Commentary from Our CIO—Year-End 2021

Fourth Quarter and 2021 Market Recap

It’s been another remarkable year for the S&P 500 Index. Not only did the index of large-cap U.S. stocks return a stunning 28.7%, nearly triple its long-term historical average, but for only the second time in market history, the index reached a new high in each and every month.

The S&P 500 also dominated U.S. small-cap stocks, developed international stocks, and emerging-market (EM) stocks for the year. Much of this outperformance occurred in the fourth quarter, with the S&P 500 gaining 11.0%, compared to 2.1%, 2.7%, and -1.3% for small caps, developed international stocks, and EM stocks, respectively.

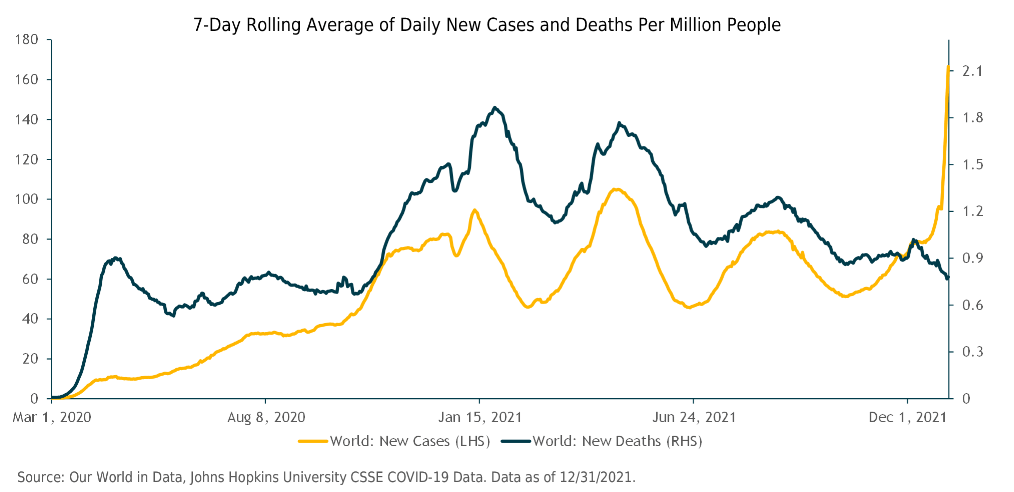

The renewed surge in COVID-19 infections late in the year (particularly in Europe and emerging markets) and China’s policy-induced economic slowdown and stock market decline were key drivers of this relative performance. The MSCI China Index plunged 21.7% for the year and lost 6.1% in the fourth quarter. Chinese stocks comprise roughly 35% of the MSCI EM Index. The MSCI EM ex-China Index gained 10.0% for the year.

Also contributing to the underperformance of international stocks for U.S.-based investors was the strength in the dollar. After falling early in the year, the U.S. dollar index appreciated sharply, ending the year with a 6.3% gain. A rising dollar is a negative when translating foreign market local-currency returns into U.S. dollar-based returns.

Looking beneath the surface of the U.S. market, the large-cap Russell 1000 Value and Growth indexes both returned over 25% in 2021, but the strong rally in growth stocks in the second half of the year gave it a slight edge over value once again for the year. However, two of the three top-performing sectors were cyclical value sectors: energy (up 54.6%) and financials (up 35.0%). The other top-performing sectors were real estate (up 46.2%) and information technology (up 34.5%). The worst-performing sectors were traditional “defensive” sectors: utilities (up 17.7%) and consumer staples (up 18.6%).

Turning to the bond markets, the core bond index (Bloomberg US Aggregate Bond Index) lost 1.5% for the year, as interest rates rose moderately. The benchmark 10-year Treasury bond yield ended the year at 1.51%, compared to a 0.92% yield at the end of 2020. Given the very sharp rise in inflation, most pundits would not likely have predicted such a mild increase in bond yields.

Credit markets fared much better than core bonds in 2021. The U.S. high-yield bond index returned 5.4% (ICE BofA ML High Yield Cash Pay Index) and the floating-rate loan index gained 5.2% (S&P/LSTA Leveraged Loan Index). These returns were consistent with our expectations given a recovering and growing economy.

Portfolio Performance & Key Performance Drivers

For 2021, our client portfolios generated solid absolute performance but trailed their strategic benchmarks on a relative basis.

On the positive side, our tactical positions in flexible, actively managed bond funds and floating-rate loan funds added significant additional return over the core bond index. Our actively managed core bond funds also outperformed the core bond index by a material margin.

Our marketable (liquid) alternatives positions in trend-following managed futures and lower-risk multi-strategy alternatives also significantly outperformed core bonds and added beneficial portfolio diversification but trailed the soaring U.S. stock market.

The main detractor from our portfolio performance was EM stocks. After outperforming early in the year, the EM stock index suffered from a one-two-three punch of (1) China’s regulatory crackdown/property–market deleveraging, (2) rising inflation and tightening monetary policy across EMs, and (3) the renewed surge in the pandemic.

In our portfolios with actively managed funds, our active fixed-income and bond fund managers strongly outperformed, as noted above. But it was a different story on the equity side, with the majority of our active managers trailing their equity index benchmarks for the year.

We made one tactical change to our target asset allocation in our portfolios during the second quarter of the year, increasing the target to U.S. stocks (by an amount ranging from 3.5% to 5%, depending on the portfolio strategy). We made a corresponding reduction in our fixed-income target allocation. This decision was supported when U.S. stocks gained roughly 13% since the change, compared to around a 2% average gain for fixed-income.

Our Macro and Market Outlooks for 2022 and Beyond: We Remain Cautiously Optimistic at this (Mid-)Stage of the Cycle

The Macro Backdrop

COVID-19:

As has been the case for the past 21 months, COVID-19 remains a key variable for the near-term (12-month) global economic and market outlook. We still believe the most likely medium-term (multiyear) base case is for continued progress in the fight against the virus and therefore a lessening of its economic impact over time. (New antiviral drugs are the latest positive medical development.) Nor, based on prior waves, do we expect the Omicron variant to derail the economic recovery in 2022, although it looks likely to have a negative impact early in the year.

If the pandemic recedes as we get further into 2022, as most experts expect, the current pandemic-related supply chain disruptions, U.S. labor market anomalies, and consumer demand distortions should also recede. This should both support overall economic growth and mitigate at least some of the inflationary pressures the U.S. and global economies experienced in 2021 related to supply/demand mismatches.

However, as we said last quarter, we are not out of the COVID-19 woods by any means. Even as global vaccinations and immunity rise and societies adapt, the risk remains of new, more contagious and/or more deadly variants emerging. We are facing that now with Omicron, which is even more contagious than the Delta variant (but seemingly less virulent). And we’ll continue to see disparate virus impacts across countries, economies, and industries, along with differing government responses. For example, in the last weeks of December, several European countries and China enacted new lockdowns and other restrictions on activity as Omicron cases surged.

U.S. Economic Policy:

In addition to the evolution of the pandemic, U.S. monetary and fiscal policy will have important impacts on economic growth, inflation, and the financial markets in 2022. After unprecedented stimulus in 2020 and 2021, both policy levers in the United States are set to tighten in 2022. But they should not become so tight as to cause a recession.

Monetary Policy:

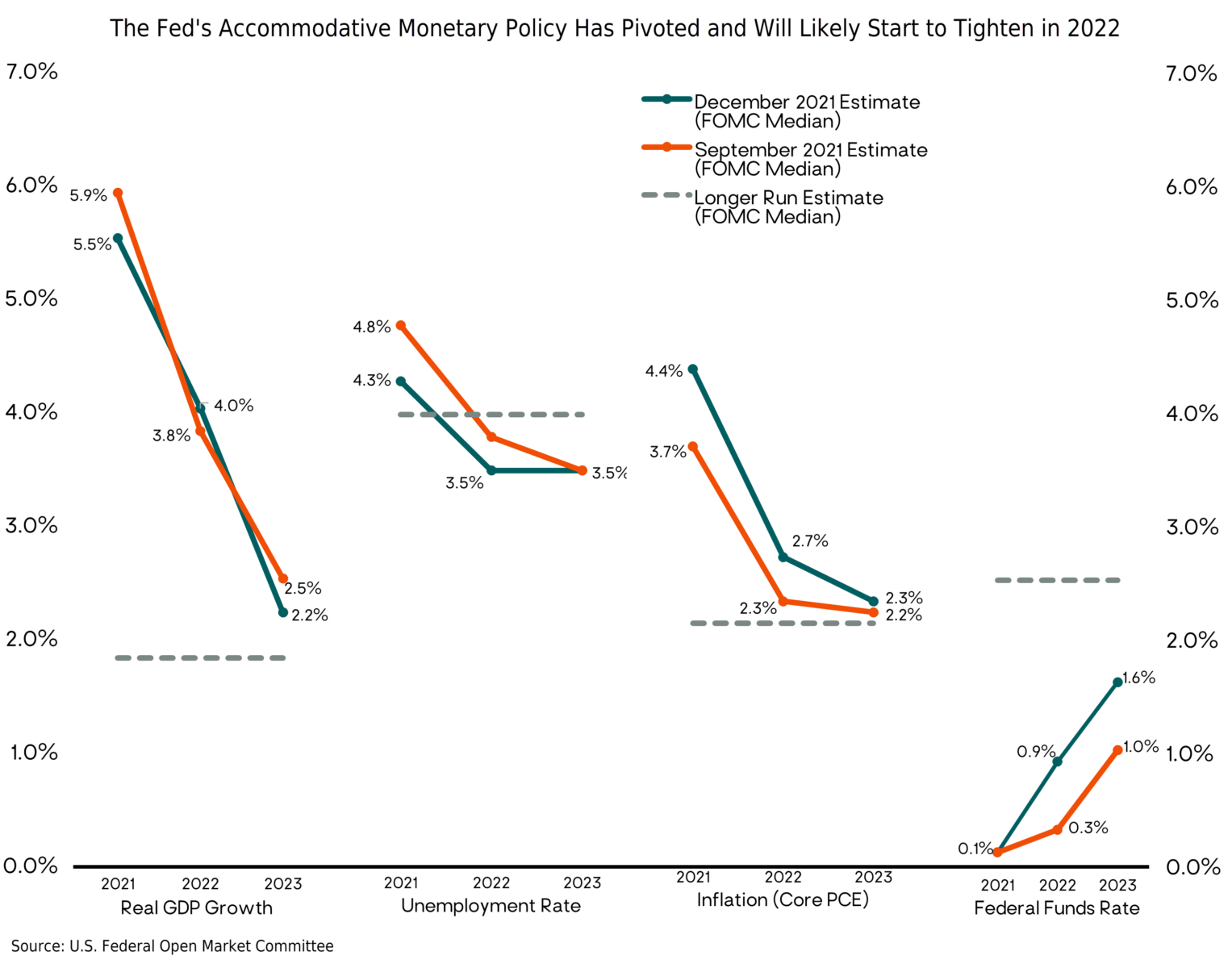

At its December Federal Open Market Committee (FOMC) meeting, the Federal Reserve expressed increasing concern about inflation and signaled it would accelerate its timeline and pace for interest rate hikes in 2022. Also, as expected, the Fed doubled the monthly pace of reducing (tapering) its quantitative easing asset purchases (QE); QE should end in March 2022, if not earlier. More hawkish than the accelerated taper, the updated Fed member “dot plot” now indicates a median of three rate hikes in 2022 (up from only one at the last FOMC meeting in September) and three more in 2023.

Of course, these are subject to change—and the track record of the dot plot in predicting the Fed’s actual behavior a year or two out is abysmal. But the dots indicate the Fed’s current collective mindset and expectations given the individual members’ reading of the economic tea leaves and where they expect the economy, unemployment, and inflation to be six to 12 months hence. And, financial markets pay a lot of attention to them.

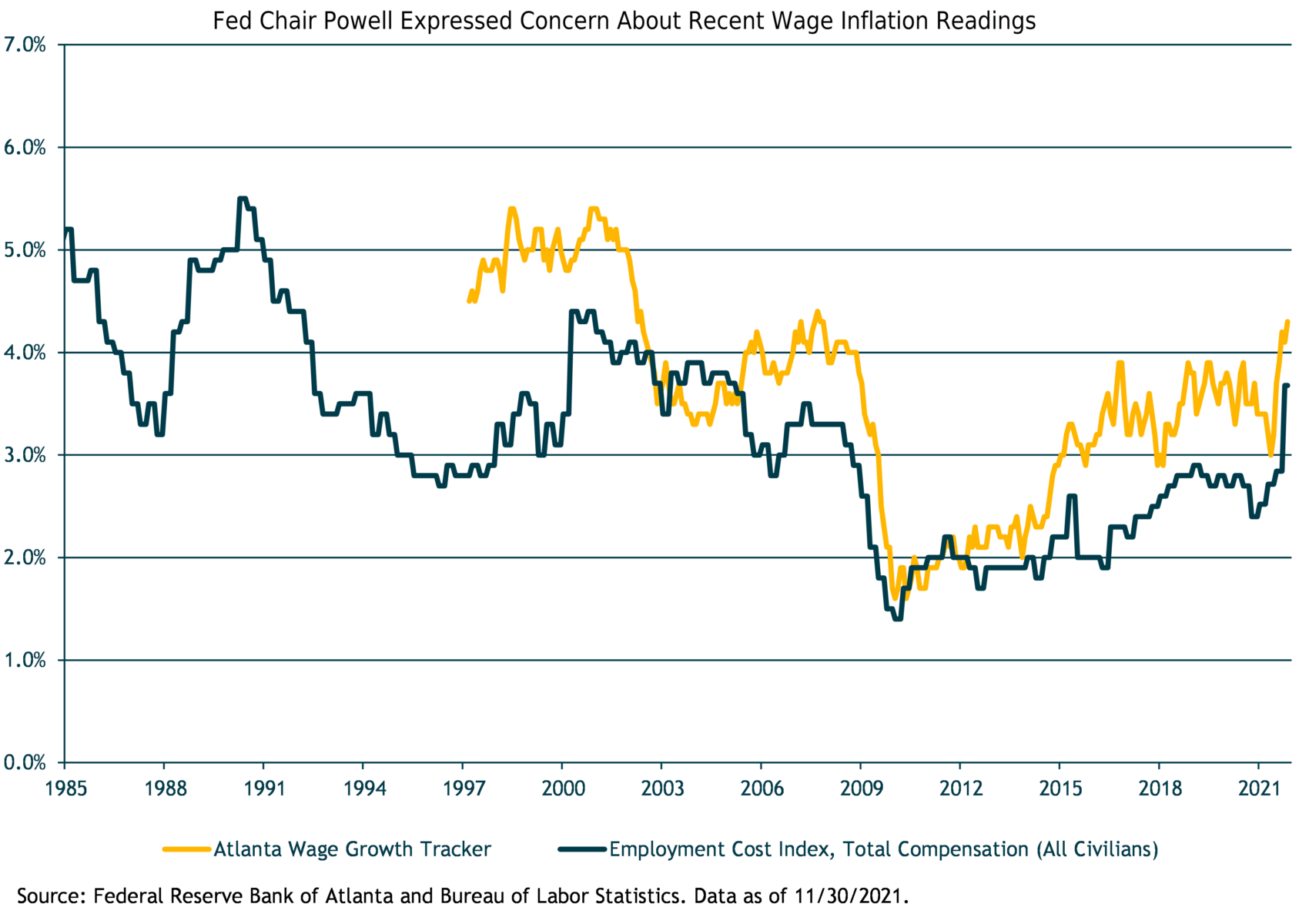

In his comments after the FOMC meeting, Fed chair Jerome Powell noted that core inflation has broadened beyond the industries most impacted by the pandemic and is well above the Fed’s 2% average inflation target. He also cited a range of economic indicators that suggest the labor market is rapidly tightening (for example, a falling unemployment rate, rising wage growth, abundant job openings, and high employee quit rates). “In my view,” said Powell, “we are making rapid progress toward maximum employment.”

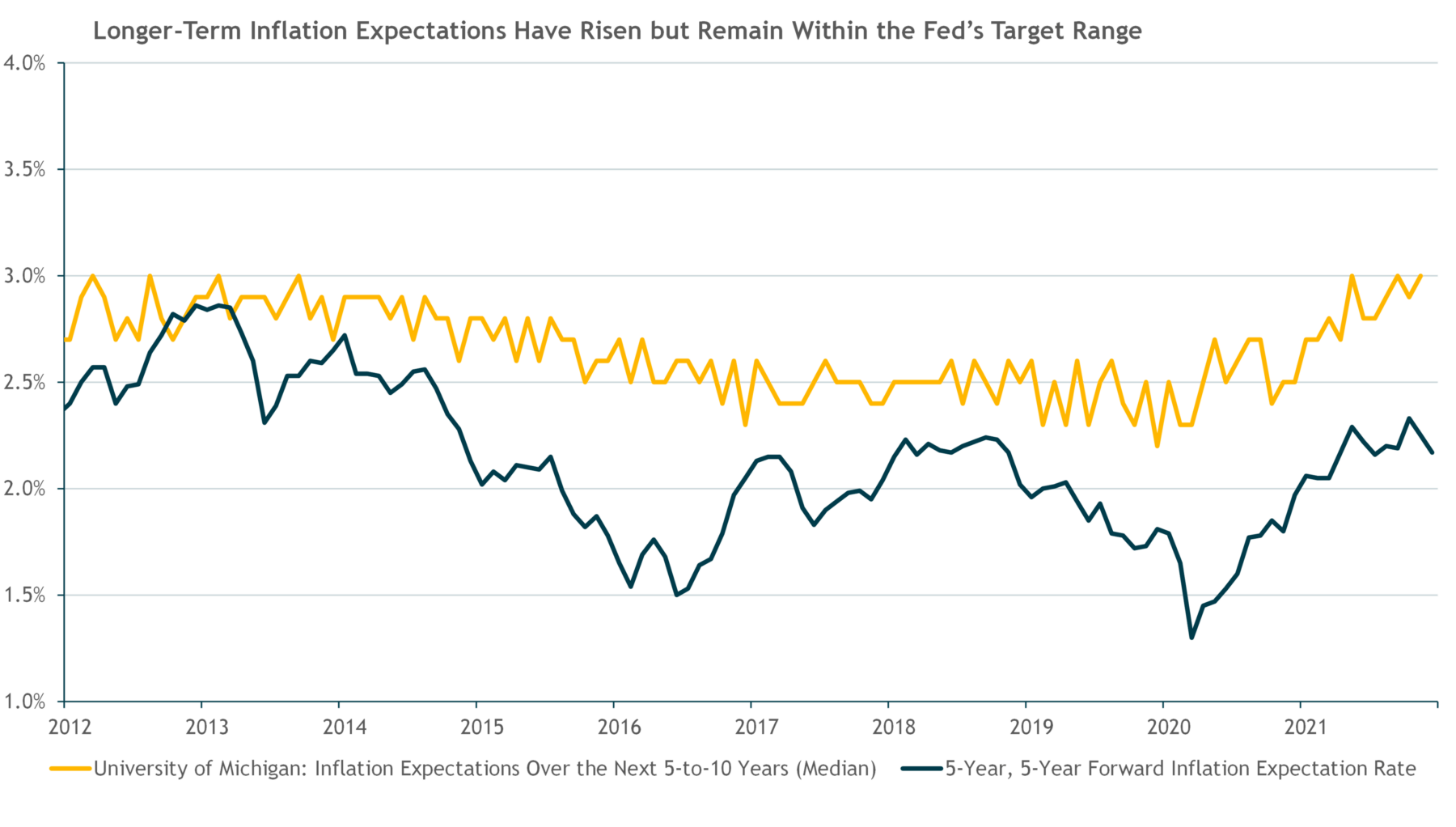

Powell also highlighted the importance of keeping inflation expectations in check to prevent a self-fulfilling inflationary spiral. “There is a real risk now that inflation may be more persistent and that may be putting inflation expectations under pressure, and that the risk of higher inflation becoming entrenched has increased. I think part of the reason behind our move today is to put ourselves in a position to be able to deal with that risk,” he said.

With both its inflation and full employment mandates likely to be met, the Fed will be in position to start tightening monetary policy (raising rates and reducing their balance sheet assets) in 2022.

Outside the United States, nearly half of all global central banks have already started raising interest rates. Notable exceptions are the European Central Bank (ECB) and the Bank of Japan (BoJ), both of which have signaled no intention to tighten any time soon given the state of their economies.

Importantly, China’s central bank (PBoC) has begun to modestly loosen policy—cutting interest rates and banks’ reserve requirement ratio—in response to weak economic data. China’s recent economic slowdown is due to both the government’s regulatory clampdown on the speculative but very large property/housing sector and their extreme “zero-COVID” policy in response to new variant outbreaks. China’s policy easing/stimulus is likely to accelerate in 2022, although it’s unlikely to be of the magnitude seen in response to China’s previous cyclical slowdowns in 2008, 2012, 2015, and 2020.

Fiscal Policy

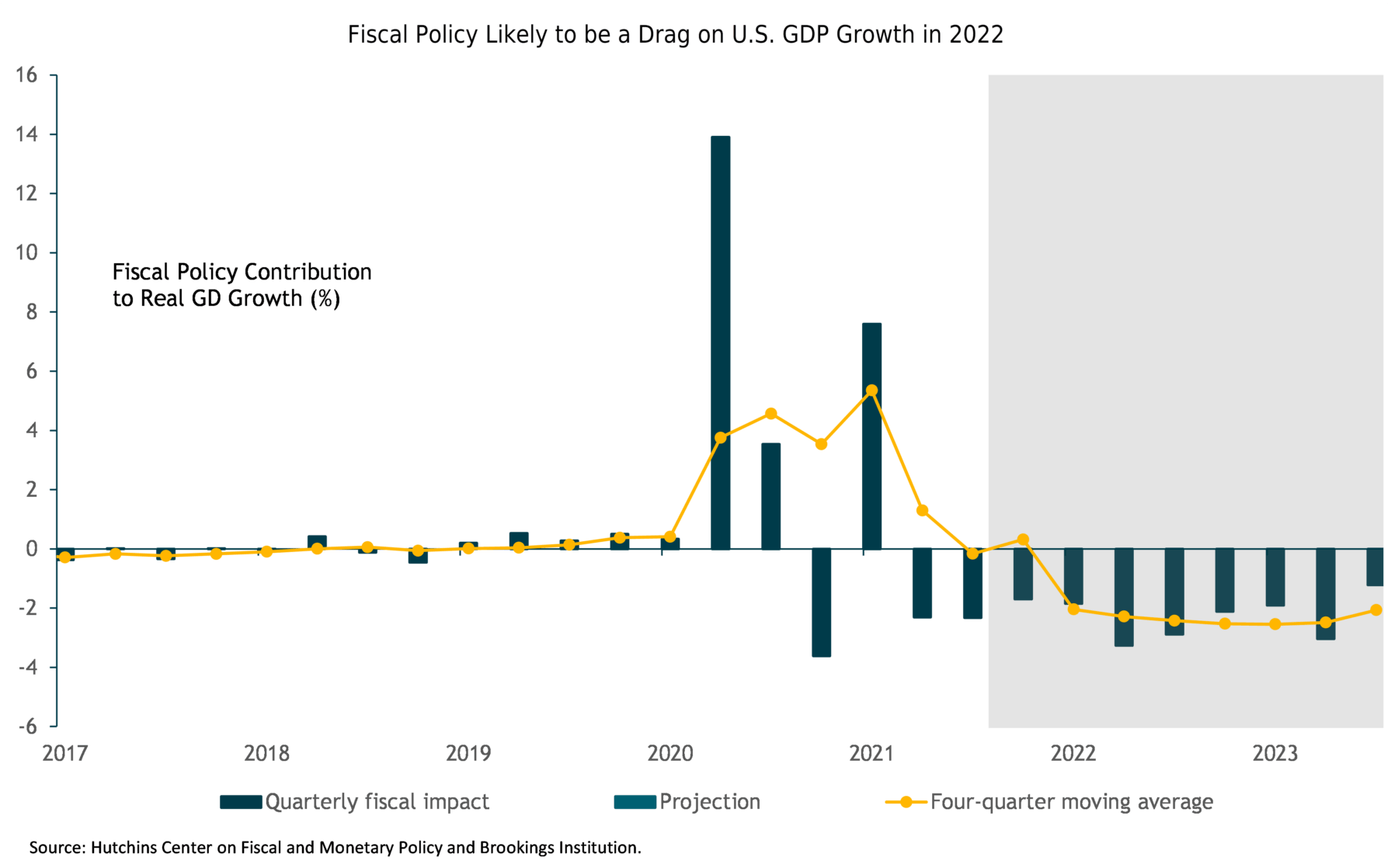

Fiscal policy is also set to turn from a tailwind to a headwind for U.S. GDP growth in 2022. This is not to say the United States won’t have another large budget deficit this year, but relative to the huge fiscal boost from 2020-2021, 2022 will see less stimulus. This will amount to a “fiscal drag”—a negative impact on GDP growth. For example, the Hutchins Center on Fiscal and Monetary Policy in Washington estimates the fiscal drag will be around 2.5 percentage points of GDP. Further, with the passage of the Build Back Better legislation now in doubt (as of late December), economists have started to factor in an even larger fiscal drag, reducing their forecasts for 2022 GDP growth.

Economic Outlook

The consensus forecasts for economic growth and inflation in 2022 are broadly consistent with our base case, which envisions decelerating growth and moderating inflation, but both still meaningfully above the economy’s longer-term trend. From an investment portfolio perspective, this macroeconomic backdrop should again be generally supportive for “risk asset” returns, such as global equity and credit markets, and a headwind for core bond returns in the face of rising government bond yields.

According to Bloomberg’s survey of economists, the consensus expects roughly 4% real GDP growth for the United States (same as the FOMC’s forecast) and slightly higher growth for Europe in 2022. This compares to around 5.5% (U.S.) and 5% (Europe) growth in 2021. Total global real GDP grew at roughly 5.6% in 2021—its fastest pace since 1980—and the consensus expects growth in the 4.5%–5.0% range in 2022.

While we don’t make GDP forecasts, we view these as reasonable ballpark baseline estimates, given the macro backdrop described above. They reflect the inevitable slowing of growth after the historic pandemic rebound but would still be well above the estimated long-run potential (or normalized) real growth rate of around 1.5%–2% for the U.S. and other developed economies, and around 3.5% for the overall global economy.

Economic forecasts for inflation next year appear to be more varied than for growth, and our crystal ball is no clearer than anyone else’s. But again, we don’t need to try to precisely predict inflation each year; our investment process and portfolio management approach don’t depend on such short-term economic forecasts. Moreover, as we’ve often said, one can get the macro right and still get the markets wrong. (To pick a few recent examples, with headline U.S. inflation soaring from under 2% to 7% in 2021, who would have forecast the 10-year Treasury yield would end the year at 1.5%, gold would be down 4% for the year, or the U.S. stock market would return 29%?)

That said, as long as the pandemic recedes over the year, the core inflation rate is almost certain to decline as pandemic-induced supply/demand distortions normalize, even if things aren’t all the way back to “normal.”

However, as we’ve discussed in prior reports, the “shelter” price component of the consumer price index (CPI) is almost certain to rise further in 2022 because it lags housing price inflation, and home prices rose nearly 20% in 2021. (Shelter accounts for roughly 40% of core CPI.)

And with labor markets tightening toward full employment, wages and labor costs could also see stronger upward pressure, which could feed into consumer goods and services prices.

All in all, our best guess is that core consumer inflation is likely to be closer to 3% than 2% next year and may remain above 2% on a more sustained basis going forward than we saw over the past 10-20 years.

That is our current base case. The data we cited earlier don’t suggest we are seeing a damaging “wage-price-expectations inflationary spiral.” The Fed’s hawkish pivot also weighs against that outcome (as long as Powell’s bite follows his bark). But our views are never set in stone—they continuously evolve and adapt as new data and evidence comes in.

Most importantly, as we evaluate investment opportunities and manage client portfolios, we always consider a range of risks and alternative scenarios outside of our base case. Building a diversified portfolio that is resilient across a range of potential outcomes while positioned to particularly benefit in our base case is our objective.

We see the following key macro risks around our cautiously optimistic base case for 2022:

- A new highly infectious and deadly COVID-19 variant emerges. Omicron also poses a near-term risk to the global outlook. Because of its very high transmissibility, there is a risk of overwhelming hospital capacity, leading to renewed lockdowns with resultant economic and social impacts.

- A wage-price inflation spiral starts to emerge; longer-term inflation expectations rise beyond the Fed’s comfort zone.

- The Fed makes a policy mistake: Either (1) the Fed tightens too much/overreacts to inflation readings; or (2) the Fed allows inflation to become entrenched (wage-price inflation spiral).

- The Chinese economy has a sharp downturn (“hard landing”), for example, due to a policy mistake related to the property-market deleveraging.

- A geopolitical or exogenous shock impacts the global economy (always a possibility).

We will now turn to the financial market and investment implications of our base-case macro outlook and the risk scenarios around the base case.

Financial Markets Outlook

Base Case

Over the next year at least, barring a global macro shock, we expect positive returns for global equity and credit markets (and risk assets in general), driven by continued corporate earnings growth that underlies these assets. In this base-case scenario, the 10-year Treasury yield is likely to moderately rise, which means another poor year for core bond returns, both in absolute terms and relative to other asset classes and alternative strategies.

Earnings-per-share (EPS) growth will sharply decelerate for the S&P 500 compared to 2021. But it should still be at least around or above its historical trend growth rate of roughly 6% and in line with the current consensus expectations of 8%–9% for 2022. We think this is reasonable because (1) corporate revenue (topline) growth should be consistent with nominal GDP growth (real GDP growth plus inflation) in the mid to upper single digits; (2) profit margins should remain near historically high levels but will depend on companies’ ability to pass through higher input and wage costs or increase productivity and profitability via capital investments; and (3) share buybacks are likely to boost the S&P 500 EPS by a few additional percentage points.

Monetary and fiscal policy in the United States will become less accommodative but is unlikely to tighten so much (yet) to trigger a bear market and economic recession.

As always, equity investors should expect market volatility and be prepared for 10%-plus drawdowns (“corrections”). But absent a recession, a 20%-plus bear market is unlikely.

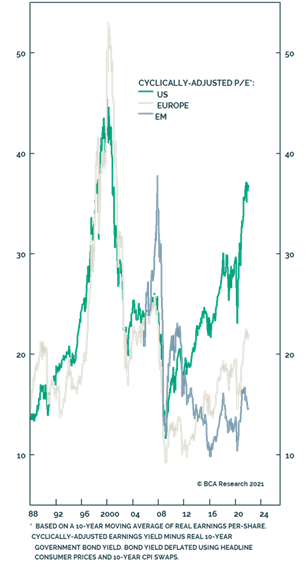

We expect international and EM stock markets to outperform the S&P 500, due to their (1) higher cyclical sensitivity to global economic growth, (2) their larger potential for earnings acceleration and positive earnings surprises after lagging U.S. stocks the past several years, and (3) their much lower starting equity market valuations.

As such, we see the likelihood for strong returns to foreign markets from both improving fundamentals (cyclical earnings rebound) and, as investor sentiment improves, higher valuations (price-to-earnings multiples) over the coming year(s).

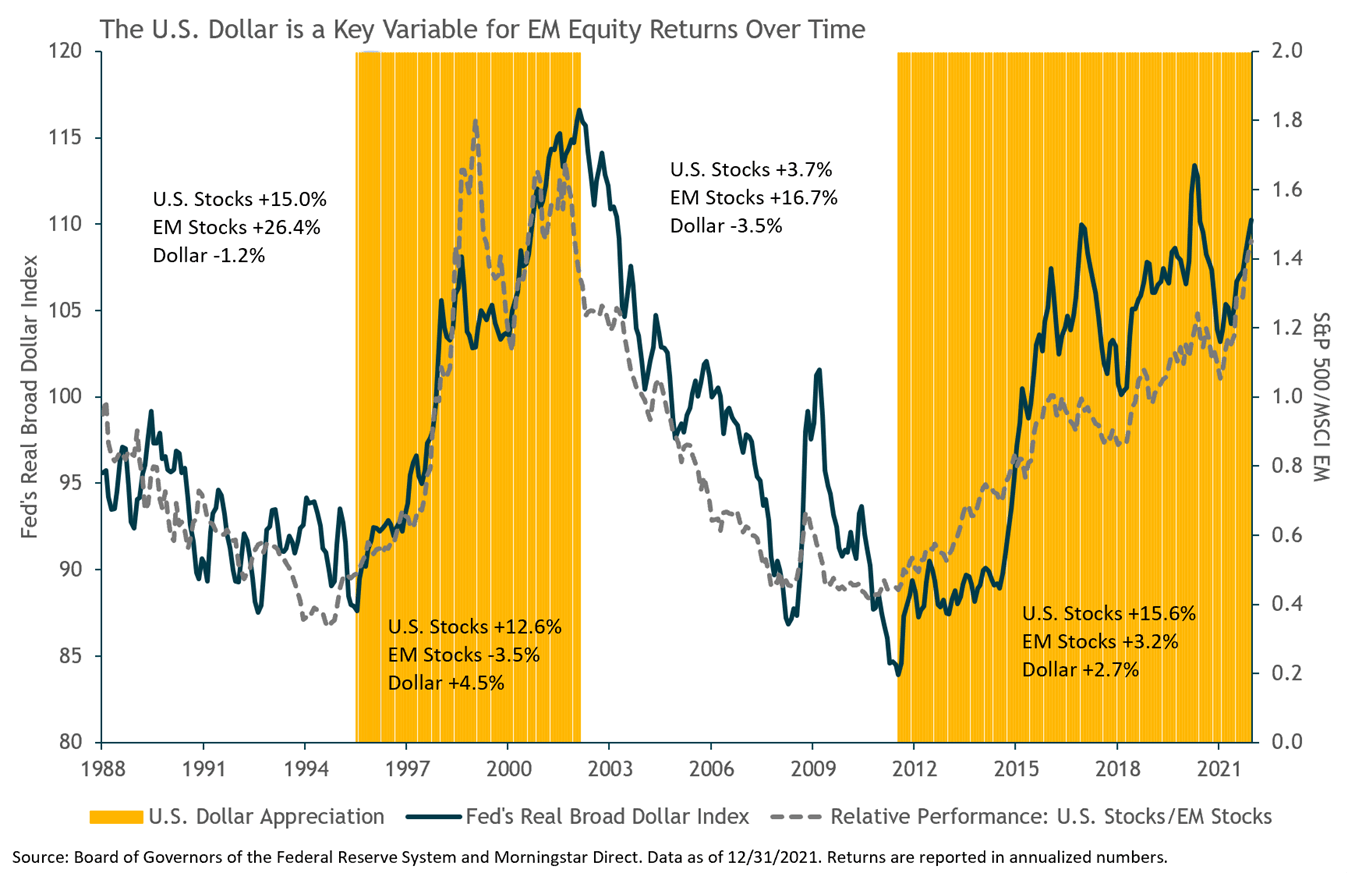

Another key variable for the performance of foreign equity markets, and EM markets in particular, is the direction of the U.S. dollar. As noted in our 2021 market recap at the top, the dollar’s strength this year was a major headwind to foreign equity market returns for U.S. dollar-based (unhedged) investors, as their returns are translated from weaker foreign currency terms into a stronger dollar.

Forecasting the short-term twists and turns of the global currency markets is a fool’s errand. But as the chart below shows, the broad dollar index has tended to move in longer-term multiyear trends, driven by macro fundamentals and shorter-term price momentum.

We won’t try to time the next inflection point for the strong-dollar trend to reverse, but our base case is consistent with it happening within the next year or so due to several factors:

- The dollar is a counter-cyclical (safe-haven) currency. Therefore, if/as the global economy grows above-trend in 2022 and with a stronger rebound in growth outside the United States—as those economies have more room to catch up from the pandemic losses—the dollar should depreciate.

- The growing U.S. twin deficits—federal budget deficit and trade deficit—should put downward pressure on the dollar.

- On a fundamental (purchasing power parity) basis, the dollar is overvalued.

- The dollar is a high-momentum currency, but bullish dollar positioning in the markets is now reaching extremes and ripe for a sentiment reversal.

- The Fed has recently turned more hawkish on inflation and monetary policy, which has boosted the dollar. But it remains to be seen what they actually do in terms of rate hikes next year. For example, there is potential for a dovish surprise relative to current market expectations of three rate hikes.

Another key driver for EM equities is the performance of China’s economy and stock market. This really hurt EM index returns in 2021, as we noted above. We think the most likely scenario is increased Chinese policy stimulus in 2022, which should boost China’s economy and stock market and support broader EM economic growth and equity markets.

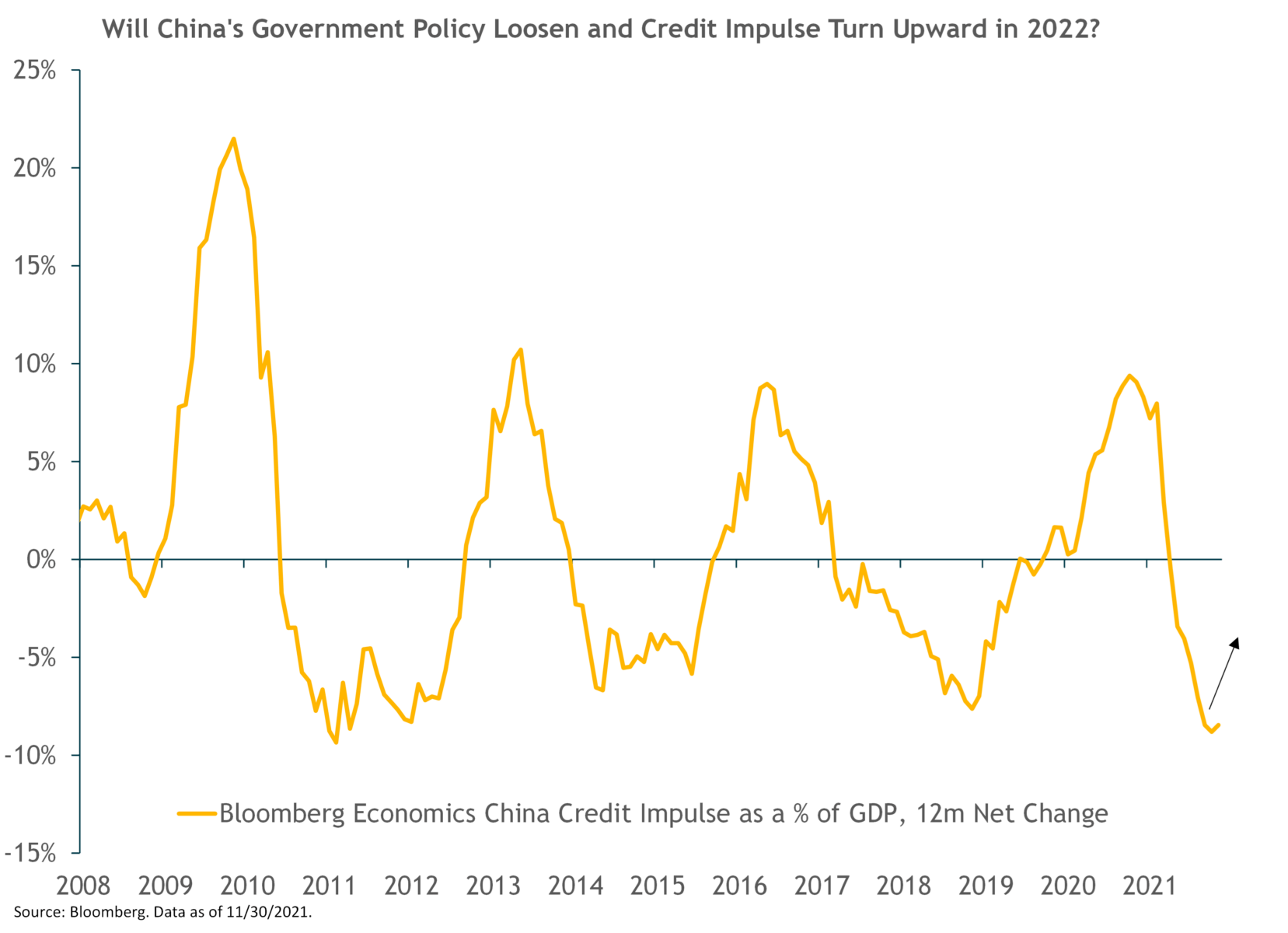

One widely followed leading indicator for China’s economy and markets is the China credit impulse, which measures the change in newly issued public and private credit (the flow of credit) as a percentage of GDP. The credit impulse tends to lead turning points in China’s economic activity by roughly six to nine months.

As the accompanying chart shows, there have been four distinct credit cycles over the past 12 years. The credit impulse recently reached historically low levels, but indications are the Chinese authorities are starting to loosen credit again. Although the stimulus is unlikely to reach the levels seen in the prior cycles—as China is now focused on slower but more sustainable GDP growth (broad consumer demand-driven growth rather than speculative property-driven growth)—it is still likely to be sufficient to spark a turnaround in the economy and equity market.

Market Risk Scenarios Around Our Base Case

Consistent with our earlier list of the main macro risks for 2022, there are two broad market risk scenarios around our base case that we incorporate within our investment outlook and positioning:

- Earnings growth surprises on the downside

- Inflation surprises on the upside

Earnings growth could fall short of expectations in 2022 for any number of reasons, but outside of an unpredictable global macro or geopolitical shock, we believe the most likely candidates are COVID-related, China policy tightening, or Fed policy tightening that sharply curtails business and consumer spending.

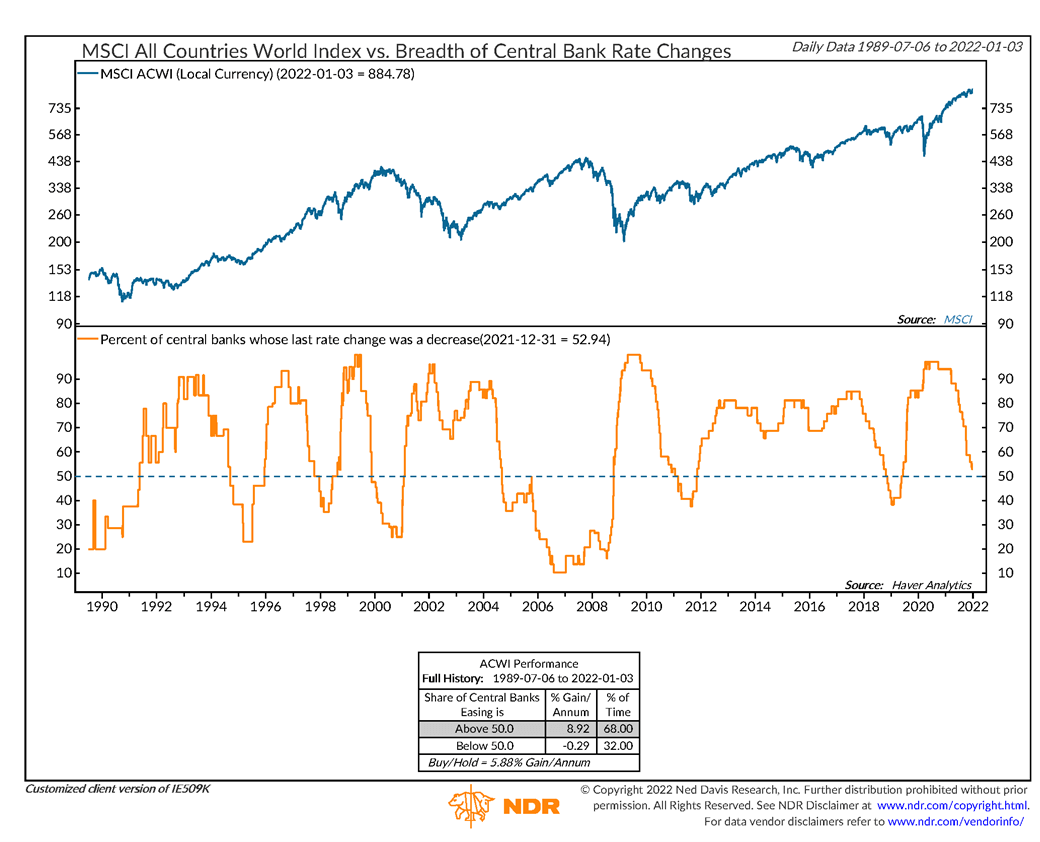

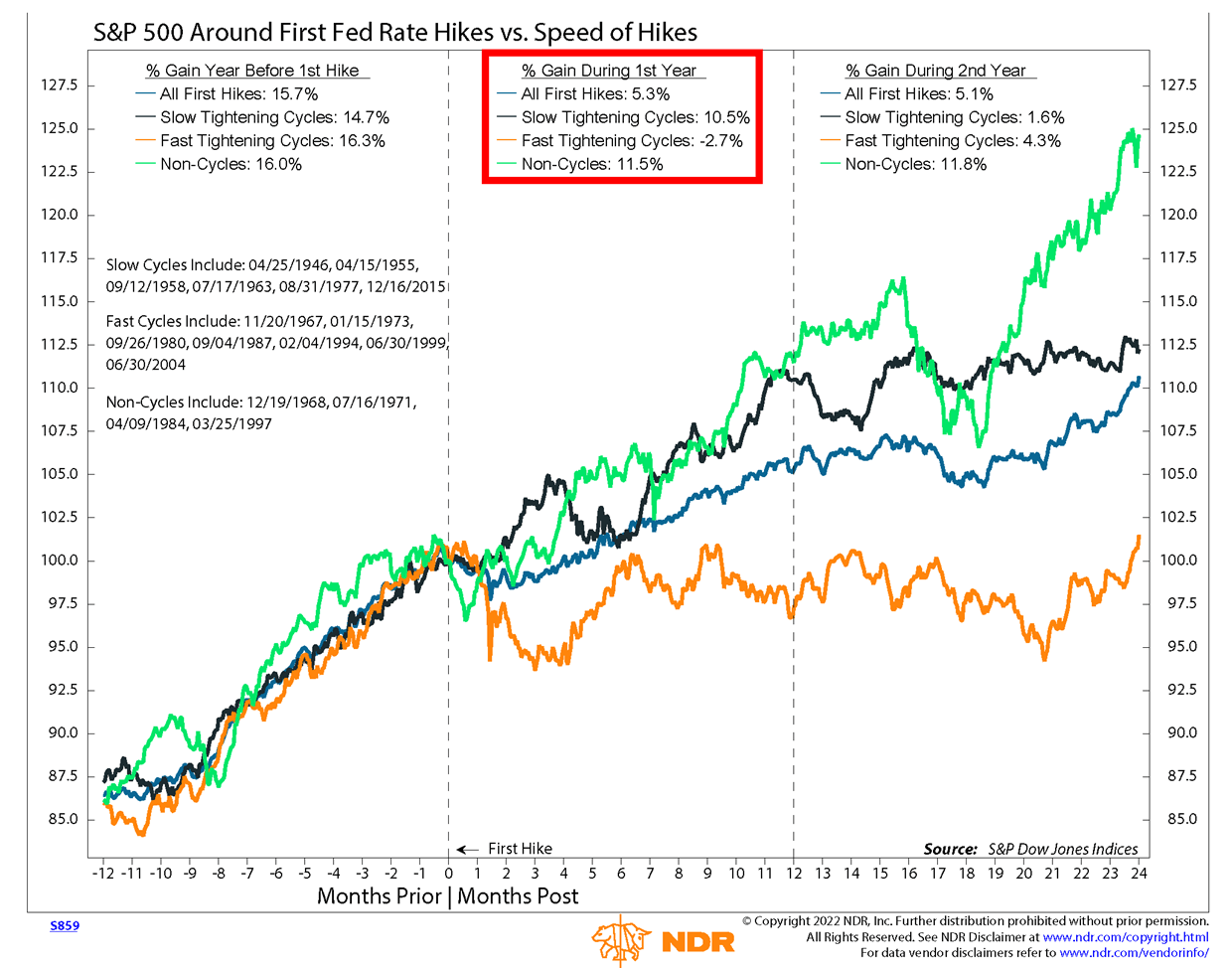

There is not a tight historical relationship between the start of Fed rate hikes and U.S. stock market performance. As this NDR chart shows, the S&P 500 has typically had solid returns in the first year of a tightening cycle. However, if the Fed initiates a “fast” rate hike cycle, where it raises the federal funds rate at nearly every FOMC meeting, the market has fared poorly. NDR concludes, “A more restrictive Fed is a leading candidate for the cause of corrections or a shallow bear market.”

In contrast, an earnings slump would likely be positive for core bonds as Treasuries and the U.S. dollar are still seen as investment safe havens.

But there is also risk in the other direction: that the current high inflation rate doesn’t meaningfully decline or even increases through the year. Again, to a large extent this depends on COVID-related developments. While the Fed is now talking a hawkish game, it remains to be seen if, when, and to what extent it will follow through with rate hikes in 2022. There is a risk that a wage-price inflationary spiral takes hold. And if it does, how would the Fed respond?

A sharply inflationary environment well above current consensus expectations would undoubtedly cause market havoc for both stocks and bonds, as interest rates rise and equity market valuations fall.

All these considerations (and more) factor into our asset class analysis and current tactical portfolio positioning.

Portfolio Positioning

We remain positioned to benefit from our highest-conviction tactical investment opportunities. But our portfolios are also strategically balanced and well-diversified across a range of global asset classes, alternative strategies, and risk-factor exposures. This should enable them to be resilient should a risk scenario or shock outside our base case occur.

Overall, our balanced portfolios are positioned with (1) a small overweight to global equities, due to our tactical overweight to EM stocks; (2) a large overweight to flexible, actively managed fixed-income funds and floating-rate loan funds; (3) core positions in lower-risk and diversifying alternative strategies; and (4) a large underweight to core bonds (interest rate/duration risk).

In our client portfolios, where appropriate, we also have core holdings in private equity and private real estate funds run by skilled and experienced managers with strong track records. These investments offer attractive long-term return potential plus additional portfolio diversification benefits relative to publicly traded securities.

Within our global equity allocation, we continue to maintain balanced allocations across the “value-blend-growth” style spectrum (either via active managers or diversified market index ETFs), as we do not have a high-conviction tactical view on individual sectors, styles, or factors. We do see potential for value and cyclical stocks to rebound (again) as COVID-19 recedes and interest rates rise. And value stocks in aggregate still look very cheap versus growth. But we also want to maintain exposure to high-quality, innovative growth companies with strong competitive advantages that are priced at not-unreasonable valuations. (There are still some out there.)

With regard to our tactical overweight to EM stocks, we are in the process of reviewing this position in light of the near-term risks we highlighted above (COVID-19, China policy/property deleveraging, Fed monetary tightening, dollar appreciation). Our five-year expected return scenarios for EM already incorporate these risks, and we believe our base-case assumptions remain reasonably conservative. But, we also estimate similar five-year base-case returns for European equities, and European markets may face fewer near-term risks compared to EM. As such, we are evaluating whether to split the overweight between EM and European stocks. We expect to decide on this in early 2022. (Of course, all our tactical allocation assessments are always an ongoing process.)

Our fixed-income positioning reflects the poor return outlook for the core bond index: The index is starting from a low sub-2% yield and interest rates are likely to rise over the coming quarters, at least until a recession hits. Our active, flexible fixed-income managers have a strong likelihood, in our view, of outperforming the index without taking imprudent risks. But we still maintain a meaningful core bond allocation in our more conservative balanced portfolios as ballast in the event of a recessionary scenario, which would hurt flexible, credit-oriented bond funds as well as stocks.

Finally, our allocations to marketable alternatives are largely a substitute for some fixed-income exposure. Again, we believe these “alt” positions offer better return prospects plus beneficial diversification across a range of scenarios beyond a traditional recession where core bonds shine.

Closing Thoughts

In sum, our portfolios are well-positioned to generate attractive returns in our base-case macro and market scenarios in which the pandemic recedes (but doesn’t disappear), the global economy slows but still grows above trend, corporate earnings growth slows but is still solid, the U.S. rate of inflation remains elevated but is falling, and U.S. interest rates rise moderately.

That would be somewhat of a “goldilocks” scenario for the economy and global equity and credit markets, although not for the core bond market. But even in the best case, it likely won’t be a smooth journey: The pandemic remains uncontained, domestic and global political and social tensions are elevated, the risks of an economic policy mistake have risen, and any number of other inevitable yet unpredictable bumps in the road may occur.

We are confident in our long-term investment process, discipline, and ability to navigate whatever comes our way, with the objective of achieving your investment and financial goals. We sincerely appreciate your confidence and trust as well.

—Jeremy DeGroot, CFA, Chief Investment Officer (1/07/22)