Finances & Aging: Tips for Planning Ahead

In this interview with Senior Advisor Gretchen Hollstein, we uncover several tips for families as they navigate the issues of financial management that often come with aging. Gretchen explains why this is so important, and how she and the advisors at Litman Gregory work with clients to follow the steps involved in planning ahead.

Gretchen, is the area of financial planning for aging something that you focus on specifically, or is it a team-wide area of expertise at Litman Gregory?

At Litman Gregory, we have been working with families and their next generations for over 30 years, so our entire team has a great deal of experience working with clients as they age. But this topic does hold a special place in my heart, as I experienced firsthand the impact of aging when my father battled the effects of Alzheimer’s. What I learned is that even after planning as well as he did, the experience can still be hard on the family. But being prepared is what also gives you the opportunity to spend precious time creating moments of joy.

How has helping clients plan for the issues around aging changed over the years?

As wealth advisors, our goal is to provide financial guidance throughout our clients’ lives, so planning for changes that come with aging has always been inherent in our work. But, as we see people living longer, we also see more families dealing with the difficult issues of dementia. This decline in cognitive skills limits a person’s ability to direct their own finances, so it’s imperative that we help clients plan in advance for the stewardship of their assets.

Do you find more people are preparing these days for the possibility of dementia?

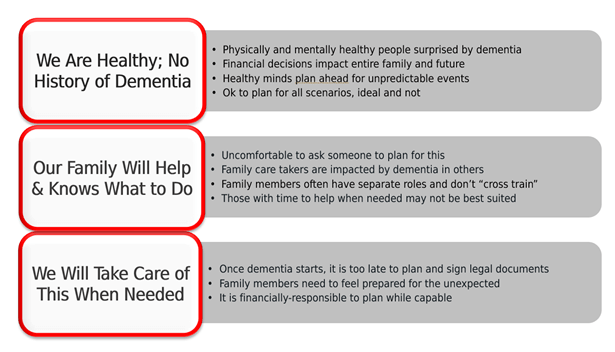

Honestly, I see that cognitive decline still comes as a surprise to most families. It can be a shock to watch the most intelligent and talented people become affected by dementia, and it can also progress slowly— sometimes years before being noticeable. Further, it is difficult and painful to acknowledge that either you yourself are losing cognitive abilities or that someone you love is struggling. Because it can come as a surprise, we try to have conversations about this with clients early. The table below shares some of the things we hear and discuss when broaching this subject

What are some pieces of advice you can give to help get these conversations started?

There are certainly many directions we go in these conversations, from planning ahead for the family’s living situation, care taking, medical support, etc. But for the moment, let’s focus on planning for finances—here are a few pieces of advice:

- Do not assume that just because someone is intelligent or financially savvy that they have everything covered. I’ve seen clients come to us after a loved one passed without some basic planning steps taken, such as designating beneficiaries. Often the family assumed they would be on top of their financial management.

- Don’t wait until there is an event or need before making arrangements for backup and protection of a loved one’s finances. I’ve seen clients have to step in when they needed to protect a family member in cognitive decline from becoming victim to financial abuse, and others need to quickly prepare documents with a family member who could decline beyond being able to sign with a notary.

- It’s really not enough to have just a Will in place, especially in California. Asset ownership and assignment of decision makers need to be supported by legal documents and kept up to date. One of my clients went through heartbreak when an independently wealthy family member died prematurely without appropriate legal documents—only an old handwritten will was found, without updated beneficiaries, and required a public legal probate process.

We always recommend planning early, when everyone is healthy, capable, and can be part of the planning discussion and decisions.

You mentioned that it’s important to have the right documents to outline ownership and decision makers for financial assets—would you review these?

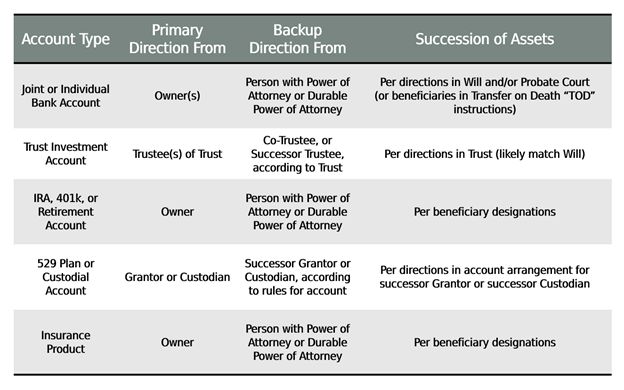

There are numerous types of investment and financial accounts, and therefore numerous options for backup and succession. The chart below gives a summary of at least five different types of ownership structures and how those assets receive direction, backup, and later succession.

In addition to getting your “docs in a row”, what other tips do you have from your work helping clients plan ahead?

One of the most impactful things we do for our clients is what I sometimes call “professional financial organizing”—helping them simplify and organize financial assets and accounts. This is helpful throughout life but becomes even more effective and important in later years. Here are a few ways we help clients simplify and consolidate:

- Consolidate Investment Accounts: One taxable investment account, ideally in the name of a Trust, and one IRA account per holder. Having less investment accounts will help simplify the oversight, tax reporting, and asset allocation review. Authorization can be given to another person for viewing an account, and taxable accounts can be registered in the name of a trust to provide backup and succession. For retirement assets, once other account types are not needed (please discuss with your advisor), consolidating to one IRA per holder helps ease the management of required distributions, tax tracking and reporting, and beneficiary designation management.

- Simplify portfolio selections and investments. In later years, it can be especially helpful for investors to have more liquid and easily tradable investments. This makes generating cash flow more efficient, creates more streamlined investment reporting, and can be helpful in reducing risk.

- Update “Trusted Contact” on record with custodian/broker. Custodians ask for a Trusted Contact as a person who can be contacted if they have any concerns related to the account holder (not as an account decision maker). This is an important resource in case they need to reach out for support.

- Use the brokerage firm’s Power of Attorney or have them review your Power of Attorney document. Estate attorneys often draft durable power of attorney documents, but not all brokerage firms can abide by them as written. It can be helpful to have the custodian’s legal team review those documents well in advance of their need, or simply adopt their own if appropriate.

- Review successor trustees, power of attorney, and other backup decision makers. If a designated backup is no longer available, or becomes cognitively challenged, it’s good to have a backup plan. If there isn’t an appropriate choice, a professional fiduciary could be considered as a successor decision maker.

- Plan for access and succession of non-financial resources and possessions. In addition to financial accounts, backup decision makers need to know how to access non-financial resources. Examples would be a safe deposit box, medical contacts and prescriptions, signed estate plan documents, social security and/or pension payments, online passwords, insurance policy information, social media accounts, household and car key storage, home security access, photo and video storage, etc.

You have likely seen some families navigate aging and financial issues as smoothly as possible. Can you share what they did well?

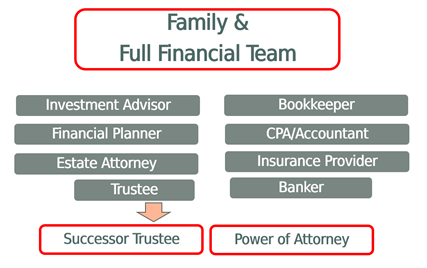

There is one consistent theme that we’ve seen within families that plan ahead well—having a trusted team of advisors. As wealth advisors, we regularly collaborate with tax and estate professionals, as well as insurance advisors, bookkeepers, and even bankers. This collaboration helps our clients receive coordinated support from a team of professionals and ensures their best interests are at the forefront of every decision. Below is an example of the types of professionals to consider as a team to support a family as the current owners begin to transition to their successors.

Do you have any other suggestions to share?

I think the key takeaway is that it’s important to be willing to think about these issues and begin planning for multiple possibilities. The first step is simply to start talking; we can help by providing a sounding board and encouragement to think through different scenarios. It’s an honor for us to be invited into the process and help our clients as they navigate unique paths into the future.

Thank you, Gretchen, for this overview of planning ahead for finances and aging. For clients of Litman Gregory, please feel free to contact your advisor to discuss these issues and your own situation.

Important Disclosure

This written communication is limited to the dissemination of general information pertaining to Litman Gregory Wealth Management, LLC (“LGWM”), including information about LGWM’s investment advisory services, investment philosophy, and general economic market conditions. This communication contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice and should not be considered as a solicitation to buy or sell any security or engage in a particular investment strategy.

LGWM is an SEC registered investment adviser with its principal place of business in the state of California. LGWM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which LGWM maintains clients. LGWM may only transact business in those states in which it is noticed filed, or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by LGWM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

For additional information about LGWM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request to [email protected]