Research Commentary on Recent Market Volatility

The fact that market declines are a normal part of investing in stocks and happen relatively often doesn’t make them any less unnerving to investors whose financial security may seem to be at stake. It’s worth a reminder that for investors with a thoughtfully constructed portfolio that considers both their temperament and their financial ability to take on risk, shorter-term market declines are not a threat to achieving their financial goals. The real threat to meeting their goals comes from a failure to stay invested through these inevitable declines.

The questions in any decline are always the same: What has been missed? Is it different this time? And the financial media turns from reporting on experts explaining why the market can keep going up to experts explaining why it can keep going down. Most helpful to maintaining a discipline in these times is to consider the underlying fundamentals, where we are likely to be left when the noise dies down, and to consider the rich historical context of how downturns typically play out.

Looking at today’s backdrop, the declines have been largely driven by heightened expectations of the Federal Reserve’s plans for tightening this year that is leading to severe drops in many growth/tech stocks, which have experienced significant gains in recent years. Since reaching a high on January 3rd, the broader market (S&P 500) was recently down almost 10%—the mark at which a correction is formally reached. The tech-heavy Nasdaq 100 index was recently down 14% from its high; the small-cap growth stock index, which contains many speculative and currently unprofitable businesses, was off 16%.

Fed policy is driven primarily by concerns about inflation, and in December the Fed signaled it expected to raise interest rates (tighten policy) several times in 2022 to cool the economy down. But there haven’t been any changes in Fed policy in the past two weeks. Nor, has there been any meaningful change in the underlying economic growth fundamentals. So, we chalk up most of this recent market volatility to the ever-fickle nature of short-term market sentiment and herd behavior.

We continue to believe that a severe bear market is unlikely without a recession, and the economic and earnings growth fundamentals and macro backdrop still look sound this year. We expect growth to decline from 2021’s pace but still remain above-trend. However, we have also highlighted—and continue to keep a close eye on—key risks, including the potential for the Fed to tighten policy more sharply than the economy can handle, a wage-price inflation spiral taking hold, a Russian invasion of Ukraine and/or a sharp slowdown in the Chinese economy. COVID-19 also remains a wildcard that we continue to monitor closely.

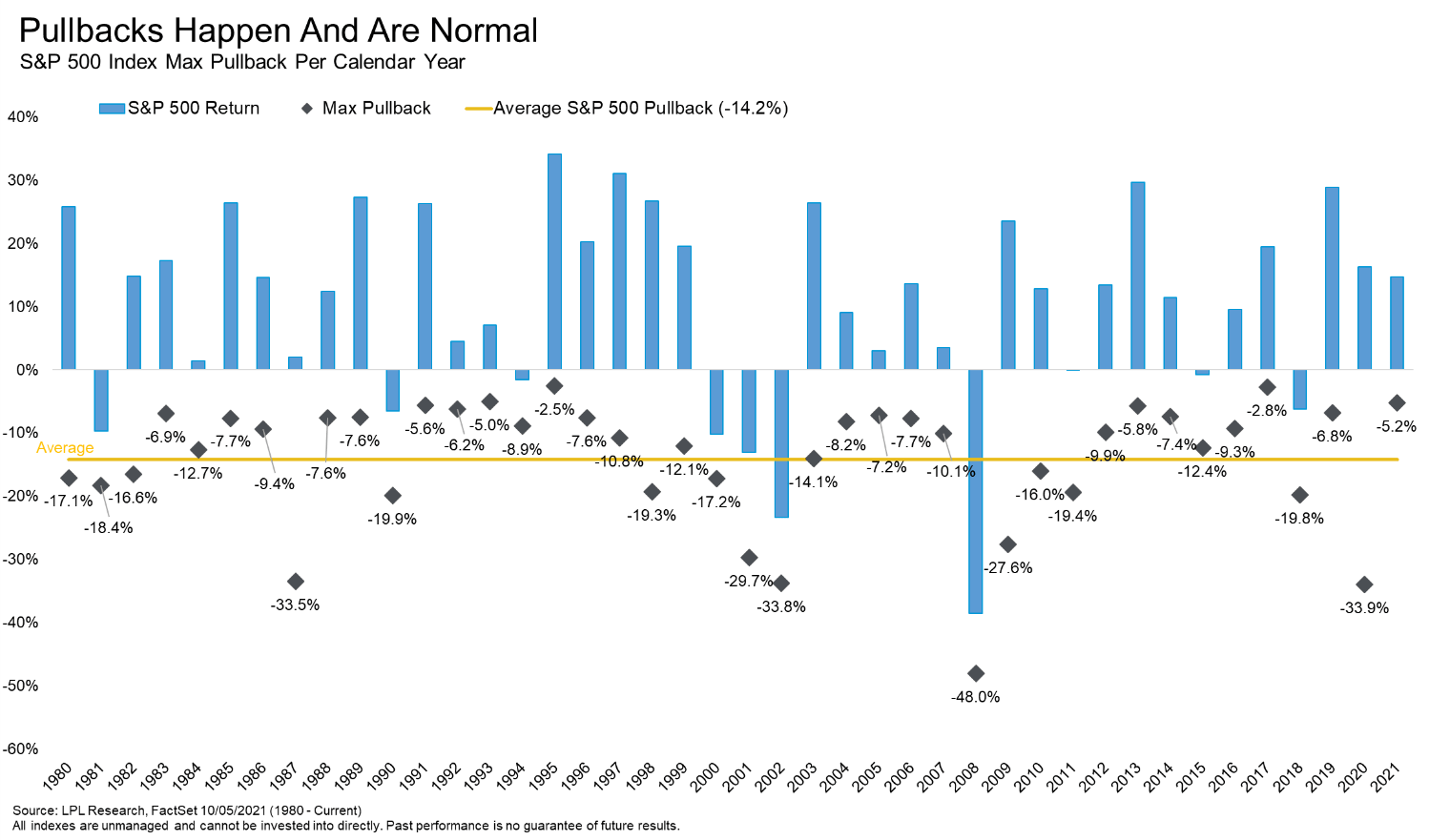

In terms of historical context, it is helpful to remember that in every market decline the same concerns are raised and each decline has fundamental similarities: fear over how far it could go followed by a reversal during which much better returns are realized. Consider that since 1950, 10% or greater market drops happen on average once a year. They are to be expected. Bear markets (20%+ drops) happen every six to seven years on average.

Meanwhile, the average rebound in the 12 months following a market bottom is 41% and over the subsequent five years it is 93%, which highlights the point that selling after a decline effectively captures some or all of the downturn and misses the rebound—a sure recipe for failure.

As always, we will monitor developments and consider new information objectively. Rather than pulling back on stocks, it is more likely if we see significant further declines that we would be adding to our equity allocation at much more attractive valuations. Meanwhile, we believe our portfolios are well diversified and built to withstand downturns consistent with their risk profiles. Please feel free to reach out to discuss your portfolio with your advisor; we welcome your questions and appreciate your trust.

—Litman Gregory Investment Team