional before taking any action. Information presented herein is subject to change without notice.

A list of all recommendations made by LWM within the immediately preceding one year is available upon request at no charge. For additional information about LGWM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request to compliance@lgam.com

LGWM is an SEC registered investment adviser with its principal place of business in the state of California. LGWM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which LGWM maintains clients. LGWM may only transact business in those states in which it is noticed filed, or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by LGWM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.