Living in a Higher Inflation World

The return of high inflation is now a dominant theme in the financial media, and for good reason: it upends a decades-long regime in which mutually reinforcing low inflation and low interest rates drove up valuations on riskier assets like stocks, while the cost of most goods and services remained relatively affordable.

The steep and so far, sustained spike in inflation that began to surface in 2021 has had significant impact on the global economy. In response, the Federal Reserve Bank (the Fed) and central banks globally have raised interest rates aggressively (to slow consumer and business spending) as goods and services became more expensive, causing both stocks and bonds to fall sharply. The chance of a recession in the near term is significant, and over the longer term we face the very likely prospect of living with higher inflation than what we’ve grown used to.

Given the reality that at least some of the recent inflation is not likely to prove transitory, as many had hoped early on, we have put together a more expansive piece on inflation that addresses the macroeconomics around the causes, outlook and investment impact of higher inflation and then digs into the microeconomics in terms of its impact on individual financial lives including around saving, investing and achieving financial goals.

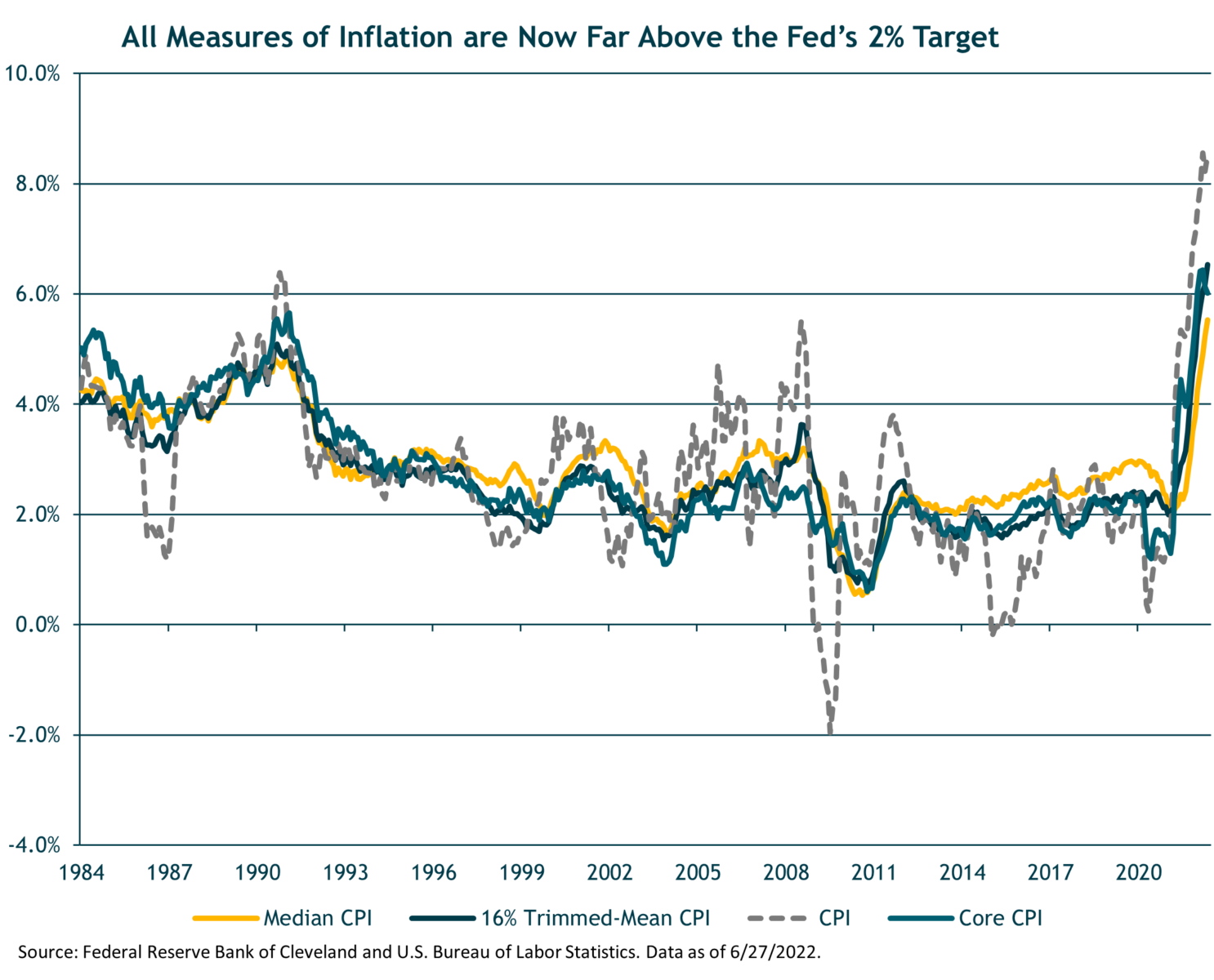

How the Inflation Fire Was Lit and What the Fed Is Doing to Put it Out

The initial drivers of higher inflation were global supply chain disruptions caused by the pandemic. There were also challenges in the labor market as a shortage of willing workers drove wages higher. A big concern now is the prospect of a wage-price spiral in which higher prices and higher wages are mutually reinforcing; this can be difficult to extinguish once lit, as we saw in the latter 1970s.

Most investors (ourselves included) expected that as the pandemic receded, supply chains and the labor market would normalize over time and bring inflation back toward benign levels. But when Russia invaded Ukraine, it was another global shock that drove energy and food prices higher (not to mention fear and uncertainty).

As inflation climbed to alarming levels the Fed has committed to act as aggressively as necessary to bring it back under control – a process that is now underway. Their basic toolkit involves raising rates to suppress economic activity, with the resulting lower demand leading to lower prices. However, the problem is that this simple cause and effect assumes the supply side of the economy remains steady. This is not the case due to the pandemic-driven supply chain disruptions and the Russia/Ukraine war’s impact on energy and agricultural commodities. We all hope and expect that over time these shocks will dissipate, but the Fed can’t do anything about them, which makes it more difficult to engineer a slowdown of appropriate (but not excessive) magnitude, often referred to as a “soft landing.”

At its June 15 Federal Open Market Committee (FOMC) meeting, the Fed hiked the federal funds rate a larger-than-expected 0.75%, to a range of 1.50%-1.75%. The Fed committee members also sharply raised their median forecast for the year-end fed funds rate to 3.4% (from a 1.9% forecast at their March meeting). At the July 27 FOMC meeting, the Fed again raised rates by 0.75%, to a range of 2.25%-2.50%. The market currently expects another 100bps (1.00%) of rate hikes over the remaining three FOMC meetings this year. This would put the federal funds rate into a restrictive zone for the economy, i.e., well above the Fed’s 2.5% estimate of the “neutral” long-run fed funds rate.

The FOMC members also sharply downgraded their median forecasts for U.S. real GDP growth to a below-trend 1.7% for both 2022 and 2023, reflecting their hope for a soft landing but not recession. An economic growth slowdown in the U.S. (and abroad) is already underway and we think the chance of a recession over the next 6-12 months is now meaningful, though the magnitude is up for debate.

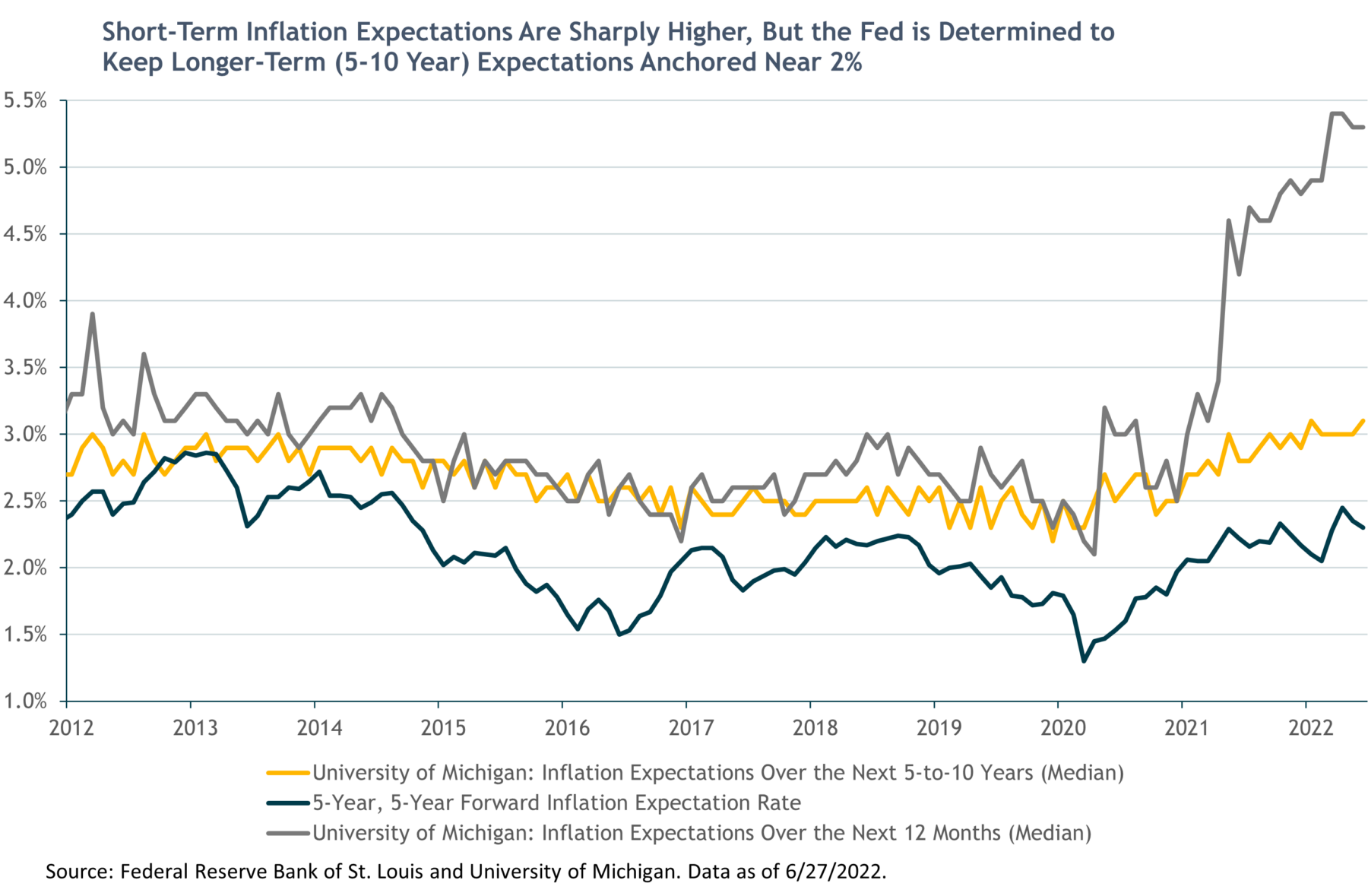

Fed Chair Jerome Powell has said the Fed wants to see “a series of declining monthly readings for inflation” as “clear and convincing evidence that inflation is coming down” before “we can consider moving at a slower pace.” He also again emphasized the Fed’s focus on longer-term (5-to-10 year) inflation expectations, saying “We’re absolutely determined to keep them anchored at 2%.”

How Inflation Affects the Investment Landscape

Recessions are part of the normal economic cycle, and our investment success doesn’t depend on predicting them – thankfully. Whether the Fed manages a soft landing or blows out a tire doesn’t make that much difference over the longer term; nor does the date at which the economy bottoms and begins the next upswing. We already know that during cyclical downturns investors in riskier (but higher-returning) assets, like stocks, anticipate a slowdown in corporate earnings and cause prices to drop in advance– as we’ve seen this year – resulting in higher return expectations looking forward as the next cycle begins.

In the case of bonds, 2022 to date has been the worst stretch in many decades as rising rates have pushed bond prices lower. We can expect continued declines, though likely less severe than we’ve seen, until the Fed eases off the brakes, but once it does the same higher rates that drove bond prices lower also shortens their recovery period.

See our post on Understanding Bond Math During Downturns.

Inflation, the catalyst for all these short-term investment fireworks, will eventually respond to the Fed’s efforts (and any improvement in the supply side factors beyond the Fed’s control) and already we are seeing signs of possible moderation in inflation reports. The key for longer term planning is to consider where we are left when all this dust settles, and the best clue is the Fed’s long-term target of 2%.

Getting back toward that target level of inflation will take some time and could cause some pain. Our belief is that we are likely to see inflation settle a bit north of that – perhaps in the 3% range – given the magnitude of the spike so far and that some of the drivers may remain outside their control. Inflation of 3% is historically average, but it’s also well above what we’ve seen for more than a decade and warrants revisiting and updating some of core investing and financial planning strategies, which we’ll cover next.

WHY own any core bonds? |

One might ask why we want to own any core bonds, and the answer is that core bonds (a mix of high-quality, intermediate-term government and corporate bonds) do perform well and provide valuable diversification in the event of a major global shock that leads to a “flight to safety.” As the last few years have reminded us, we can never rule out unforeseeable shocks and so we continue to own core bonds, even while our actual allocation has been below the target for some time. |

How Inflation Informs Our Investment Views

Fixed Income

Given the strong tie to interest rates, the impact of inflation on bonds is more significant and direct. We have long been unhappy with the ultra-low yields for high-quality “core” bonds as represented by the Bloomberg U.S. Aggregate Bond Index. The problems, as we’ve written often in our commentaries, are less downside protection (since rates have less room to fall, and prices less room to rise), poor expected returns (given very low yields), and vulnerability to rising rates (which drives bond prices lower).

As a result, we’ve long held large allocations away from core bonds, in favor of flexible fixed-income strategies with higher yields and less sensitivity to interest rates, and alternative strategies with low correlation to core bonds. We have also moved more into private alternatives, such as direct real estate, (funded in the portfolio through a reduction in both stocks and bonds). This is an area we expect to perform well in an inflationary environment as rents and leases can adjust upward with inflation.

Overall, our allocation away from core bonds diversifies our fixed-income position while offering better long-term returns in our view, while still providing the downside protection we want for portfolios that include stocks.

Strategic Allocation

Another step we took that acknowledges the likelihood of a higher inflation environment over the next decade is the reconfiguration of the “strategic” allocations that serve as our default starting point for building and managing client models. While we made these modifications before the recent surge in inflation, they nonetheless include several dedicated allocations that we expect(ed) to perform better in a higher-inflation world. These include allocations to Treasury Inflation Protected Securities (TIPS), which increase in value as inflation increases, and a Short-Term Corporate Bond index ETF, which by virtue of its shorter maturity and duration is less impacted by rising interest rates that accompany inflation. Additionally, we added a dedicated allocation to Managed Futures, which we believed would benefit from a sustained inflationary trend (which has been the case) but that can also do well in other environments as long as there are trends up or down in global equity, interest rate, commodity, and currency markets.

Equities

Turning to stocks, inflation is more an indirect influence on our equity allocations in that the rising interest rates it has triggered have in turn led to significant market declines across the globe that may or may not create tactical opportunities as relative valuations shift between U.S. and foreign stocks. We are always on the lookout for tactical opportunities, but our focus in this article is on the longer-term impact of a higher-inflation regime. So our question becomes whether modestly (but not hugely) higher long-term inflation is likely to impact stocks over the long term in ways not yet recognized (and priced in) by the market. And the short answer: We think not.

It is true that higher inflation and coincident higher interest rates affect companies differently, both in terms of revenues/earnings and in terms of how investors value their stock. Generally speaking, higher rates favor stodgier value stocks over high flying growth stocks because the valuation of growing companies is driven by future earnings. When those earnings are discounted back to present value at a higher interest rate, the present value is lower. Companies more reliant on increasingly costly raw materials may suffer relative to those that are not. Companies carrying higher debt loads are more apt to be hurt by higher borrowing costs.

At the overall asset class level, stocks can be considered a hedge against inflation in that corporate revenues and earnings are expected to grow with inflation. That’s not the same as real growth but as a baseline it’s better than the erosion of value that inflation can wreak elsewhere – such as with negative real yields on savings instruments.

The conclusion is that we want to continue to own stocks and the long-term target allocations in our portfolios are not changed by our expectation for modestly higher inflation over the next decade versus the last. At a tactical level within our equity allocations, we acknowledge the differing impact of inflation on different equity asset classes and industries, but we don’t currently (and think it’s unlikely that we will) see opportunities driven by higher inflation that the market does not, nor do we see a compelling “strategic” case for making long-term shifts within our equity allocations based on the expectation of sustained higher inflation.

How Inflation Impacts Financial Planning

Given the level of uncertainty around the trajectory of inflation, there is value in considering how it impacts all areas of one’s financial life and planning. Since it’s over the long-term that inflation is more impactful, for these scenarios we consider the impact of entering a 3% inflation world, after having recently experienced many years of sub-2% inflation.

Savings and Emergency Funds

The positive news for savers is that their safe, liquid savings dollars can be expected to earn better yields. The caveat is that what matters is “real return,” meaning the net return after subtracting inflation. When inflation is eroding the value of those dollars by more than even the goosed up yields they are now earning, then you are losing ground. The risk of inflation increasing by more than risk-free yields is compounded by the ultra-low yields going into this period. Almost every risk-free savings type instrument was earning close to zero before inflation began to surge. But inflation doesn’t suffer from inertia and anchoring – it rises as quickly as the underlying economics demand – while savings rates can be slower to respond. Therefore, it becomes especially important to be vigilant in obtaining highly competitive savings rates and moving your money accordingly if warranted.

Home Purchases and Mortgage Decisions

While we’re not going to try to forecast home prices, we know that higher rates reduce affordability. How this plays out in different segments and different regions of the housing market can vary widely. Generally, the initial impact of higher rates is to pull home prices down while over the longer term the impact of inflation pushes them higher. Meanwhile, we think it’s a reasonable expectation that the surge in inflation we’ve seen to date won’t persist for the long term. As we’ve said, we expect longer-term inflation more like 3% versus the high single digits reached recently.

The question for a nearer-term buyer who will be using a mortgage is the degree to which the housing market in their area will cool, thereby improving affordability, versus the degree to which increasing mortgage rates will reduce the level of house they can buy with the same dollars. We can frame the issue but trying to give specific advice is a disservice given all the variables (including current cost of housing, savings rates toward the down payment, etc.).

The question for a long-term borrower is whether their mortgage interest rate is reasonable compared to their expected return on the assets (that they would otherwise use toward the home purchase). Only months ago a 30-year fixed mortgage could potentially come with less than a 3% interest rate, but today that loan will likely be quoted with over 5% interest. Working through scenarios with a mortgage broker and your advisor is important, as the comparison of interest charged to potential return has narrowed and become more nuanced. Further, it’s important to understand up front whether lenders might quote a lower rate for a mortgage at the initial purchase, vs. a later request for a cash out refinance loan. Knowing your current and future options, and what flexibility you can build in, will help make a better decision today.

Funding College Expenses

In planning ahead for college costs, the broad inflation number doesn’t matter as much as tuition inflation, and this has far exceeded the traditional CPI numbers. Other costs of school may be more connected to CPI such as food, travel, housing, etc. All of these costs need to be considered in the projections for the cost of sending a student to college, and in turn the savings plan for this goal.

Living Expenses in Retirement

A common tendency in planning for living expenses in retirement is to ignore the impact of inflation and underestimate the damage it can do to supporting your future lifestyle. For example, the spending value of $1,000 after ten years at a 2% inflation rate is $817, and only $665 at a 4% inflation rate. Higher inflation demands consideration of seeking higher investment returns and/or saving at a higher rate in order to fund the same lifestyle in the future. It’s pernicious but manageable. One positive is that the higher interest rates that accompany higher inflation allow for higher returns, with more of the work done from the bond side of the portfolio versus higher risk stocks which have seen valuations driven up by low rates.

With an appreciation for the damage inflation can do, financial planning projections should include an assessment of the potential impact of rising costs on the different areas of a person’s spending, and how those areas are impacted by the components of inflation, such as housing, food, energy, etc. The ability to fine tune assumptions to individual circumstances gives a clearer picture of where things stand and if any adjustments need to be made.

Closing thoughts

The amount of time we spend considering and discussing the impact of higher inflation should not be misinterpreted as reflecting the magnitude of impact or level of concern warranted.

Our outlook and expectations remain that inflation will normalize at a level higher than the years preceding this spike but return to a rate more in line with long term inflation: something in the range of 3%. The risk of stagflation – in which we experience higher inflation along with slow growth – is real but not likely to persist over longer time frames, as unpredictable and uncontrollable shocks like COVID19 and the Ukraine war subside we expect those contributors to inflation to subside as well.

We have consistently used inflation assumptions in our work with clients that are in line with long-term historical averages, and so they have been higher than actual inflation for many years preceding the recent spike. This means smaller and less disruptive changes to assumptions and actions will be needed now to take into account the changed world we find ourselves in.

That said, it is nonetheless true that things have changed. As always, our goal with every client is to work together to take into account both external changes like inflation and investment returns along with any individual changes to their own circumstances. The goal is to create clarity on where a client stands in terms of reaching their goals, and to make needed adjustments early so that time is their ally.

As always, we encourage you to reach out to your advisor and talk through these issues to address any questions you may have. We appreciate the trust you place in us to guide decisions that help you reach your financial goals.