How We Think About Elections & Investment Decisions

Each time a U.S. presidential election approaches, we revisit with clients our views about the impact on our investment outlook and portfolio positioning. Here is a quick review of how we think about elections in general within the context of our overall investment approach.

Why We Don’t Market-Time Elections

While the specific circumstances of any given election are always unique, our approach remains the same. We recognize that to the extent a particular election outcome is widely expected (for example, based on strong, consistent polling data), current financial asset prices should already reflect that market consensus. The public information is discounted in the markets in real-time.

For us to believe there is a reason to change our overall portfolio positioning stemming from a particular election outcome, several things must be true. We’d need to believe we have an edge and high conviction in our ability to assess the likely outcome better than the market consensus. Our view would also have to be materially different from the consensus view. And we’d need to have conviction that our divergent election view would clearly translate into a specific investment outcome. But history tells us that the linkage between an election result and a market impact is not always clear. The 2016 presidential election was a perfect example of this, with stocks initially plunging on the surprising result and then soaring.

There is too much uncertainty and too many non-election variables that impact investment outcomes over time for us to likely see any value in positioning our portfolios for a particular result. Even if we had a higher degree of certainty as to both the outcome and the policies that would be implemented, the ultimate economic effects and outcomes would still be highly uncertain. Macroeconomics is far from a hard science. There is a multitude of other factors and variables that impact economic and financial market outcomes.

Market Performance Around Elections

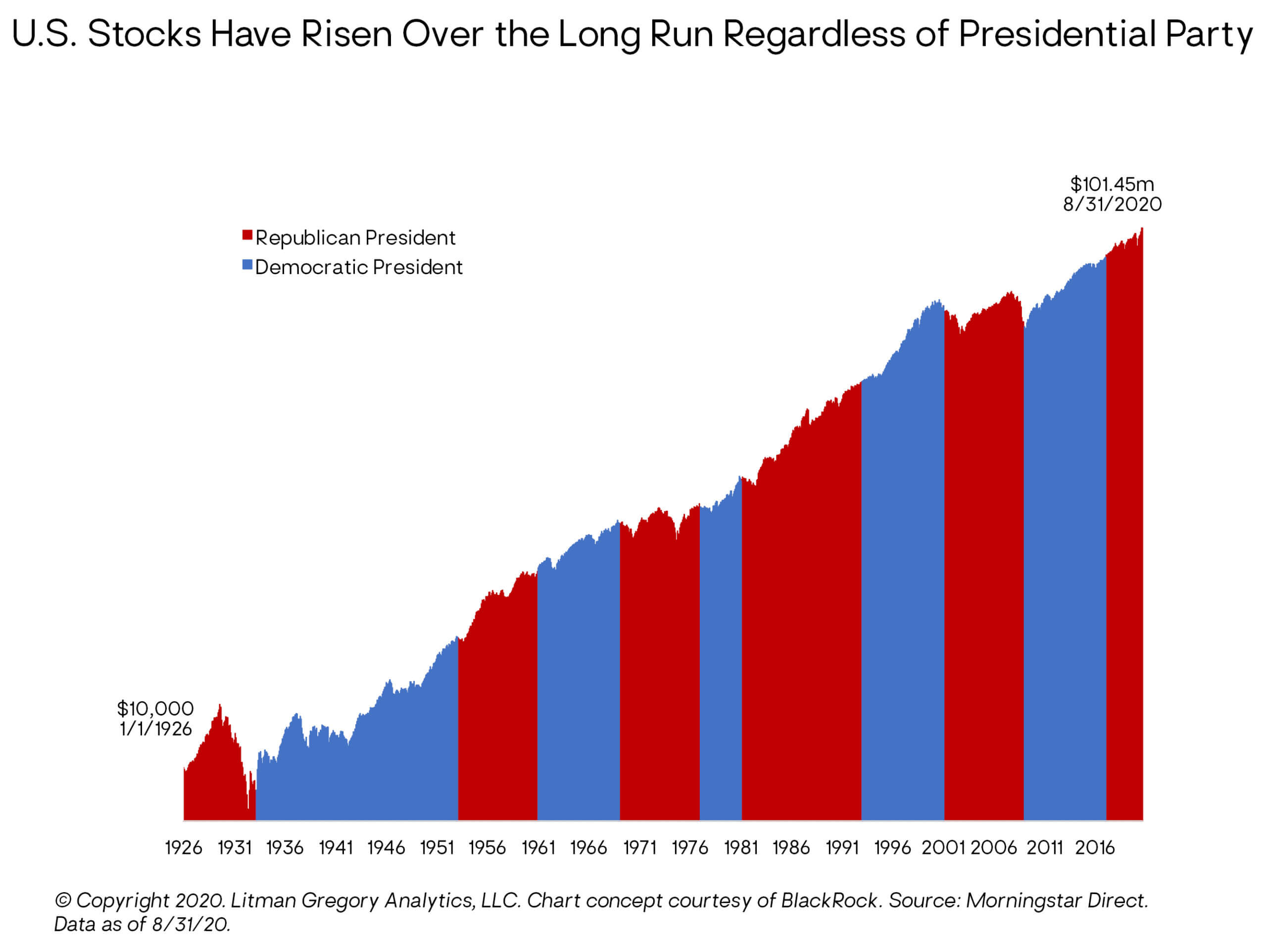

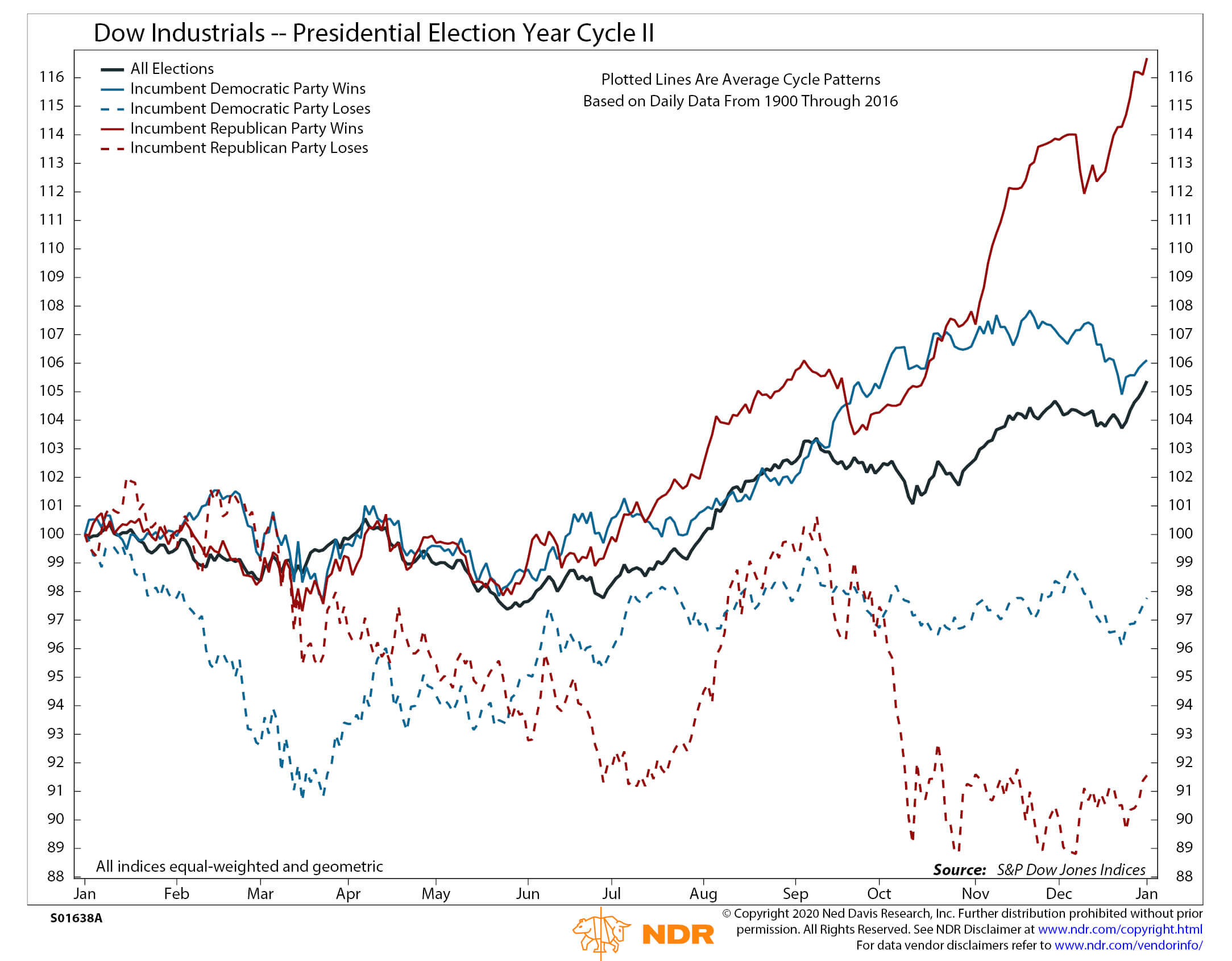

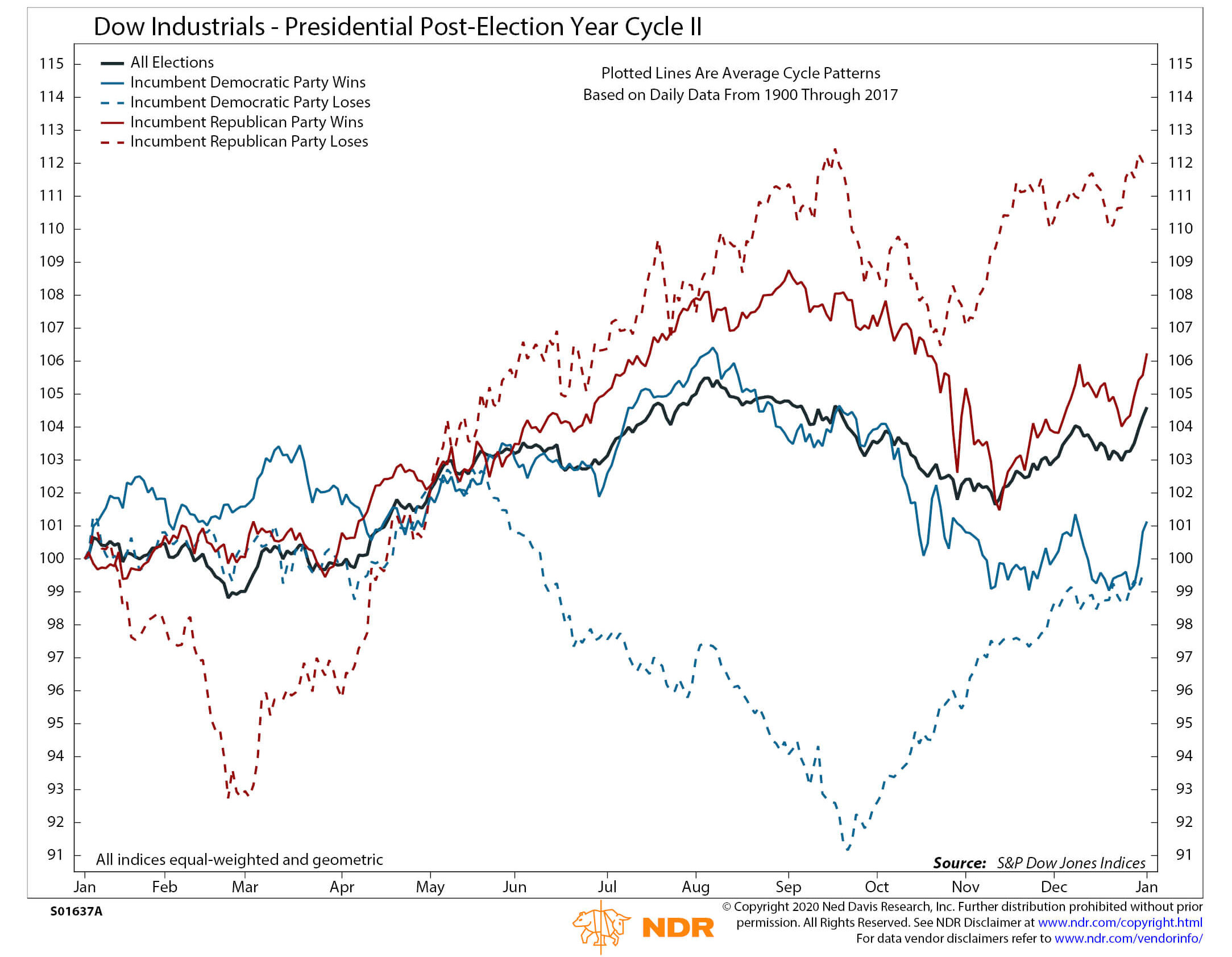

Election years have sometimes led to downside volatility for the stock market, especially when incumbents lose. However, markets typically rebound strongly from any declines around elections the following year. (See the two charts to the right courtesy of Ned Davis Research.) This supports our point that for any investor with a time horizon longer than a year or two, elections do not have a meaningful or long-lasting effect on investment performance. It will generally pay off to look beyond the election at the other drivers of markets and potentially even to take advantage of election-year declines.

It’s important to note that the election and post-election year analyses in these charts represent the average result historically, and the sample size is often small. There are many reasons the market could respond differently this year, among them the large amount of economic stimulus, the ongoing pandemic, a quickly rebounding economy, and so on.

Fundamentals Drive Long-Term Investment Outcomes, Regardless of the Party in Power

Instead of betting on election results, we stick to our longer-term analytical framework, in which we consider and weigh multiple macro scenarios, and assess the potential risks and returns for numerous asset classes and investments in each scenario. As investors, we expect to experience market volatility and shorter-term downside risk at times. Stock market history makes this clear. The degree will depend on the portfolio’s risk profile and the corresponding risk exposure. Experiencing volatility is a necessary evil of owning stocks and other higher-returning “risk assets.” They wouldn’t be considered risky otherwise!

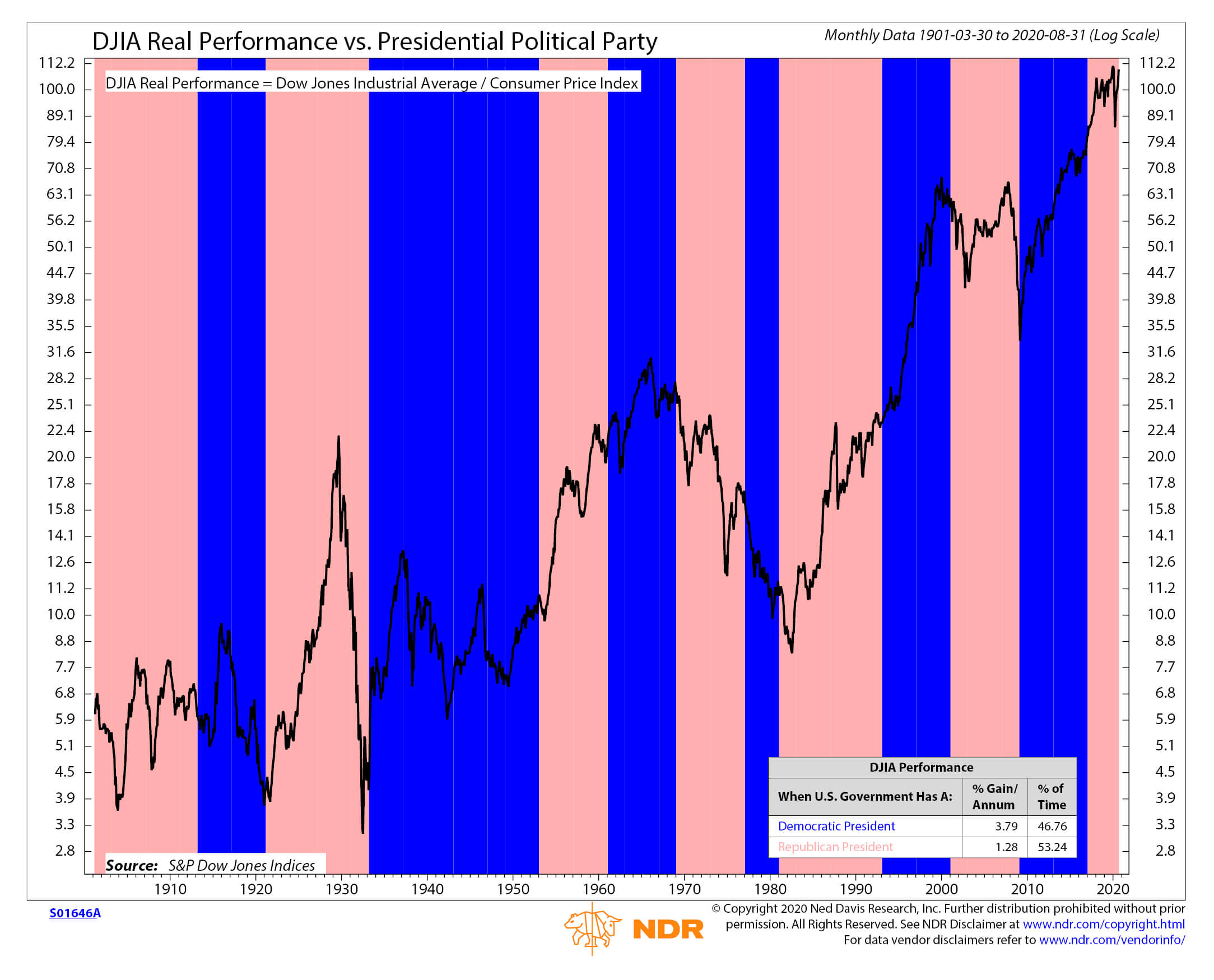

Finally, history also shows that the political party in power is not a significant differentiator or driver of investment returns. There are simply too many other factors, variables, and events that impact markets and asset prices over time beyond election outcomes.

In summary:

- We are not willing to bet on a particular election result relative to the odds already embedded in current market prices.

- There is a wide range of potential macro outcomes around either result.

- There are many factors unrelated to the election results and out of U.S. politicians’ control that are likely to have at least as meaningful an impact on the course of the global economy and financial markets over the next several years.

—Litman Gregory Investment Team