With Inflation Rising, Why Have Inflation-Protected Bonds Declined?

Treasury Inflation Protected Securities, aka TIPS, provide investors with a return that is indexed to inflation over the life of the bond. With the sharp rise in inflation that began in 2021 (see our recent post for more detail on the causes and investment impact) many investors who own TIPS expected to see gains as a result. But actual TIPS’ performance during this span has disappointed them and for some become a source of confusion. We’ll do our best to explain what’s going on with TIPS performance and set appropriate expectations for the future.

How TIPS Work

A quick reminder of TIPS basics is a necessary starting point.

- TIPS are issued by the U.S. Treasury in 5-, 10- and 30-year maturities with the initial interest rate set by auction. In other words, the market decides what it is willing to pay for the inflation protection built into TIPS (e.g. if investors expect higher inflation they will pay more for the bonds and thus receive a lower interest rate, and vice versa).

- Once issued, the value of a TIPS bond is adjusted twice a year in accordance with changes in the Consumer Price Index (the CPI). If prices increase (aka inflation) the principal value of the bond increases commensurately, or, more rarely, if the CPI is negative (deflation) the TIPS value declines by that amount.

- While the interest rate or coupon is fixed at the time the bond is issued (per the auction), that rate is applied to the principal value of the bond, which increases along with inflation. The result is that changes in inflation result in increases (or decreases) in both the value of the bond and the interest payments it generates over time.

- While the price of a “conventional” bond changes with changes in nominal interest rates (meaning the “regular” rates we see quoted every day which are gross of inflation) the price of TIPS are affected by changes in “real” rates, which are net of inflation expectations. (More on this shortly.)

How TIPS Behave, and Sometimes Seem to Misbehave

TIPS are reliable in delivering on expectations if held to maturity. You know the bond’s cost and interest rate up front. You know those values will increase with inflation and that if held to maturity you will receive that value (making any volatility along the way of little consequence). For more information on bond pricing while interest rates change, please see our recent post on “bond math.”

Over shorter periods, though, TIPS can be volatile. TIPS with long maturities are more sensitive to changes in real rates (which is the mashup of nominal rates and inflation expectations) and investor expectations on those variables affect prices. Generally speaking, TIPS can be expected to perform well when unexpected inflation emerges, and real rates don’t spike, as was the case in 2021. During that year, inflation rose from 1.4% to 7.0%, a level well above expectations, while 10-year real yields ended the year virtually where they started.

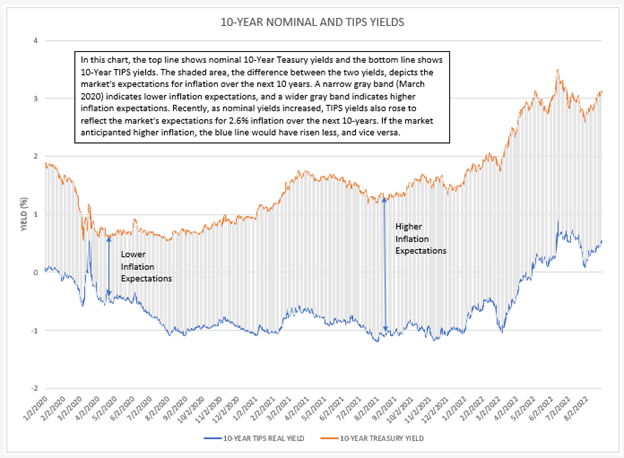

This takes us to this year, in which we saw TIPS fall in value during a period of higher inflation. While TIPS’ investors benefited from higher principal and interest payments, investors have expressed their collective belief that inflation won’t remain at today’s high levels. At the end of August, investors are anticipating inflation to be 2.6% to 2.7% in five to 10 years, a far cry from today’s elevated levels. The result of nominal interest rates spiking higher at a time when investors believed longer-term inflation would come back down was effectively an increase in real rates. (The chart below illustrates this.) And as we know, TIPS prices move inversely to changes in real rates just as conventional bond prices change in accordance with nominal rates. That is what drove the decline this year; interest rates rose by enough to more than offset the benefit that TIPS received from the inflation adjustment.

Source: U.S Department of The Treasury. As of 8/15/22.

One way of thinking about this is that the normally reliable “bond math” around rates and prices that we see with conventional bonds is less definitive for TIPS – especially in volatile periods – because there is more for investors to anticipate with both interest rates and inflation rates. Just as investors would pay less for the stock of a company if they had a strong belief its earnings were going to fall, TIPS buyers are paying less than what current inflation numbers suggest in anticipation of inflation coming down from elevated levels. In fact, this is consistent with our own belief on inflation, as we’ve written many times.

Our Take on TIPS

We understand that some are disappointed in TIPS performance this year, but it’s worth the reminder that disappointment or happiness is always a function of expectations. We aren’t concerned or surprised by TIPS performance. When we discussed adding TIPS in 2021 as part of the prudent periodic revision of our long-term “strategic” allocations, we wrote “we will initially be underweighted to TIPS given their negative real yields, and the current implied level of inflation.”

But TIPS are part of the long-term strategic allocations for most client portfolios and we are confident they will do the job we believe they are well suited to do: mitigate the impact of long-term higher inflation, outperform core bonds during rising-rate environments, and provide diversification through their low correlations to other types of investments.

We appreciate the opportunity to answer any additional questions. Please feel free to reach out to your advisor to discuss this and/or your individual situation.

Important Disclosure

This written communication is limited to the dissemination of general information pertaining to Litman Gregory Wealth Management, LLC (“LGWM”), including information about LGWM’s investment advisory services, investment philosophy, and general economic market conditions. This communication contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice and should not be considered as a solicitation to buy or sell any security or engage in a particular investment strategy.

There is no agreement or understanding that LGWM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information.

Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this newsletter will come to pass. Individual client needs, asset allocations, and investment strategies differ based on a variety of factors.

Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management feeds or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio.

Nothing herein should be construed as legal or tax advice, and you should consult with a qualified attorney or tax professional before taking any action. Information presented herein is subject to change without notice.

A list of all recommendations made by LWM within the immediately preceding one year is available upon request at no charge. For additional information about LGWM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request to [email protected]

LGWM is an SEC registered investment adviser with its principal place of business in the state of California. LGWM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which LGWM maintains clients. LGWM may only transact business in those states in which it is noticed filed, or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by LGWM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.